Will the 2023 season have a lasting effect on Canadian insurance and real estate markets?

Canada is currently experiencing its worst wildfire season on record. Earlier this summer, wildfire outbreaks in Alberta and Nova Scotia burned homes, forced evacuations and disrupted business operations.

More recently, the entire capital city of Yellowknife, Northern Territories, was forced to evacuate due to encroaching flames. Fires in British Columbia burned homes and businesses to the ground in Scotch Creek and the popular resort town of Kelowna.

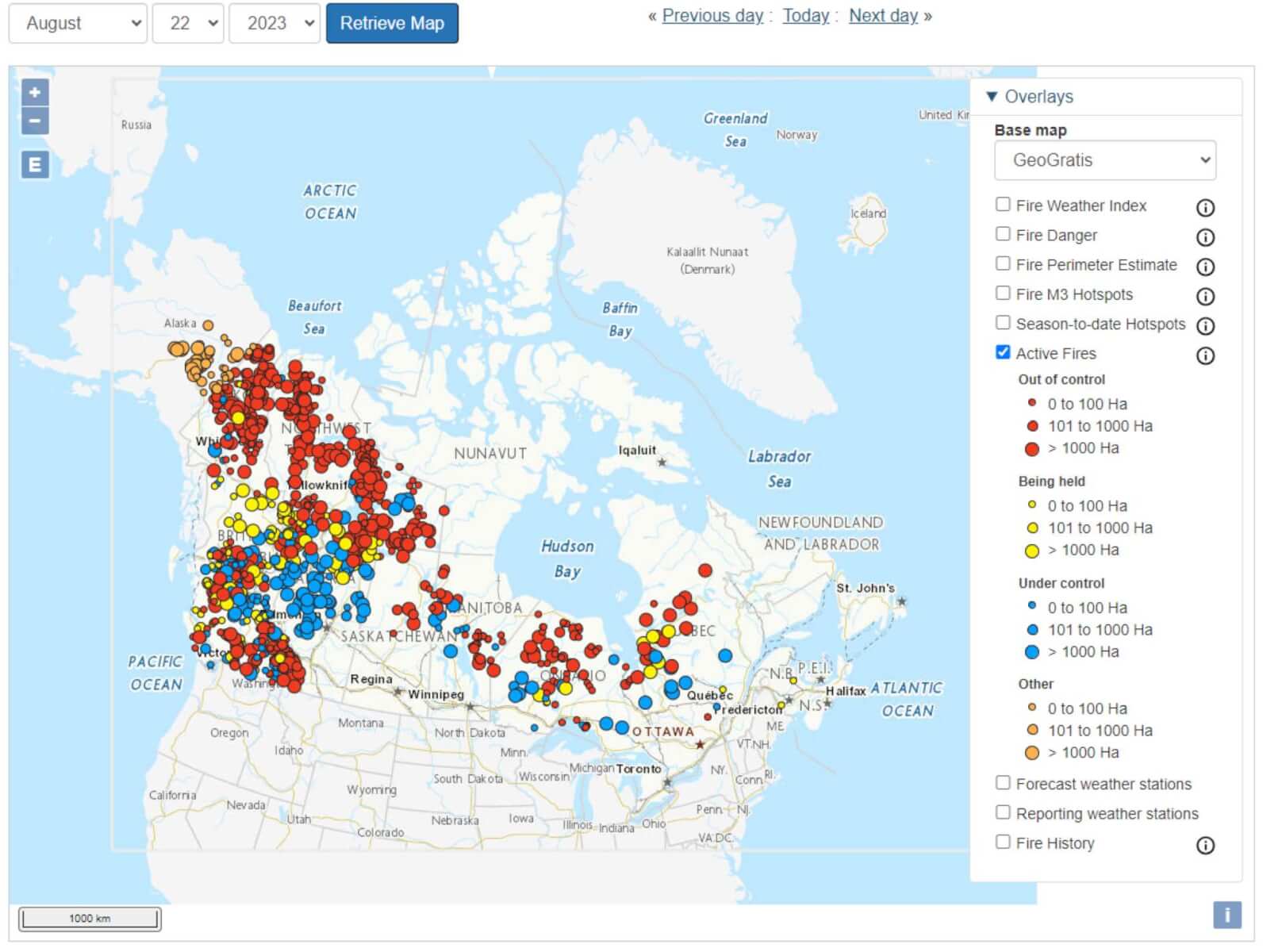

According to Aug. 16 reports from the Canadian Wildland Fire Information System (CWFIS), there were 220 “out of control” wildfires, 100 fires were being held and 194 were controlled fires. Figure 1 presents a map of the current wildfire locations in Canada as of Aug. 22.

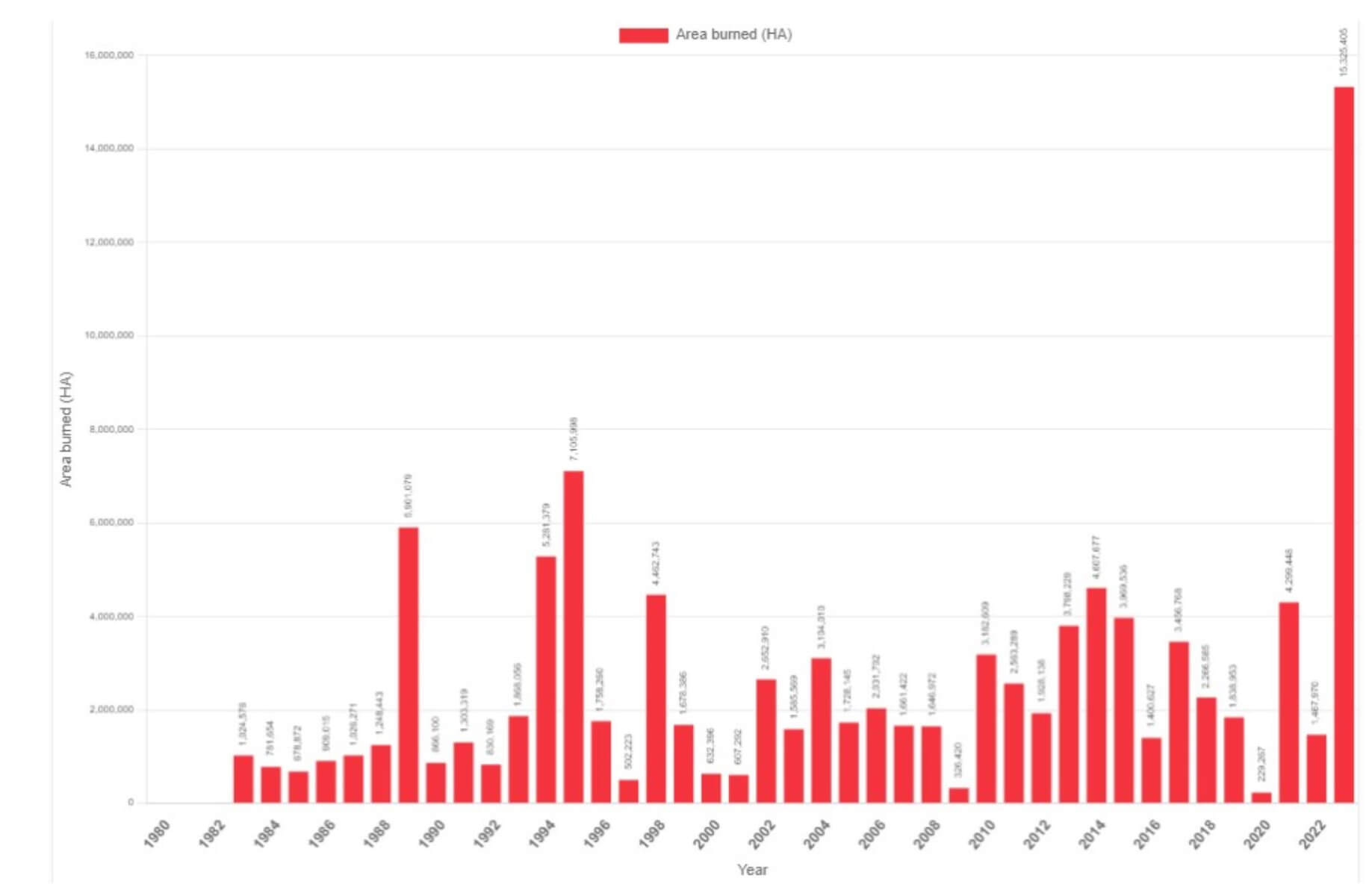

Between Jan. 1 and Aug. 21 of this year, nearly 5,900 wildfires have consumed 15 million hectares of wildland across Canada, according to the Canadian Interagency Forest Fire Centre (CIFFC). Although the current number of fires this year is close to the long-term, 30-year running average of approximately 7,000 wildfires per annum, the total burned area in 2023 is significantly higher than the past 40 years, even when accounting for notable damaging fire years such as 2016 (Figure 2).

A fire season of this size may have significant implications for a range of property-focused sectors, such as the insurance, real estate, mortgage lending and appraisal industries.

Canadian Natural Catastrophe Insured Losses Are Rising

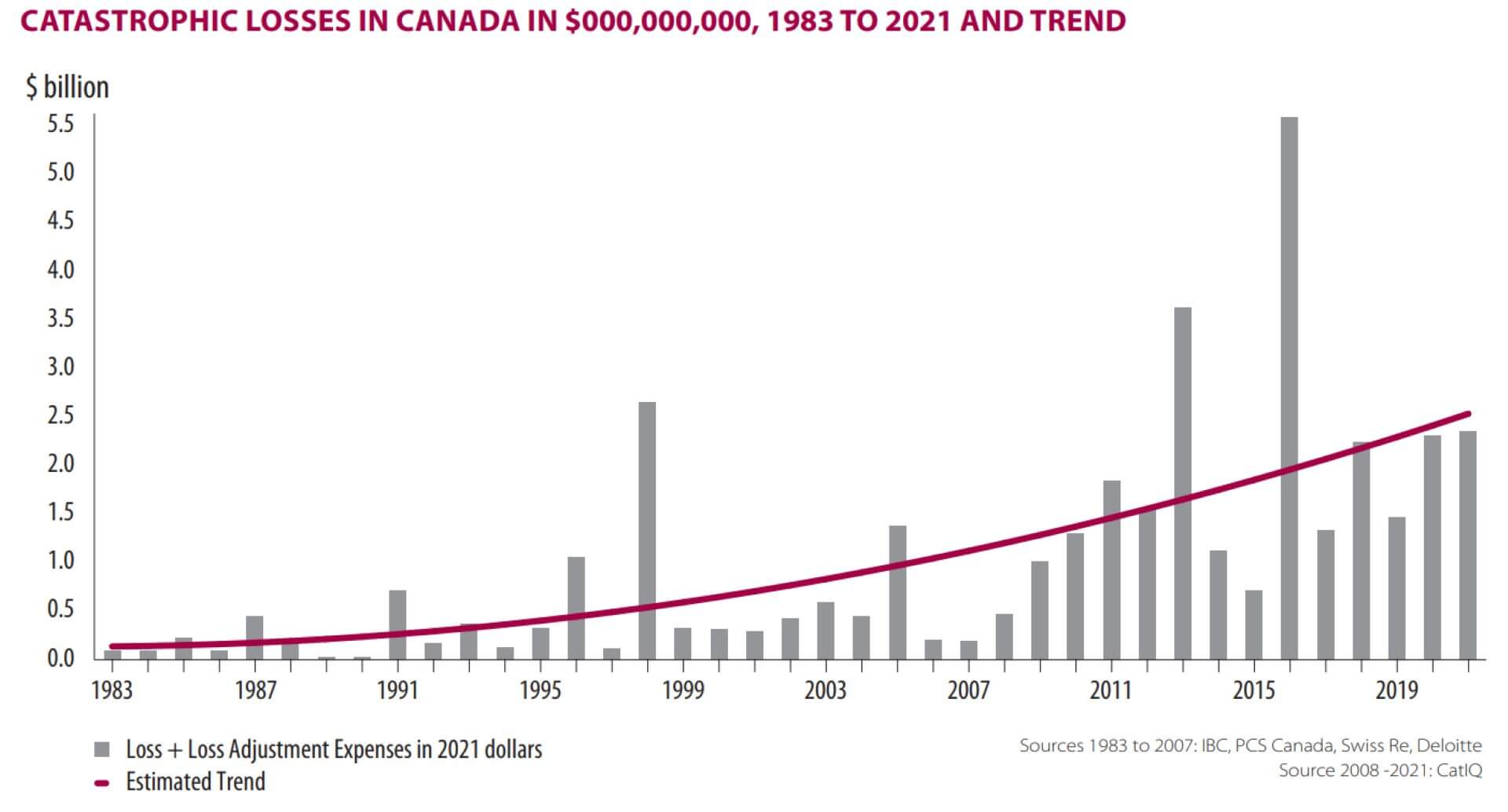

Like other developed nations with a robust insurance ecosystem, Canada is experiencing a growing trend in natural catastrophe insured losses. Severe weather (winds, tornadoes and hail), fires, flooding and winter storms contribute to the annual insured loss totals across Canada (Figure 3).

The highest yearly insured loss was in 2016 when fire damage was devasting despite the relatively small number of hectares burned (1.4 million). The Fort McMurray wildfire in northern Alberta destroyed over 2,500 homes and buildings and thousands of vehicles. According to the Insurance Bureau of Canada (IBC), property owners submitted roughly 60,000 claims, leading to approximately $4.1 billion (CAD) of insured losses.

It is too early to determine the full economic and insured impact of the 2023 Canadian wildfire year, but given the record-setting area burned to date, there is potential for another expensive year.

However, the threat of continuously increasing annual insured losses from disasters such as wildfire poses the same question to Canadian insurers that carriers in the U.S. are starting to grapple with in states like California. This summer, Allstate and State Farm announced that they would no longer write new policies in California and indicated that the frequency and intensity of natural disasters contributed to their decision. It is possible that Canada is becoming a riskier place that is more expensive to insure, partly due to inflationary pressures on restoration costs, such as material and labor shortages.

Will My Home Keep Its Value?

Beyond damaging or destroying a home, there are secondary effects of wildfire activity with regard to property. CoreLogic® investigated the effects of wildfires on California property values in a recent analysis, looking specifically at how average home prices within certain distances to wildfire perimeters changed.

CoreLogic determined that the average price of properties within a fire perimeter declined by 0.64%. In contrast, properties located within one mile from a fire experienced price appreciation of 5.1%, while those situated one to five miles away saw a 7.21% gain. Please note that the average price appreciation for California during the same two-year period was 12.3%.

These findings indicate that buyers carefully considered past wildfires, which is reflected in housing price movements. Although U.S. markets differ from Canada, homeowners can take away a few notes from the study. There is a potential for the same trends to continue across the border into Canada.

CoreLogic Hazard HQ Command Central™ will continue to watch the wildfire situation across Canada. Updates may be provided when is more known.

©2023 CoreLogic, Inc. The CoreLogic statements and information in this blog post may not be reproduced or used in any form without express written permission. While all the CoreLogic statements and information are believed to be accurate, CoreLogic makes no representation or warranty as to the completeness or accuracy of the statements and information and assumes no responsibility whatsoever for the information and statements or any reliance thereon. CoreLogic® and Hazard HQ Command Central™ are the trademarks of CoreLogic, Inc. and/or its subsidiaries.

Contact: Please email [email protected] with questions regarding the Canadian wildfires or any CoreLogic event response notifications.

Visit www.hazardhq.com for updates and information on catastrophes across the globe.