Standard Delinquency Measures Paint an Incomplete Picture of the Severity of Mortgage Distress

The latest loan performance data from CoreLogic shows that the nation’s mortgage delinquency rate in February 2021 was 5.7%, a small increase from January’s 5.6%. The delinquency rate calculates the number of loans in various stages of distress — 30-59 days past due, 60-89 days past due, 90+ days past due, and foreclosures — as a percentage of all first-lien mortgages in servicing.[1]

Loans 90+ days past due or in foreclosure are referred to as serious delinquencies. As the name suggests, serious delinquencies can reveal more severe borrower distress. Under normal circumstances, lenders will typically begin moving loans that are 90+ days past due through the foreclosure pipeline. But with COVID-19 forbearance and foreclosure moratoria, serious delinquencies could build up quickly as foreclosure activities remain muted. In February, the serious delinquency rate was 3.7%, 51 basis points lower than the pandemic high reached in August 2020.

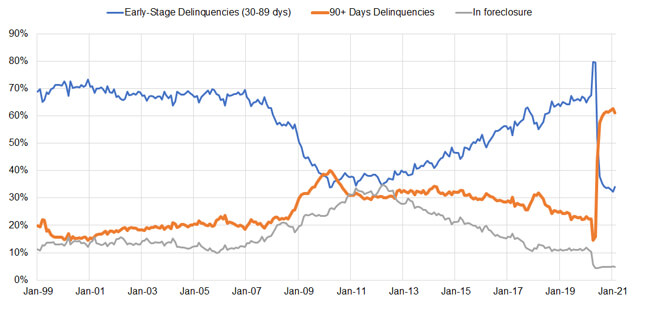

However, when serious delinquencies are disaggregated into loans that are 90+ days delinquent and those in foreclosure, there has been a steady buildup of mortgage distress among delinquent borrowers even as serious delinquencies overall have fallen. And there is a good reason to look at the two separately because payment forbearance and foreclosure moratoria have kept foreclosure activities low and muted.

In Figure 1, two decades of loan performance data reveals that with millions of homeowners in COVID-19 payment forbearance, loans that are 90+ days delinquent — as a percent of all distressed loans — have reached levels never seen before, not even during the height of the last mortgage crisis when they peaked at about 40%.

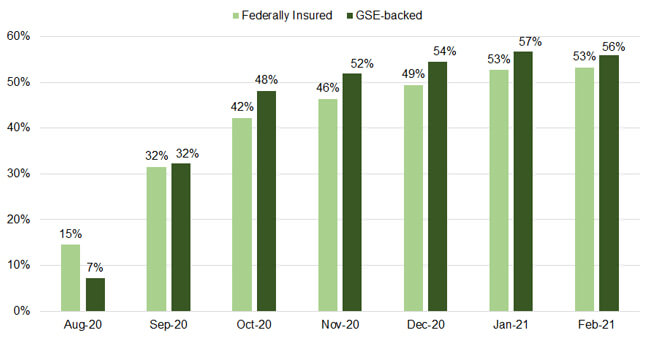

CoreLogic loan-level market analytics data further shows that as of February, not counting foreclosures, 56% of the delinquencies backed by the government-sponsored enterprises (GSEs) were more than 180 days past due — eight times the rate reached in August (Figure 2). Similarly, 53% of federally insured or guaranteed mortgages that are delinquent were 180+ days past due — three and a half times the August rate.

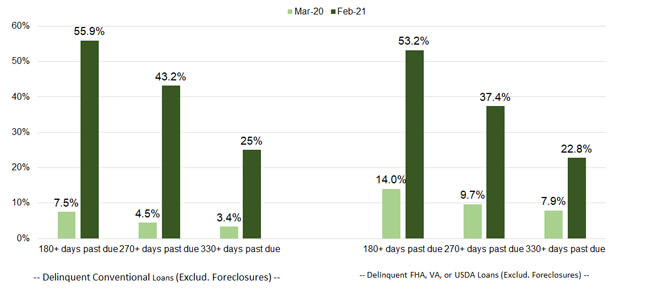

Figure 3 provides pre- and post-pandemic comparisons of loans in severe payment distress, ranging from 180+ days past due to 330+ days past due. Twelve months after the pandemic, shares of mortgages in severe payment distress have multiplied many times. For example, the share of 180+ day delinquencies is nearly eight times the pre-pandemic level. 270+ day delinquencies, meanwhile, are nearly ten times the pre-pandemic level.

It is evident that with COVID-19 forbearance and foreclosure moratoria, the extent of mortgage distress cannot be fully captured by standard delinquency measures that place all loans that are at least 90 days delinquent into one metric. To better account for the severity of payment distress incurred by many borrowers in COVID-19 forbearance plans, it is critical to also measure the distribution of months past due for the loans that are 90 days or more delinquent. Additional measures that factor in the severity of payment distress in number of months can help servicers better monitor how to prepare for the potential challenges ahead when the forbearance period comes to an end.

©2021 CoreLogic, Inc. All rights reserved.

[1] Under the CARES Act, servicers are prohibited from reporting to the credit bureaus loans in forbearance and past due as delinquent. CoreLogic has calculated delinquencies based on the last paid installment from the borrower, as reported to CoreLogic by servicers.