Updated May 1, 2024

Calculating the replacement cost of a home is imperative for accurate insurance policies

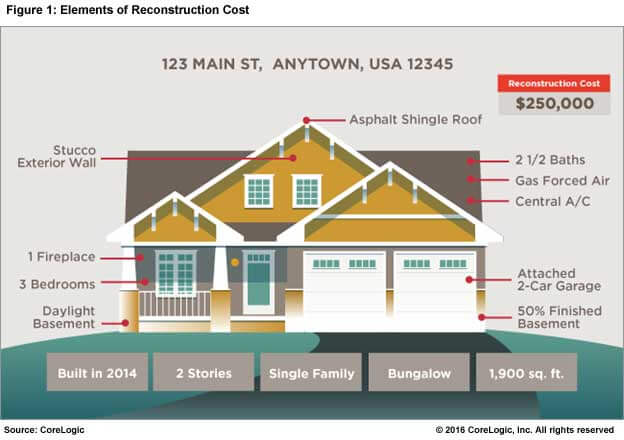

Reconstruction cost, not market value or assessed value, is used by insurers to determine homeowner coverage limits and is an important factor in determining a policy’s premium. Due to the many variables involved, home replacement cost estimators have had to become much more sophisticated in recent years.

At its most basic, the purpose of a homeowner’s policy is to restore the home and possessions to the way they were before a loss occurred. Therefore, it is important that the home insurance reconstruction cost estimate is used to accurately determine the structure replacement coverage amount.

If the coverage is too low, the homeowner may not have enough insurance to cover the losses incurred.

Get a Detailed Explanation of Reconstruction Cost Valuations

How to Calculate the Replacement Cost of a Home

Today’s best practice for reconstruction cost estimating requires a combination of structure-specific information with detailed construction and pricing knowledge .

Using a method similar to those used by builders, insurers can apply the current localized costs of labor and building materials to create a cost estimate that is unique to the specific home at the time of the estimate. This produces objective estimates that do not have the inaccuracies produced through subjective quality judgments or unsophisticated estimating tools.

Traditional processes for estimating home replacement costs required the homeowner to provide all of the details about the home in question. However, the estimation process has advanced significantly since then.

Now, digital home replacement cost estimator tools incorporate disparate data resources that can pre-fill information to automatically populate fields with information required for a comprehensive, accurate calculation.

This is particularly useful since a new homebuyer may not have all the facts readily available to determine an accurate home insurance reconstruction cost.

Incorporating reliable data sources into the process allows the homeowner to simply validate the information and add any additional known features to speed up the insurance quote process for all parties involved in calculating the replacement cost of a home.

The 7 Biggest Factors Impacting Home Insurance Reconstruction Costs

The more specific the information about the home, the more reliable the reconstruction cost estimate.

The following list are the building characteristics that generally have the most impact on calculating the replacement cost of a home. They are the most important for a home replacement cost estimator:

- Square Footage: Clearly the size or the square footage of the home is one of the major factors in calculating reconstruction cost. It doesn’t take a professional builder to recognize that.

All things being equal, a 4,000-square-foot home will require more building materials and labor to build than a similar quality 1,200-square-foot home.

- Year Built: The year the home was built also plays a key role in the estimation.

Older homes may be built with different building materials or construction techniques like lath and plaster interior walls rather than more modern two-inch by four-inch framing and drywall. Older homes also tend to have smaller rooms than modern, open-plan homes, which affects the number of interior walls and thus the cost of materials and labor.

- Architectural Style: In combination with the year built, the style of the home is another important consideration.

A Queen Ann or Victorian-style home will affect features such as exterior and interior trim — crown molding, chair rails, gingerbread — and ceiling height. A sophisticated estimating tool will use the age of the home and style to understand how the home was built, which influences the calculation of the final reconstruction cost.

- Number of Stories: The number of stories in the home impacts building costs, including the cost of the foundation.

For example, a 2,000-square-foot home with one story requires twice the amount of concrete and/or basement finish for its foundation as a 2,000-square-foot home with two stories because the two-story home foundation is half the size.

- Foundation and Roof: The type of foundation, including basement finishes if applicable, is another major factor in reconstruction cost. Roof cover and style is another major consideration for cost valuation.

- Kitchen and Bathrooms: Cabinets and countertops in kitchens and bathrooms have a significant impact on the cost along with built-in kitchen appliances and bathroom size and fixtures.

Both the quality of materials and the workmanship in these rooms can vary dramatically irrespective of the size, age, or style of the home — sometimes the quality can even within the same home.

This is an area where input from the homeowner or the ability to review interior photos of the home can be crucial to getting the cost estimation right.

- Garages: The size and type of garage will impact the reconstruction cost as well. Attached, built-in*, and basement garages all impact the final cost.

Of course there are many other home features that add to the overall cost and must be taken into account by the reconstruction cost estimator. However, features such as HVAC, flooring, whole-house systems, and other elements tend to have a lesser impact on the total cost than the features and characteristics described above.

Because big ticket items are not typically attached to the home they don’t have a significant impact on the primary structure (Coverage A) reconstruction cost.

Such items include:

- Swimming pools

- Detached garages

- Pool houses

- Outbuildings

- Sports facilities

These detached structures are typically covered in homeowner’s policies under what’s called Coverage B, and the reconstruction estimate will provide a separate cost figure for these features of the home.

The Importance of An Accurate Reconstruction Cost Estimator

Accurately estimating reconstruction costs can be a fairly simple task for the agent, homeowner, or underwriter. However, simplifications requires a sophisticated digital home replacement cost estimator tool.

The best tools will pre-fill estimates with property data about all the characteristics we discussed above. The right solution will be embedded with an understanding of construction techniques and the interplay of building characteristics, as well as up-to-date, localized material, and labor costs.

* Built-in garages are garages attached to the home with living area above the garage.

The CoreLogic statements and information in this blog post may not be reproduced or used in any form without express written permission. While all the CoreLogic statements and information are believed to be accurate, CoreLogic makes no representation or warranty as to the completeness or accuracy of the statements and information and assumes no responsibility whatsoever for the information and statements or any reliance thereon. CoreLogic® and Marshall & Swift® are the registered trademarks of CoreLogic, Inc. and/or its subsidiaries.