October 2020 Economic Outlook

The World Health Organization declared COVID-19 a global pandemic on March 11. By mid-March, shelter-in-place orders were issued across many nations. While each of us may think about how it has affected our own local neighborhood, it has also affected communities across the world.

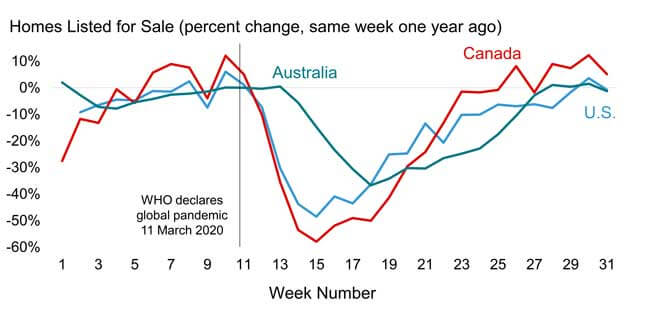

To illustrate, CoreLogic home sales data on listings and contracts can be compared across the U.S., Canada and Australia. The effect of the global pandemic has been consistent across each country: Homes newly listed for sale plummeted after mid-March. Measured relative to listings for the same period one year earlier, listings were down 40% to 60% relative to the prior year by mid-April. As shelter-in-place orders began to gradually lift, listings came back on to the market. By July new listings were at or above year ago levels.

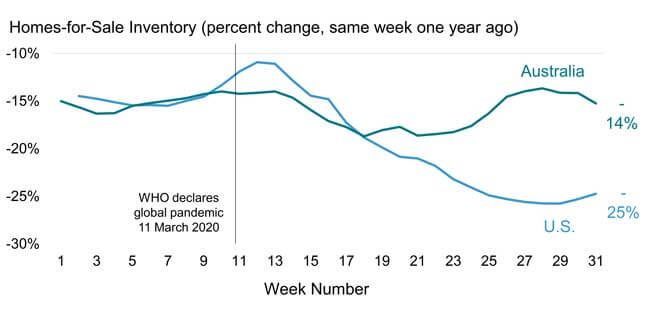

Nonetheless, a shortage of homes for sales remained relative to the prior year, as older homeowners with timing flexibility have delayed listing their homes. For-sale inventory was 25% lower in the U.S. and 14% less in Australia during July, compared with a year earlier.

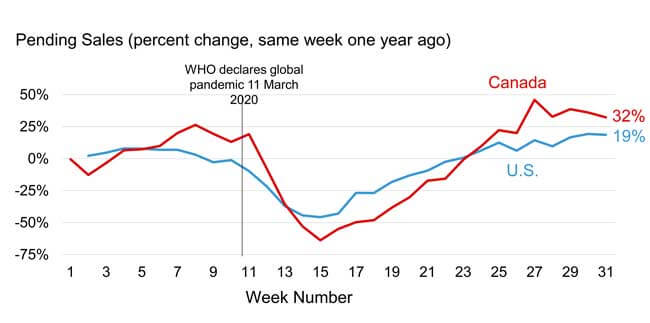

By July fixed-rate mortgage rates hit record lows in the U.S. and Australia while five-year mortgages approached record lows in Canada. These low rates sparked a pick-up in demand, especially by millennial households, leading to a recovery in home sales.

Signed contracts to sell, also known as Pending Sales, collapsed after mid-March and reached a nadir in April. Low rates sparked renewed buying. The traditional spring buying season was delayed by about three months, reflected in robust sales in July. By the last week of July, pending sales were up 19% in the U.S. and 32% in Canada relative to year-ago volumes.

The global pandemic hit all three nations at about the same time. As a result of shelter-in-place orders and mortgage rate reductions, the response of housing activity was largely similar across the three: new listings and pending sales fell precipitously after mid-March, reached a trough in April, and then rebounded by July to levels at or above prior year levels.

© 2020 CoreLogic, Inc. All rights reserved.

Get the CoreLogic Economic Outlook for September 2020 on YouTube. Each month, CoreLogic Chief Economist Dr. Frank Nothaft will provide data driven analysis for the economy and property industry. For more insights, subscribe to our YouTube channel.

Note: U.S. and Canada data are 7-day weeks ending Saturday. Australia weekly data are 28-day rolling total ending Sunday. The U.S. tabulations were form CoreLogic Partner Info Net, the Australia data were from CoreLogic International (Tim Lawless), and the Canada calculations were from CoreLogic Real Estate Solutions (Laura Salekin).