July 2021 Economic Outlook

June marked the beginning of the Atlantic hurricane season. Recent years have seen an increase in the number of severe storms and resulting property damage and personal injury. Experts are predicting an above-normal number of tempests again this year. In 2020, in the span of six weeks, Hurricanes Laura and Delta made landfall 12 miles apart, together taking nearly 100 lives and decimating southwest Louisiana. A look back at the effects of these two hurricanes on the Lake Charles metro shows the potential effects on properties.[1]

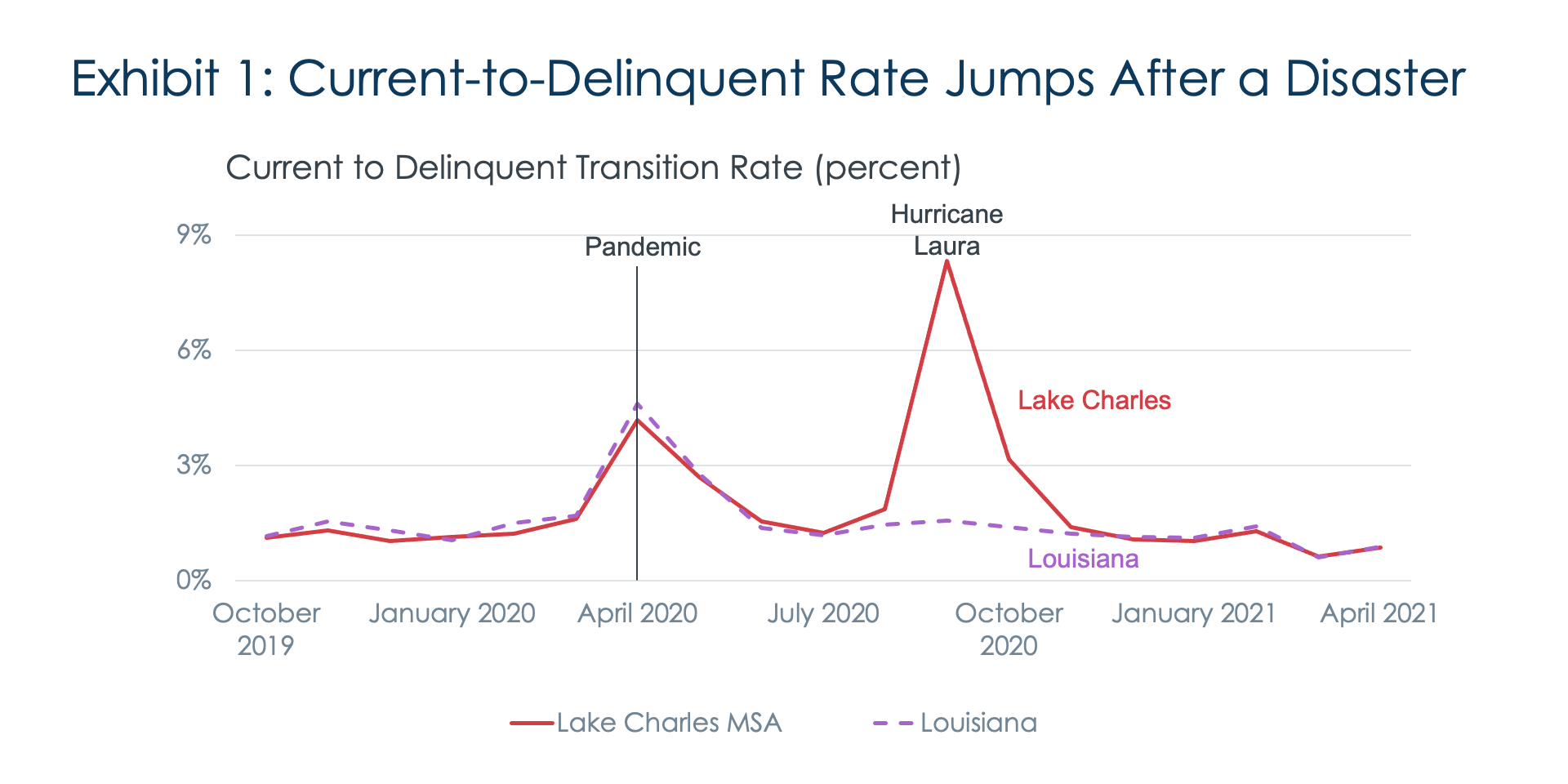

Lake Charles was already hurting economically prior to Hurricane Laura because of the pandemic and recession. By August 2020, the unemployment rate in Lake Charles had more than doubled from what it had been one year earlier. Similar to the rest of Louisiana and the U.S., Lake Charles experienced a jump in delinquency rates at the start of the pandemic. The percent of current mortgage borrowers who fell into delinquency in April 2020 was more than triple the average rate during the preceding year. When Hurricane Laura hit, the transition rate into delinquency spiked even higher in Lake Charles.

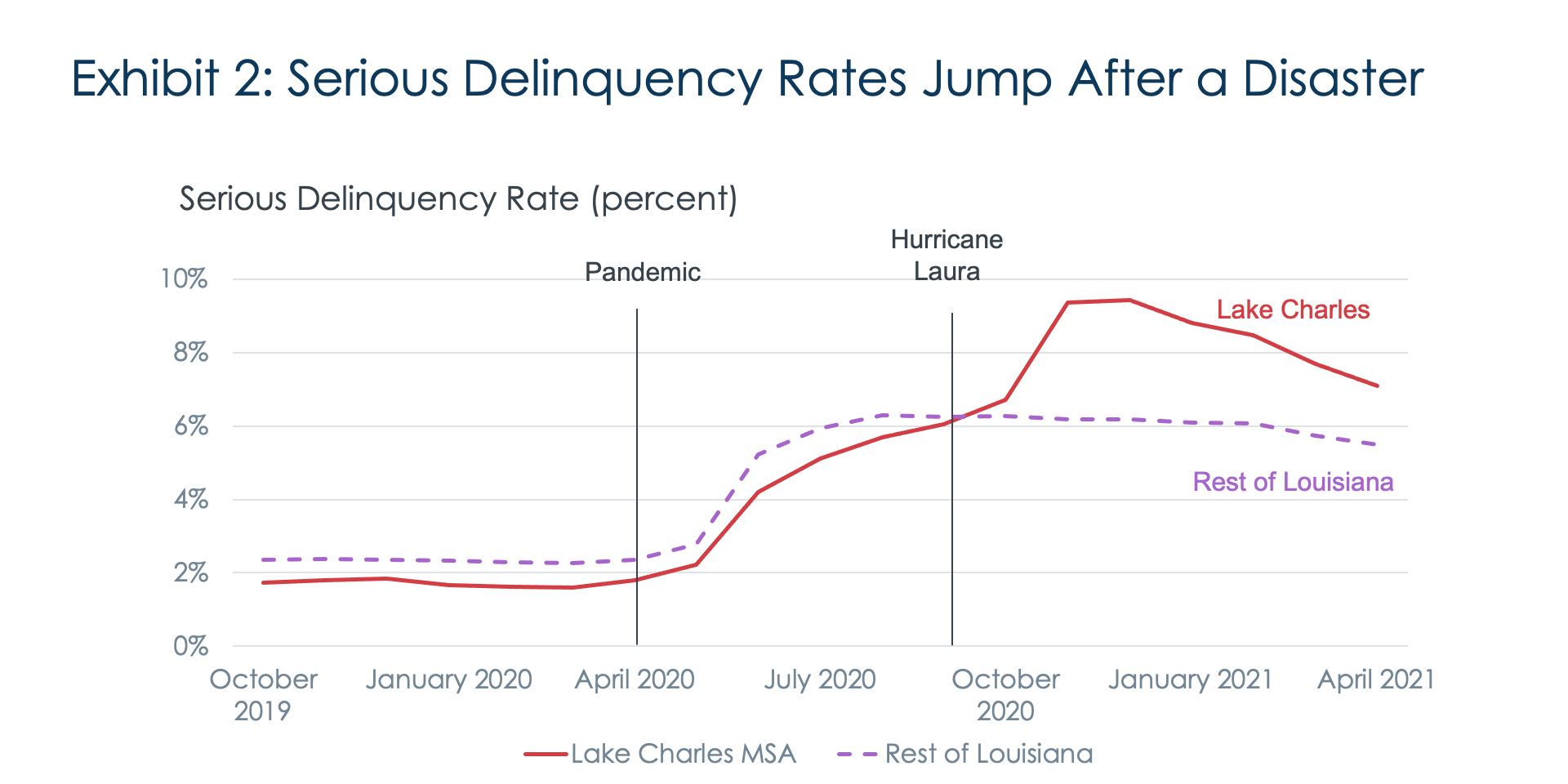

While the effect on the current-to-delinquent transition was temporary, it had longer-term consequences for many homeowners. The serious delinquency rate in Lake Charles was below that of the rest of Louisiana prior to the pandemic, rose along with the rate for Louisiana in the early months of the pandemic, but then moved even higher after Hurricanes Laura and Delta.[2] By the end of 2020 the rate was more than three percentage points higher in Lake Charles than in the rest of Louisiana.

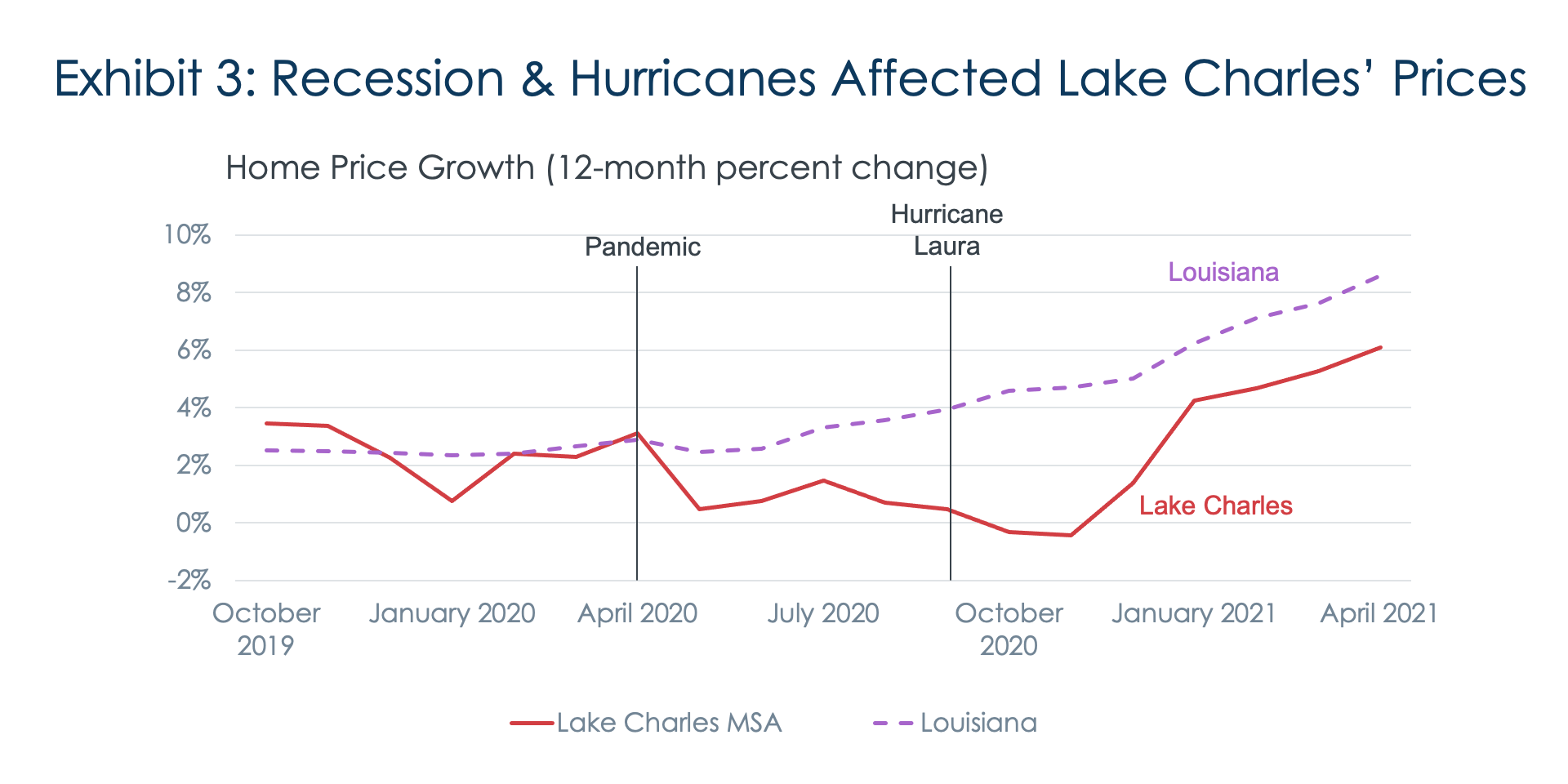

The double whammy of an unforeseen recession and back-to-back hurricanes also had a deleterious effect on home values in Lake Charles. Home prices had been rising close to the Louisiana average before the pandemic, then slowed during the first few months of the pandemic and turned negative after Hurricane Laura. While price growth has recovered in Lake Charles in early 2021, it was running below that of the rest of Louisiana and is only one-half of the national growth rate as of April.

Natural disasters cause extensive property damage, personal injury, a reassessment of hazard risk, and disruptions in local housing markets: Mortgage delinquency rates spike and the price and availability of shelter are affected as well. These effects are likely to reoccur when the next tropical cyclone makes landfall in the U.S.

1 Laura was a Category 4 hurricane when it made landfall in Louisiana on August 27. It was followed by Hurricane Delta which hit Louisiana on October 9 only several miles away. Both made landfall in Cameron Parish, part of the Lake Charles metro. CoreLogic has estimated that the property damage in the mainland U.S. was about $9 to $13 billion from the two storms. Hurricane Laura was estimated to have caused $8 billion to $12 billion in wind and storm surge damage and Delta about $0.7 to $1.2 billion in onshore damage.

2 Serious delinquency measures the percent of mortgages that missed three or more monthly payments or were in foreclosure proceedings.