13 Markets Overvalued Based on Fundamental and Speculative Metrics

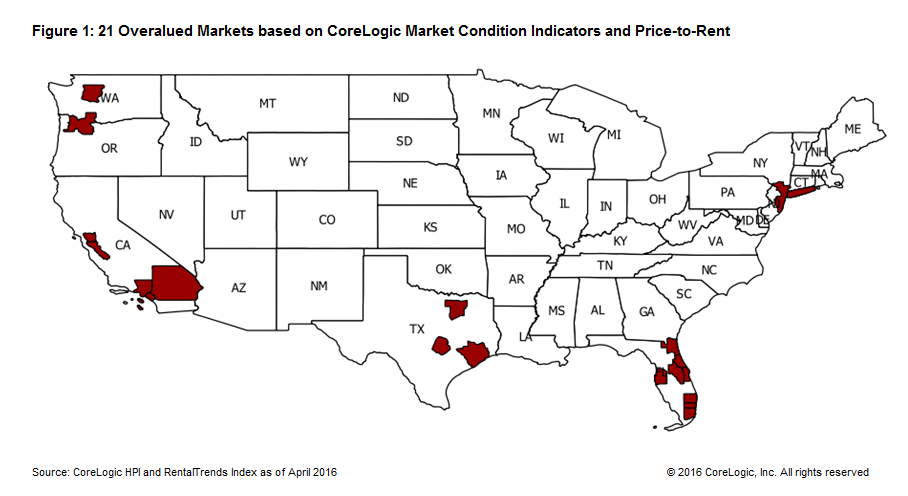

In Part I [1] of this series we evaluated the top 100 Core Based Statistical Areas (CBSAs) using CoreLogic Market Condition Indicators (price-to-income) and the price-to-rent metrics which classified 21 markets as overvalued. Figure 1 shows the distribution of these CBSAs. According to Joseph Stiglitz’s (1990) [2] definition of a bubble, besides the fundamental drivers, we also need to find metrics to capture the speculative belief that “selling price is high tomorrow.” In this blog we examine two new CoreLogic metrics for measuring speculative belief: the Flipping Index and the Fraud Index.

One of the key features of a bubble is the popular belief that the selling price will be high tomorrow. A housing bubble can start with a legitimate increase in housing demand. But at some point in time, speculators enter the market, believing that quick profits can be made through short-term buying and selling. As more and more people are involved in such speculative transactions, a housing bubble becomes self-fulfilling. Hence, one key observation of a housing bubble is flipping transactions, which can represent short-term buying and selling activities.

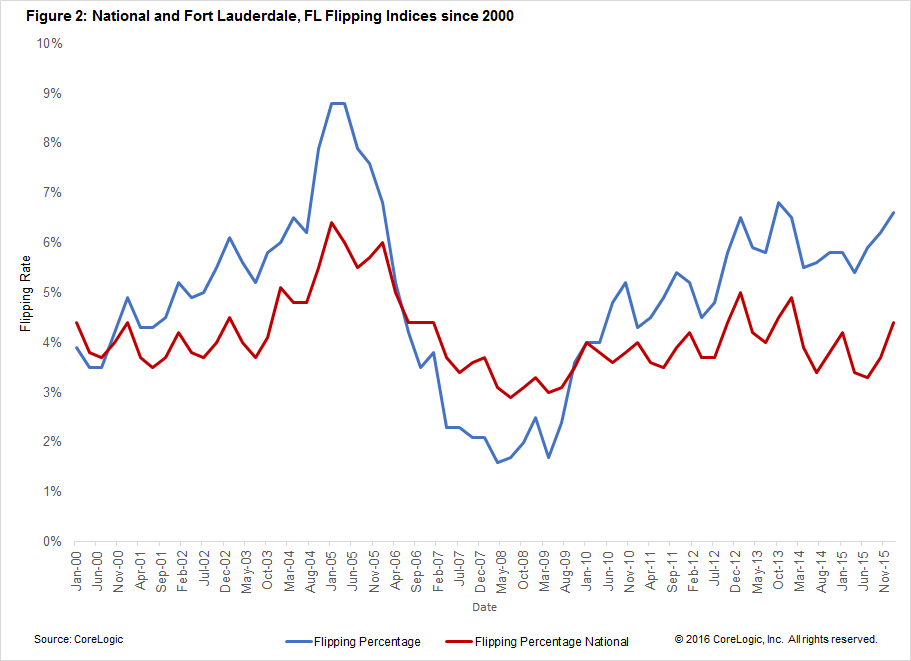

CoreLogic has developed a Flipping Index [3] which tracks the short-term buying and selling activities in local markets. Figure 2 presents the flipping percentages since year 2000 at the national level and for Fort Lauderdale, FL. We define a flipping transaction as when someone bought and sold the same house within nine months. The flipping percentage is the share of flipping sales relative to total sales within each quarter. As shown, the national flipping percentage was at an all-time high of 6.5 percent during the 2005-2006 bubble years, and fell to 3 percent during the Great Recession. It hovered around 4 percent in Q1 2016. The flipping percentage in Fort Lauderdale started at the same level as the national average in 2000, but rose quickly as the housing boom started in Florida and hit an all-time high of 9 percent during the 2005-2006 bubble years. It fell sharply below the national average level during the Great Recession, but leaped significantly from 2 percent in 2009 to 6.5 percent in 2016, 2 percent above the national average.

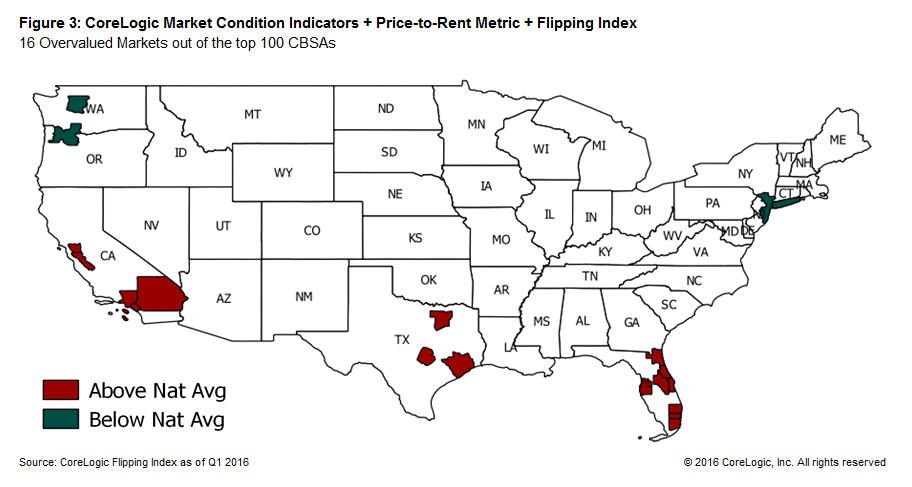

Figure 3 shows that, among the 21 overvalued markets identified by the price-to-income and price-to-rent metrics, the Seattle, Portland and New York CBSAs still have below-national-average flipping activities. If we define the overvalued markets as the CBSAs with abnormal (i.e., higher-than-national-average) flipping percentages, we end up with 16 overvalued markets among the top 100 CBSAs, all in California, Texas and Florida.

Another thing we know about housing bubbles is the widespread mortgage fraud that accompanies them. We’ve all heard stories about misrepresentation on income, employment and occupancy during the heat of housing bubble in 2005. One interesting question is: Do we see fraud risk increasing in these 16 identified overvalued CBSAs?

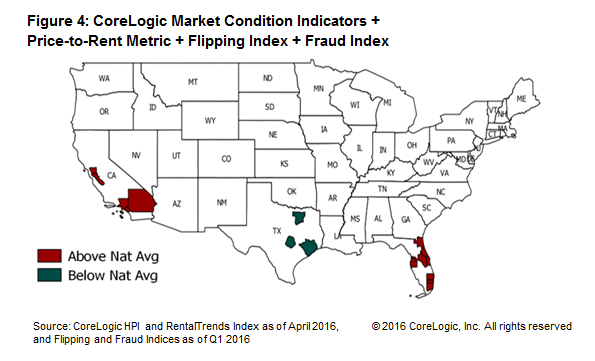

CoreLogic has developed the Mortgage Application Fraud Risk Index [4] in which we track mortgage fraud risk since 2010. Figure 4 shows that the CBSAs in Texas have below-national-average fraud risk, while the other 13 markets in California and Florida are all above the national level.

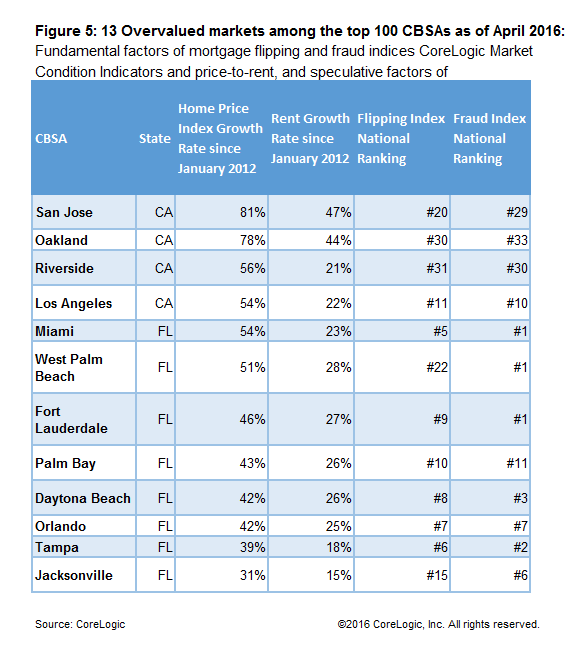

In summary, CoreLogic applied four metrics to the top 100 CBSAs: price-to-income and price-to-rent for fundamental factors, and the Flipping Index and Fraud Index for speculative behavior, resulting in 13 overvalued markets meeting all four criteria. Table 1 shows the details of home price and rent growth rates in these CBSAs, along with their national rankings in flipping and fraud risk. In most CBSAs, home prices grow twice as fast as rent. Also, many CBSAs have national flipping and fraud rankings at the top quartile, indicating significant bubble risks.

In the next blog, we will discuss what preemptive actions the industry can take to minimize risks in these overvalued markets.

[1] Link to Part I of this blog series

[2] Stiglitz, J. E. (1990), “Symposium on Bubbles,” Journal of Economic Perspectives 4(2), Spring, pp. 13-18

[3] Bin He: Is Flipping Coming Back? Part I

[4] Bin He: Is Flipping Coming Back? Part II

[5] Mortgage Fraud Trend Reports

© 2016 CoreLogic, Inc. All rights reserved.