The Modern Age of Desk Adjusting for the Insurance Industry

Deploying adjusters to the field is a large overhead cost for insurance companies. Incoming claims vary in terms of size and severity, and with that, not every claim requires an on-site adjustment. Thus, in addition to field adjusters, insurance companies rely heavily on a robust desk adjustment program to address smaller claims at higher volumes. To make for effective desk adjusting, these adjusters must have an arsenal of innovative technologies and tools available to ensure a favorable customer experience while keeping overall internal costs manageable for the carrier.

Weather Verification – Damage from Hail and Wind Impact

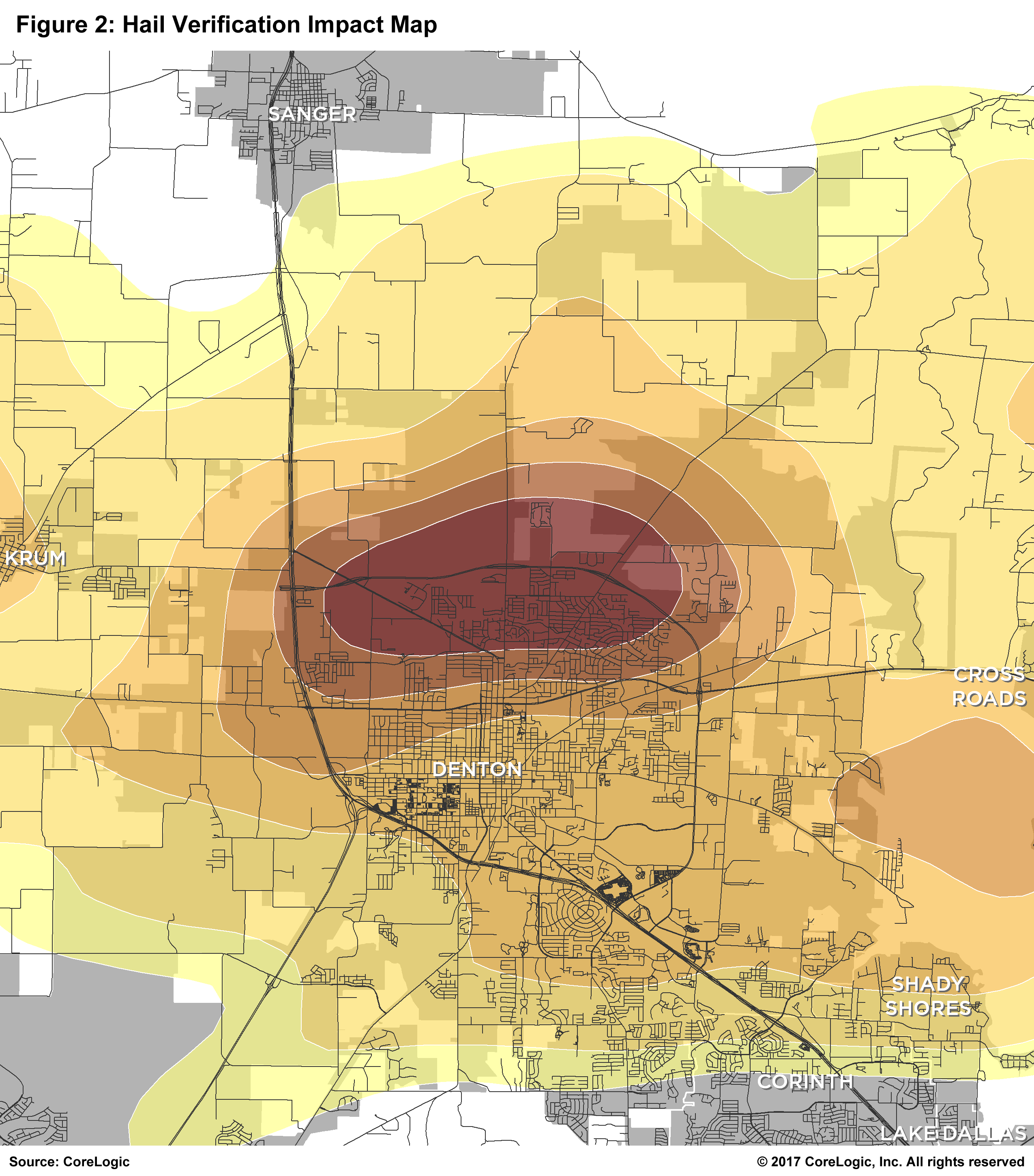

When a storm hits, the most precious commodity is time. Every year, weather disaster events alone cause significant damage and contribute to large influxes of claims, especially those surrounding roof damage. Being able to effectively deploy a catastrophe response program is critical for insurance companies who are looking to ensure customer satisfaction. Thus, insurance companies rely on advanced weather verification technology to target impact areas and verify hail and wind claims made by policy holders.

Technological advances and weather verification technologies allow adjusters to quickly and accurately verify incoming claims or detect those of the fraudulent variety. In addition to mapping the hail/wind swath (the storm’s footprint on the ground), these mapping techniques can also be used to identify the size of hailstones/speed of wind and create mapped contours to enable the ability to identify areas subject to the greatest damage. These highly accurate contours can be overlaid on street maps, satellite images and parcel boundaries to precisely identify, down to the parcel-level, the size of hailstones/speed of wind in the areas affected by the storm. This attention to detail results in reliable and accurate hail and wind footprints that enable desk adjusters to quickly and confidently make claims decisions.

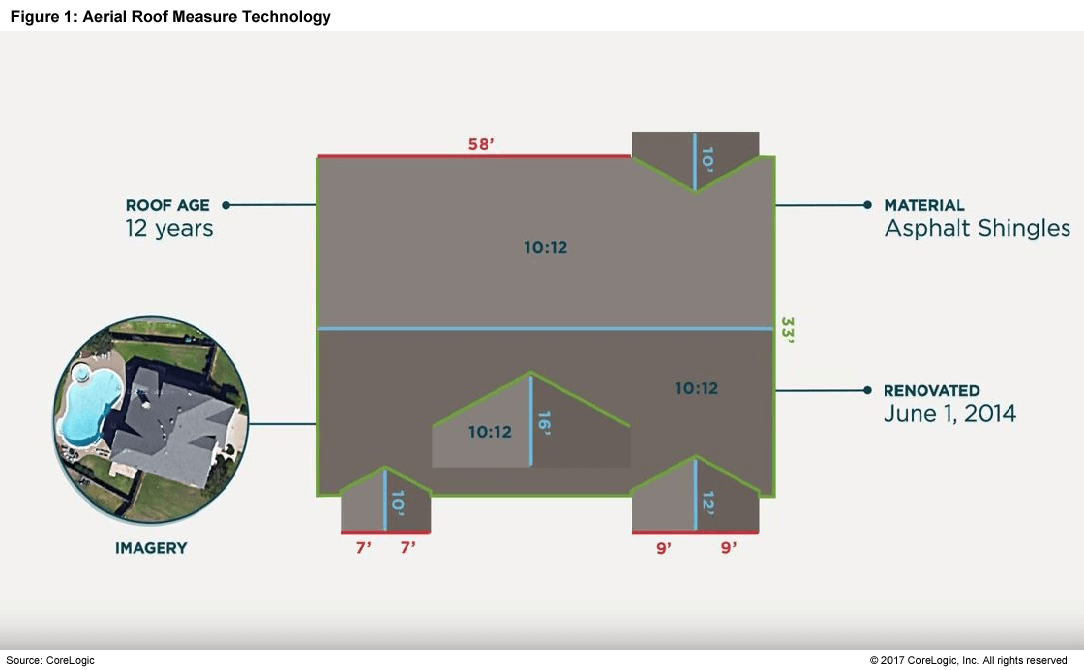

Aerial Roof Measurement

Another great tool that desk adjusters should have in their technology arsenal is aerial roof measurement. The concept of aerial roof measurement has not only revolutionized the way that adjusters view their time spent, but also gives them the confidence they need to save time and forego risky practices that were previously critical to the claims process. By using aerial roof measurement technology, desk adjusters can confidently estimate the cost of a roof claim and further accelerate the claims process.

Desk adjustment programs can be very effective for insurance companies that are looking to streamline their claims process. However, as the desk adjustment process has reliance on information from a variety of sources, tools like weather verification and aerial roof measurement are critical to the success of these programs, enabling insurance companies to make the most out of their time spent and ensure that levels of customer satisfaction remain high.

© 2018 CoreLogic, Inc. All rights reserved