Fears about the coronavirus pandemic have prompted public officials to order quarantines and stay-at-home orders across the nation. A Gallup poll on April 3rd indicated that 75% of Americans have self-isolated in their household.1 This means that all of those hours previously spent at the workplace are now being spent at home.

How much extra time is that? Data from the Bureau of Labor Statistics gathered in July 2019 found that the average full-time employed person worked 8.5 hours on the weekdays that they worked.2 Moreover, Census data from 2018 indicates that the majority of the nation worked primarily outside the home, with only 4.9% of the nation working entirely from home before the start of the coronavirus pandemic.3

Consequently, with stay-at-home orders in place, many people are spending an additional 8.5 hours in their homes each day, often with additional occupants, including college students and extended family, living under one roof. As a result, water heaters, washing machines, bathroom facilities, dishwashers, plumbing, sinks, and faucets are taking on significantly more use and wear.

The Effect of COVID-19 on Non-weather Water Risk

Increasing household sizes and time spent at home instead of work for so many means that pipes, valves, faucets, hoses, and appliances in American homes are working overtime and are wearing down faster than ever.

Data from the Environmental Protection Agency WaterSense indicates that the average American uses 69.3 gallons of water in the home per day. Most of this water is consumed by toilet use (18.5 gallons per person), laundry machines (15 gallons per person), and showers (11.6 gallons per person).4

Amid COVID-19, insurers can expect to see a higher volume of claims for non-weather water damages. Data indicates that 1 in 15 policyholders experience a non-weather water claim during the standard five-year policy life expectancy. These claims are responsible for 20% of US property insurance losses. That is $1 out of every $5, totaling a whopping $8.2 billion annually. Some of the most common culprits of non-weather water damage are appliance leaks, water heaters, plumbing and pipe failures, fixture leaks, and ruptured connecting hoses.

Moreover, families faced with unemployment or other financial struggles are likely to delay home maintenance. As states begin to reopen and people go back to work, families may forget or forego critical repairs, resulting in more frequent and severe water claims just months down the line. It is the perfect storm of increased use, delayed maintenance, and then going back into the work force — leaving the home unattended where small problems can become big ones. Now, turning on a washing machine or dishwasher before leaving for work may result in costly damage. If there is a malfunction or overflow, there may not be anyone home to help mitigate.

The Risky Business of Non-weather Water Claims

The risk of a non-weather water claim varies dramatically by location, ranging from a low of 1 in 167 to a high of 1 in 2 during a five-year period in the U.S. Florida, California, and Maryland are the top states with the highest statewide claim risk.

Many areas within those states have especially high non-weather water claim frequency. Some of the counties with the highest average claim probability are Miami-Dade County, FL (1 in 5), Orange County, CA (1 in 8), and Montgomery County, MD (1 in 8). These three regions are likely to maintain their lead in claims and losses as homes experience significantly more wear and tear while foregoing needed maintenance. All regions throughout the nation are expected to see an uptick in non-weather water claims.

Case Study: Uncovering Hidden Risk Using Prediction Technology

By using portfolio analysis combined with new non-weather water risk prediction technology, insurers can be better prepared for the side effects of broad stay at home orders and/or unemployment leading to intensive use of household systems. We can predict the risk of non-weather water claims and losses by leveraging water damage surveys, combined with detailed appliance failure reports, localized climatological reports, physiography data, public service/code enforcement, and custom water repair costs.

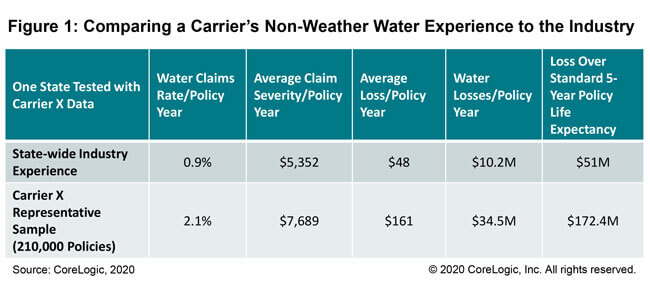

Many carriers are unaware of the hidden non-weather water risk of their policies. For one Carrier X, data revealed that the carrier was paying out far more in claims than their state’s industry average. The statewide industry experience was 0.9% water claims rate per policy year, yet the carrier’s experience was 2.1% water claims rate per policy year.

Moreover, for water losses on over 200,000 policies, the industry average for the state was about $10.2 million per year, while Carrier X had more than $34 million per year. Why was this carrier paying out three times the industry average for the state?

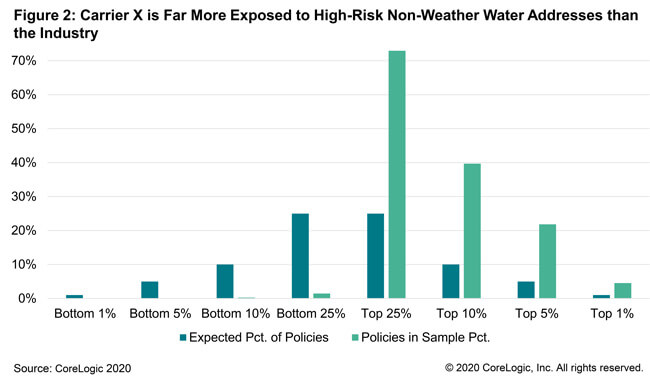

Carrier X was far more exposed to high risk nonweather water addresses than the industry. We can see this exhibited in their portfolio’s risk distribution.

70% of the carrier’s policies fell in the top 25% risk bracket, followed by 40% in the top 10% and 25% in the top 5%. This carrier’s portfolio is highly skewed towards high non-weather water risk; yet without having access to the latest data analytics on water risk, adverse selection and agent footprint are resulting in a significant increase in losses.

Carriers can avoid this by using non-weather water risk prediction technology to fill gaps in their homeowner’s and commercial losses, as well as:

- Avoid higher frequency business

- Improve re-underwriting actions

- Better tier placement

- Adjust deductibles

- Optimize eligibility lines

- Reduce inspection costs

- Automate underwriting decisions

Non-weather water risk prediction technology can be a valuable asset in helping reveal hidden exposures. With these new tools in hand, carriers can reduce uncertainty and avoid losses while profitably underwriting non-weather water coverage amid the pandemic.

Sources:

[1] https://news.gallup.com/poll/307760/three-four-self-isolated-household.aspx?utm_source=alert&utm_medium=email&utm_content=morelink&utm_campaign=syndication

[2] https://www.bls.gov/news.release/atus.nr0.htm

[3] https://www.census.gov/programs-surveys/acs/news/data-releases/2018/release.html

[4] https://www.epa.gov/sites/production/files/2017-02/documents/ws-specification-home-suppstatement-v1.0.pdf