Cash needed to buy and monthly mortgage payment are two dimensions of affordability

This season home seekers are faced with both opportunities and challenges. An opportunity is low-cost financing, a challenge is the high level of home prices. Mortgage rates and home prices affect two dimensions of affordability: the monthly payment and the up-front cash needed to buy.

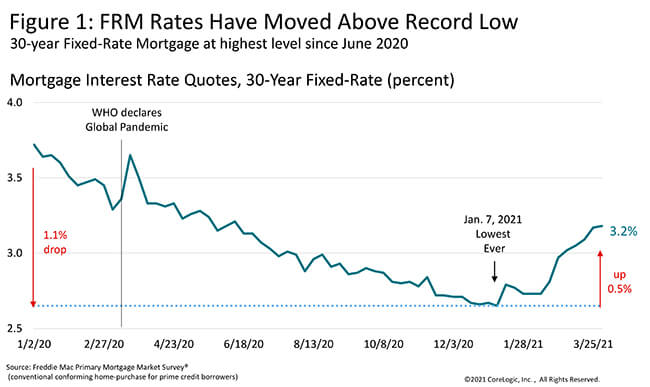

Mortgage rates were on a downward slide for most of 2020 and reached a record low at the beginning of this year, 1.1 percentage points lower than one year earlier. Since the start of 2021, mortgage rates have moved up by one-half percentage point, and currently are about where they were last June. (Figure 1)

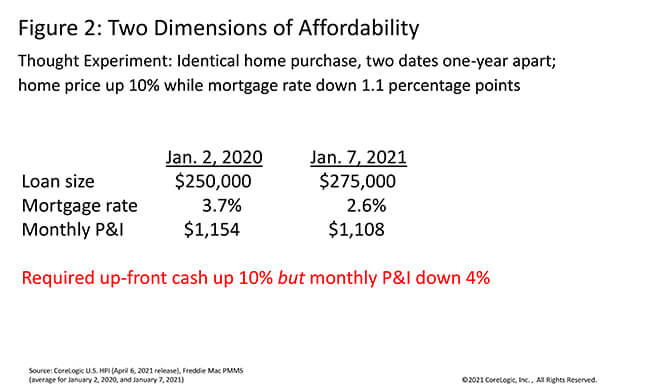

To illustrate the two dimensions of affordability, let’s do a thought experiment. Let’s say you consider buying a home at the beginning of 2020 and need a loan of $250,000. Before you can buy it, the home is taken off the market. One year later the same house is listed again. However, mortgage rates are now 1.1 percentage points lower but its price, as measured by the CoreLogic Home Price Index, is 10% higher.[1] If you plan to make the same percentage down payment as a year ago, is the home more or less affordable? (Figure 2)

The up-front cash needed for the down payment, closing costs and cash reserves will be about 10% higher, so the home is less affordable on that dimension. But with mortgage rates so low, the monthly mortgage payment is less than a year ago, even though the loan amount you need is 10% larger. Taken together, the up-front cash you need is larger but the monthly payment is lower, so it’s hard to say whether the home is overall more affordable or not.

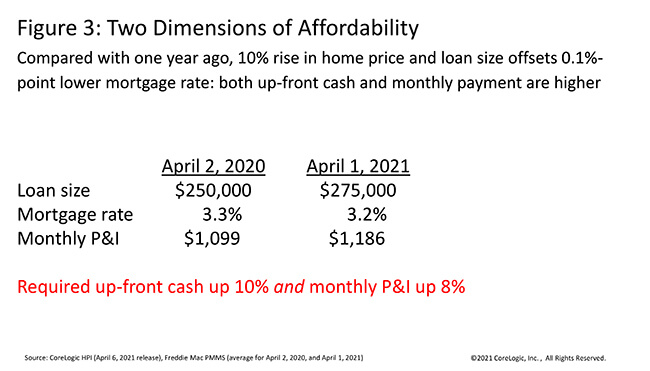

The squeeze on the buyer’s pocketbook becomes more severe when home prices and mortgage rates move up at the same time, as has happened the last three months. Mortgage rates are no longer low enough to offset the increase in loan size needed to buy a home, given the double-digit rise in prices. (Figure 3) If the up-front cash and mortgage payment continue to rise, the decline in both dimensions of affordability may reduce home purchases. Lower demand will moderate price growth and allow time for income gains to catch up, gradually restoring a degree of affordability.

Summary:

- Mortgage rates were at a record low at the start of this year but were up 0.5% over the first three months of 2021.

- Strong home-price growth has increased the amount of cash that buyers need at closing, worsening this component of affordability.

- Mortgage rate declines last year lowered the monthly payment, holding all else the same, improving this part of affordability.

- While mortgage rates are still less than one year ago, home price increases have offset the lower rates and affordability has recently lessened across two dimensions.

- Lack of affordability may lower demand to buy homes and moderate home-price growth later this year.

©2021 CoreLogic, Inc., All rights reserved.

[1] The 12-month growth in the CoreLogic U.S. Home Price Index was 9.7% for January 2021 and 10.4% for February 2021 (April 6, 2021 release).