Denial rate differences appear related to DTI, LTV, and credit score

Home Mortgage Disclosure Act (HMDA) data provide the most comprehensive detail on loan application decisions across the US residential mortgage market. However, HMDA does not collect many applicant-level variables that determine the underwriting decision. For example, HMDA data do not provide credit score, debt-to-income (DTI) ratio and loan-to-value (LTV) ratio. CoreLogic Loan Application data has these three variables but not the underwriting decision. In this blog, we calculate the denial rate for single-family home-purchase loan applications in underserved neighborhoods (low-income and minority census tracts) and compare with all other neighborhoods using HMDA data.[1] We then analyze the trend in home-purchase applicant average credit score, DTI, and LTV using the loan application data.

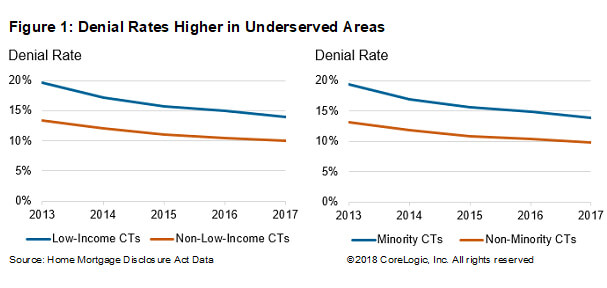

Though the share of home-purchase mortgage lending in low-income census tracts (CTs) has increased steadily and the denial rate has declined, the denial rate in low-income CTs is higher than in other CTs.[2] The overall denial rate for home-purchase loans in low-income CTs was 14 percent in 2017 compared with just 10 percent in the non-low-income CTs (Figure 1). The denial rate for home-purchase loans in low-income CTs dropped by 6 percentage points from 20 percent in 2013 compared with 3 percentage points drop in denial rate in non-low-income CTs. The denial rate gaps are likely related to borrowers in underserved neighborhood having less wealth (thus, higher LTV), less income/savings (thus, higher DTI), and a lower credit score.[3]

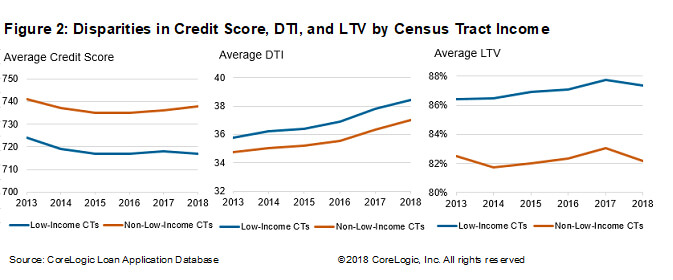

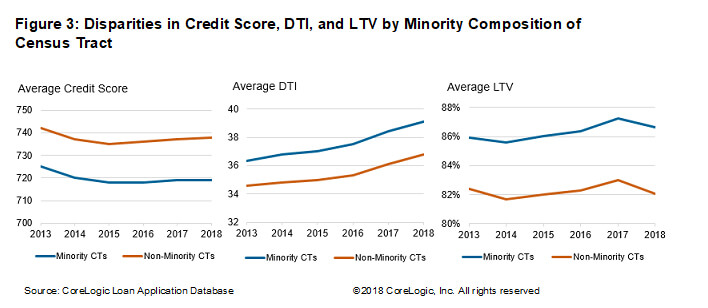

A study conducted by the Bureau of Consumer Financial Protection (BCFP) found that consumers in low-income areas were less likely than those in higher-income areas to establish good credit.[4] For 2017 we found that the average credit score of applicants in low-income CTs was 718 compared with 736 for the applicants in non-low-income CTs, consistent with the BCFP finding (Figure 2). Further, we found that the average LTV of applicants in low-income CTs was higher than for applicants in other CTs. Since many of the applicants in low-income CTs may not have enough savings for a substantial down payment, their LTV ratio is higher compared to applicants in non-low-income CTs. Likewise, applicants in low-income CTs had higher DTI than the applicants in other CTs. We also found that applicants in low-income CTs have lower income than the applicants in non-low-income CTs. Figure 3 shows similar trends of disparities in credit scores, DTI, and LTV among applicants in minority CTs and non-minority CTs.

The substantial disparities in average credit score, DTI, and LTV among the applicants in low-income CTs and non-low-income CTs are reflected in the denial rate. Wealth and income constraints have challenged access to mortgage credit for potential home-buyers in underserved neighborhoods. In addition to wealth and income constraints, a tight housing supply and rising home price in the lower price-tier market increases the challenge of narrowing the gap in homeownership between low-income CTs and other neighborhoods.

[1] A low-income census tract is a census tract in which the median income does not exceed 80 percent of the area median income. The FHFA defines “minority census tract” as any census tract that has a minority population of at least 30 percent and a median income of less than 100 percent of the area median income.

[2] Both HMDA data and CoreLogic’s public records data show increasing share of mortgages in low-income areas.

[3] The analysis is at the CT level, and thus it doesn’t explore borrower demographics such as race and ethnicity.

[4] Source BCFP website

© 2018 CoreLogic, Inc. All rights reserved