More than Three-Fourths of Home Sales Growth Is Driven by Millennial Buyers

For many millennials, the pandemic has been anything but an obstacle to leaving their rent-based urban lifestyle behind and settling down — and for good reasons. With plummeting interest rates, the timing to buy homes and invest in wealth-building homeownership couldn’t have been more perfect.

Shelter-at-home and remote work have driven a desire for larger living space and privacy which are often lacking in apartments. Financially, trading city rents and expenses for a mortgage may not pose too much of a budget stretch for many previous city dwellers, with or without down payment assistance from family or friends.[1]

Last year, leveraging their tech savviness to their advantage in navigating the pandemic homebuying, the millennial generation — typically considered to be those born in the 1980s and early-to-mid 1990s — emerged as the biggest force driving the housing market. According to the 2020 Home Mortgage Disclosure Act (HMDA) data, home purchases by young millennials, or those in their 20s and early 30s, represented the fastest-growing segment of buyers to power the pandemic housing market.

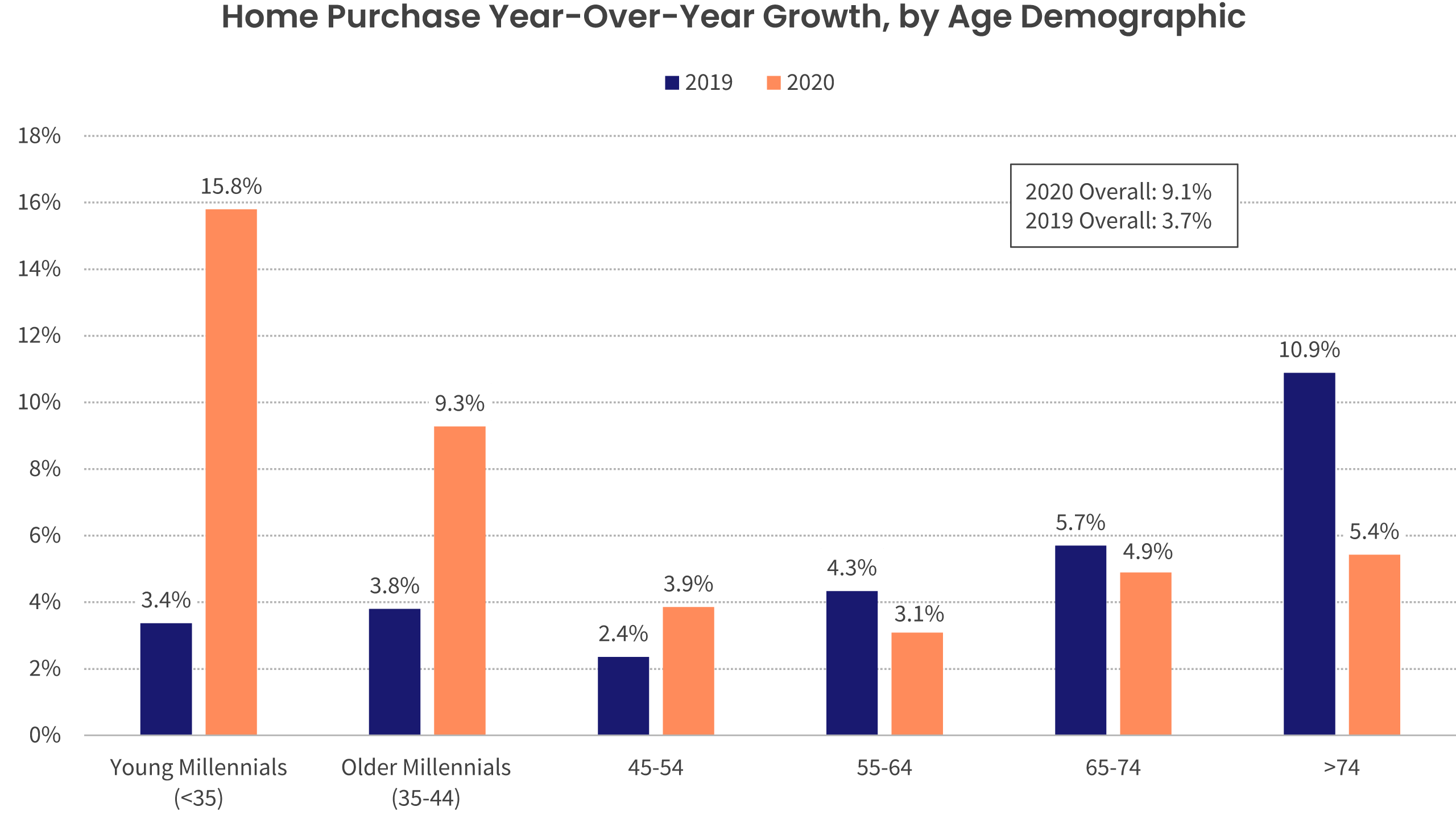

Of the 4.75 million home purchases reported in 2020 HMDA, approximately 1.78 million homes were acquired by young millennials, growing 15.8% since 2019 and far outpacing all other age cohorts, as seen in Figure 1.[2]

The double-digit growth in millennial homebuying is responsible for more than 60% of rising total home sales in 2020. Just a year earlier, young millennials’ homeownership acquisition grew only 3.4% and lagged behind older millennials or their parents and the baby boomer generations.

Figure 1: Millennial Buyers Are the Fastest-Growing Buyer Segment in 2020

Only mortgaged transactions are reported by the HMDA, which means all-cash purchases are not reflected in Figure 1. According to CoreLogic, about 30% of all purchases in 2020 were cash transactions, down 3 percentage points from 2019. But cash transactions are not common among millennial buyers as compared to non-first-time buyers, especially baby boomers.[3]

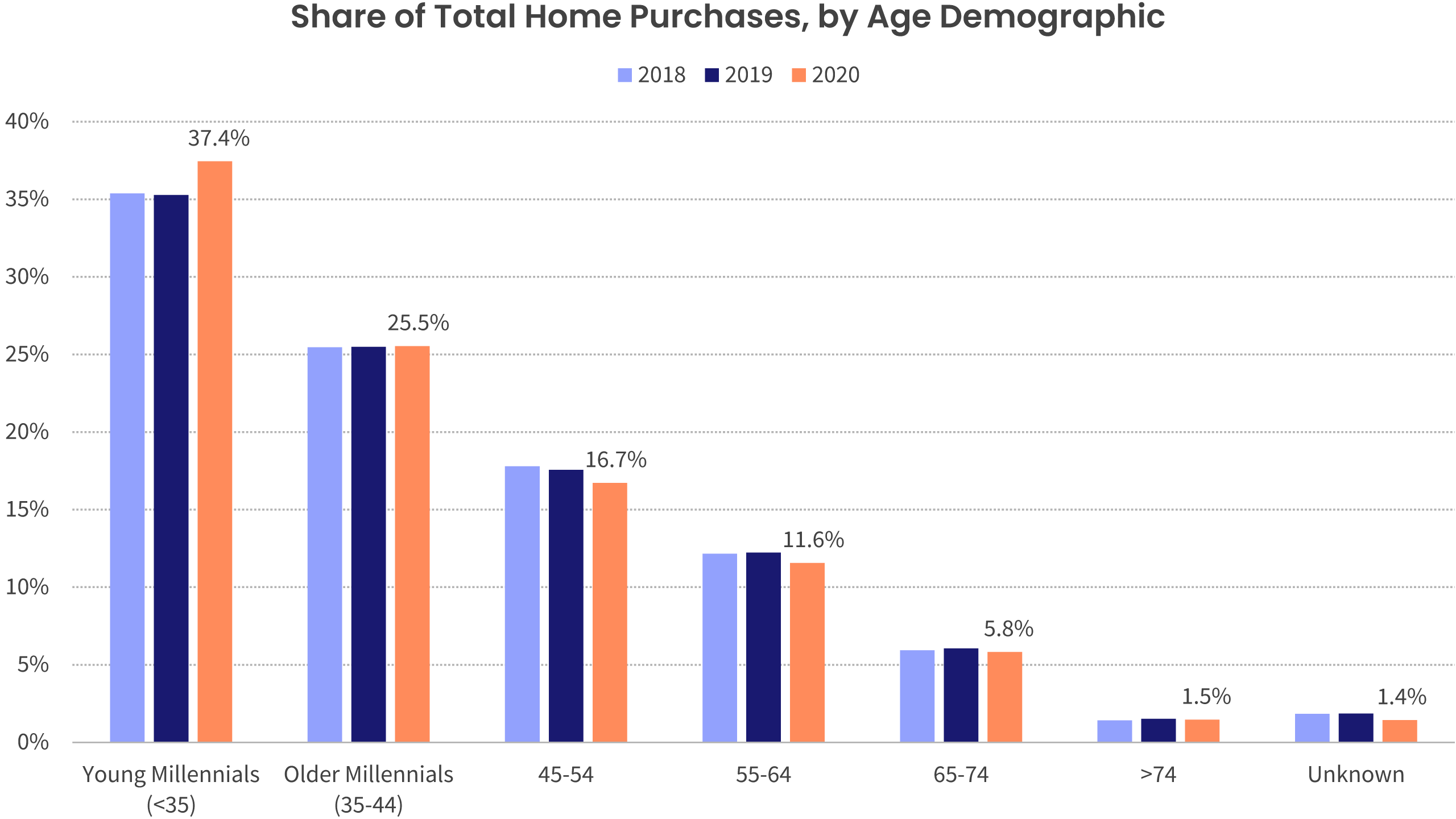

When each age cohort’s relative purchase volume is tabulated, as shown in Figure 2, it is more evident that millennials have accelerated home purchases during the pandemic. As a percentage of all reported mortgaged home sales, millennial homebuying reached a three-year high. Millennial buyers made up a steady 35% of all homebuyers before the pandemic. In 2020, the share of millennial buyers rose more than two percentage points to 37.4%; by contrast, the other age cohorts had flat or declining participation rates.

Figure 2: Young Millennials Are Making the Biggest Inroads into Homeownership

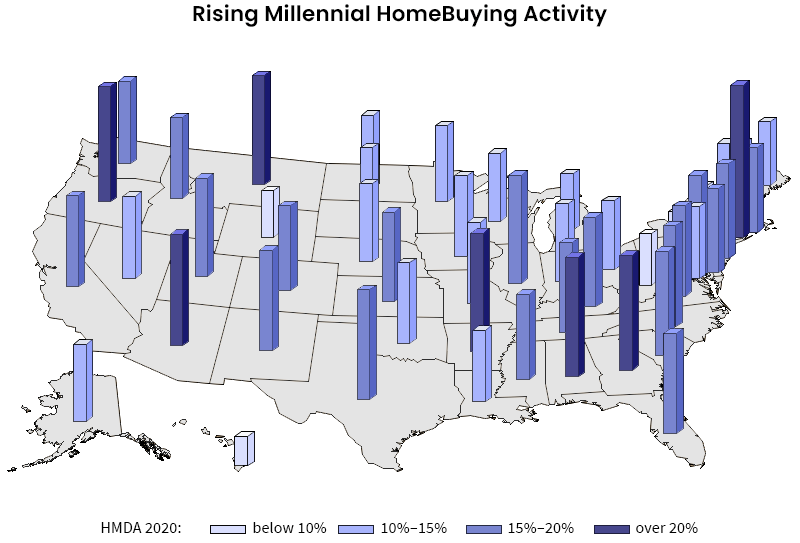

Figure 3 maps the growth in millennial homebuying activity for individual states. Connecticut leads with the fastest rise in millennial buyers at a growth rate of 28.2% over 2019, followed by Oregon (21.6%), Alabama (21.2%), Arkansas (21.2%), Georgia (20.5%), Montana (20.5%), Arizona (20%), and Illinois (19.8%). The smallest increases are in West Virginia (9.3%), Wyoming (8.5%), Pennsylvania (7.9%), New York (6.6%), and Hawaii (5.0%).

Figure 3: Mapping Millennial Homebuying Growth Spurts

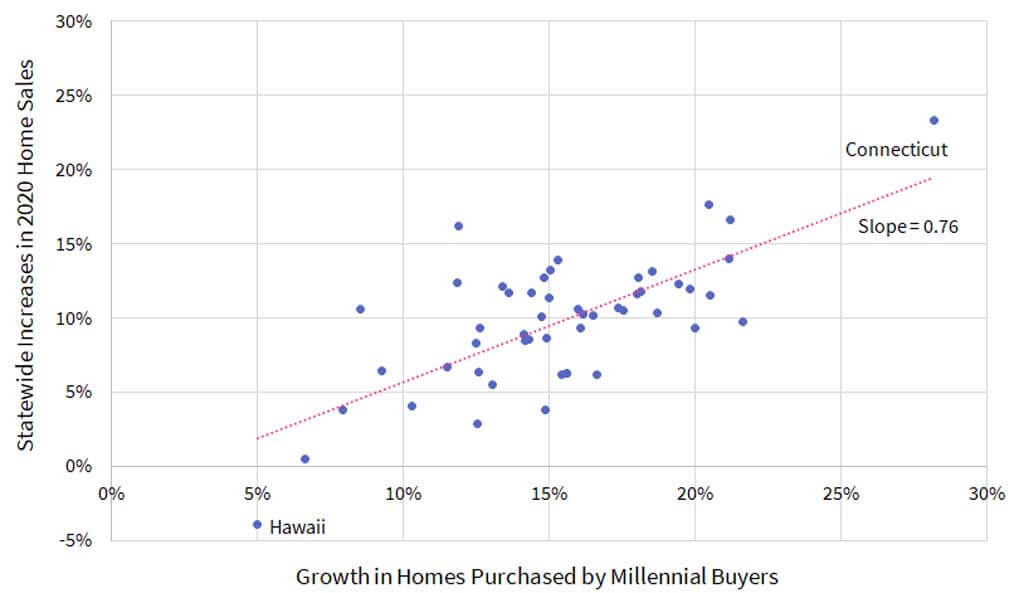

The force of millennial buyers in driving the pandemic housing market is more evident when plotting rising total home sales against growth in millennial homebuying for all 50 states (Figure 4). The correlation is strong, and a linear fit line indicates that more than 75% of rising home sales is driven by acceleration in millennial purchases. Connecticut’s millennial buyers drove a 23.3% rise in statewide home sales, the highest among all 50 states. Even for New York and Hawaii, where total statewide home sales were flat or declining, rising millennial homebuying has helped to offset an overall weakness.

Figure 4: More than Three-Thirds of the Growth Is Driven by Millennial Buyers

Acquiring homeownership in 2020 was a challenge on many fronts, from financial setbacks due to pandemic-related job or income loss to participating in one of the most competitive markets of more than a decade — and not to mention having to adapt to the intricacies of the pandemic homebuying process. Despite these barriers, young millennials emerged as the fastest-growing buyer segment, far outpacing older millennials, their parents and the baby boomer generation.

Will the demand continue? A few factors are likely to help sustain the trend. First, lasting changes to many employees’ remote work flexibility in the eventual post-pandemic economy will likely keep the momentum for space, privacy and proximity to family and friends going.

Secondly, millennials are more likely to be influenced by their peers and social media when it comes to whether or not they are considering buying a home or the proximity of its location.[4] Multiplications of potential herding behaviors among the millennial buyers will likely shape the housing market in the years to come.

[1] According to the National Association of Realtors, 28% of young millennials used a gift or a loan from family or friends for the down payment.

[2] When the age of the co-applicant is also considered, 1.92 million homes were purchased by young millennials. Smaller lenders that originated fewer than 100 closed-end mortgages were not required to file the HMDA reporting.

[3] Typically about 5-6% of first-time homebuyers pay all cash. In 2020, the percentage increased and averaged about 7-8%. Source: https://www.nar.realtor/blogs/economists-outlook/all-cash-sales-are-rising-sharply-amid-intense-buyer-competition

[4] 2018 Home Buyer and Seller Generational Trends, National Association of Realtors.