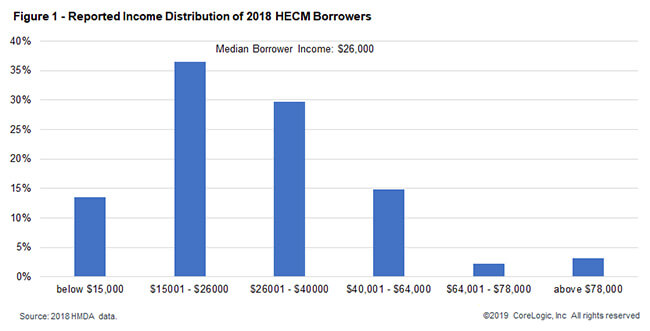

A reverse mortgage, such as the FHA-insured Home Equity Conversion Mortgage (HECM), offers older homeowners a way to tap into the housing wealth in their home to help increase monthly cash receipts. These owners often have quite modest income: the median income of borrowers who took out a HECM in 2018 was $26,000, in contrast to the U.S. median household income of $61,937 (Figure 1). When borrowers’ income was compared to their own age cohorts, there was also a large disparity between the two: 84.5% of HECM borrowers had a reported income below the median income of households headed by a person age 65 or older, $44,992, according to the 2018 American Community Survey.

Unlike other forms of equity borrowing (e.g., open-ended HELOC loan; close-ended second mortgage; cash-out refinance), reverse mortgages do not require repayment of the loan or accrued interest and fees – as long as the borrowing homeowner resides in the home. And importantly, for those carrying a mortgage debt into their senior years, a reverse mortgage offers a way out of existing mortgage debt. Indeed, many older homeowners could potentially benefit from using a reverse mortgage to pay off current mortgage debt: According to a recent study, the past two decades have seen the number of older homeowners holding mortgage debt doubling from 20% in 1992 to more than 40% in 2016.[1] Also unlike traditional mortgages, HECM borrowers with low income or limited credit history are not subject to credit screening – if the borrower could demonstrate a financial ability to maintain the property by paying property tax and insurance.

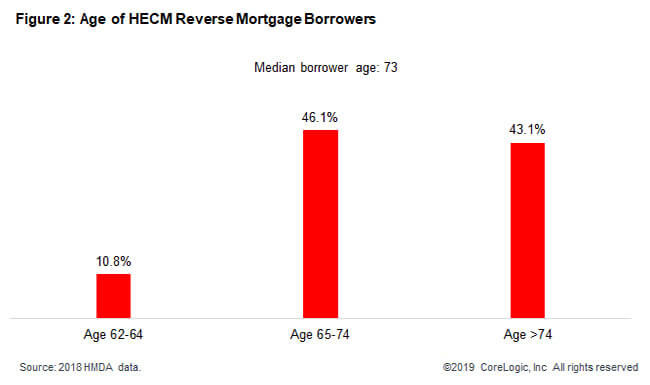

In particular, the HECM reverse mortgage – with a 95% share of the reverse market – allows a homeowner aged 62 or older to convert the equity in their primary residence.[2] The 2018 HMDA data shows the median age of HECM loan borrowers was 73 (Figure 2).[3] About 11% of the borrowers were aged under 65.

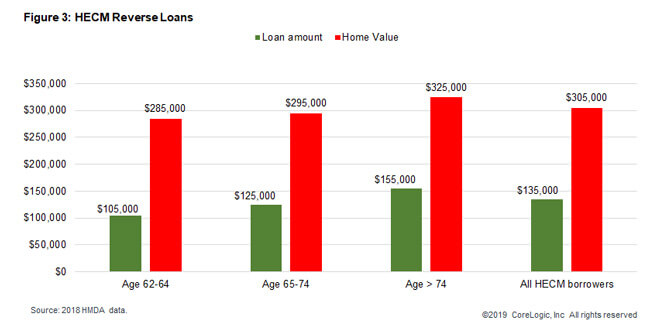

The amount that HECM borrowers may receive is determined by multiplying the principal limit factor (PLM) by the current value of the property. The PLM is partly an actuarial factor and is determined by the age of the borrower as well as the expected average interest rate over the expected life of the loan. The older the borrower age or the lower the expected interest rate, the higher the PLM. For instance, at an expected interest rate of 4.5%, the PLM is 0.459 for a 65-year old borrower and 0.519 for 75-year old borrower. If the expected interest rate drops to 3.0%, the PLM rises accordingly to 0.542 for the 65-year old and 0.609 for the 75-year old.[4] Borrowers could receive the loan in an up-front lump sum withdrawal or as a line of credit for future draws.

In 2018, the median loan amount of a HECM reverse mortgage (before fees and insurance premium) was about $135,000 and ranged from $105,000 for borrowers age 62-64 to $155,000 for those 75 and older. A higher PLM as well as home value contributed to the larger loan amount available to older homeowners. As shown in Figure 3, the median property value of older borrowers was larger.

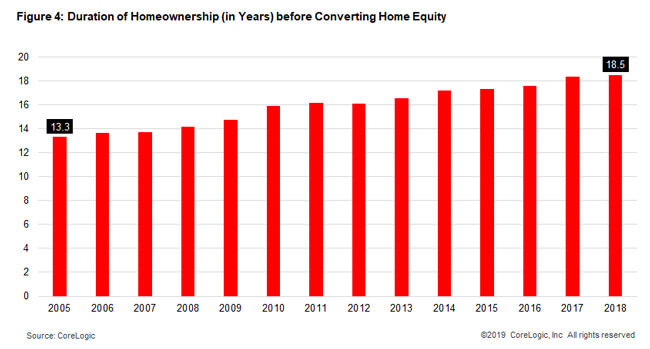

Using CoreLogic data to measure the length of home ownership when the HECM was placed shows that in the last decade this duration has gradually increased (Figure 4). The 2018 cohort of HECM borrowers had a median ownership duration of 18.5 years, a lengthening of 5.2 years compared to the 2005 cohort of HECM borrowers. A number of factors are likely at work. The upward trend in the number of senior homeowners carrying mortgage debt offers one plausible explanation. When homeowners are slower in paying off mortgage debt, they would also have to wait longer before they could build sufficient home equity to benefit from in a reverse mortgage. Likewise, the crash of home prices in the last boom-and-bust cycle and a slow recovery that followed also means many homeowners had little or no home equity to convert into a reverse mortgage. Meanwhile, demographic factors such as many Baby Boomers working longer beyond the normal retirement age means they will likely keep their home longer before cashing in on the housing wealth. In 2018, the labor force participation rate for people age 65 to 74 has reached 27%, up from 17.7% in 1998 and 25% in 2008, and is projected to rise to reach 32.5% by 2028. (Source: Bureau of Labor Statistics)

© 2019 CoreLogic, Inc. All rights reserved.

[1] “Unlocking housing wealth for older Americans: Strategies to improve reserve mortgage,” by Stephanie Moulton and Donald Haurin, the Ohio State University, 2019.

[2] https://www.housingwire.com/articles/47706-more-borrowers-turn-to-proprietary-reverse-mortgages/

[3] Based on applicant’s age only without considering the co-applicants. The median age is obtained from the report published by the Consumer Financial Protection Bureau, Introducing New and revised Data Points in 2018 HMDA, August 2019.

[4] Source: The U.S Department of Housing and Urban Administration.