“Pig in the Python” effect follows jumps in 30-day in April, 60-day in May

The widening pandemic led President Trump to declare a national emergency on March 13, sparking shelter-in-place directives across many communities. The shuttering of commercial establishments subsequently put many American workers out of work.

Initial claims filed for unemployment insurance averaged 218,000 per week in 2020 through March 14, and then ballooned to more than 3.1 million per week the following 16 weeks, totaling 50 million initial filings between mid-March and Independence Day.

As such, many homeowners affected by sudden job loss were ill prepared to maintain payments on their home mortgage loans. The CARES Act[1] provided mortgage forbearance for homeowners who were financially harmed by the pandemic recession and had a federally backed loan – a home loan insured or guaranteed by FHA, VA, or the USDA, or owned by Fannie Mae or Freddie Mac. Servicers could extend forbearance to other home loans as well, although they were not obligated to do so under the CARES Act. Because loans in private-label Residential Mortgage-Backed Securities (RMBS)[2] do not meet the federally backed definition, they are a segment of debt that may be more at risk. An analysis of CoreLogic® private-label RMBS data reveals the impact the pandemic recession has had on mortgage-payment timeliness.[3]

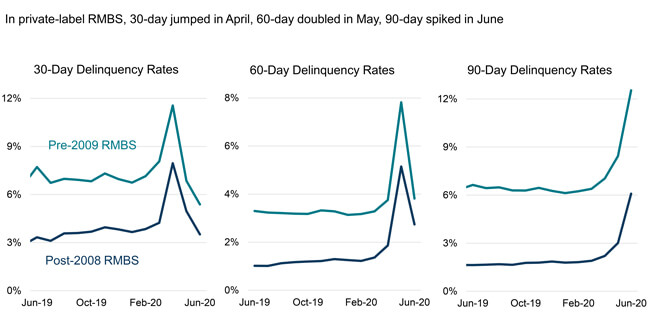

Because underwriting quality has improved since 2008, the CoreLogic data has been separated into private-label RMBS issued 2008 and earlier and those issued after 2008. Comparing 30-day, 60-day and 90-day delinquency rates reveals two clear differences (Figure 1).

First, the younger private-label RMBS have delinquency rates that are roughly one-half that of the older RMBS, reflecting the higher quality of underwriting after 2008. Second, delinquency rates during spring 2020 leapt to double what they had been pre-pandemic. The delinquency jumps reflect a “pig in the python” pattern: 30-day rates spiked during April, 60-day rates in May, and 90-day rates in June. Next month’s data will likely show an increasing serious delinquency rate, especially since double-digit unemployment rates continued through July.

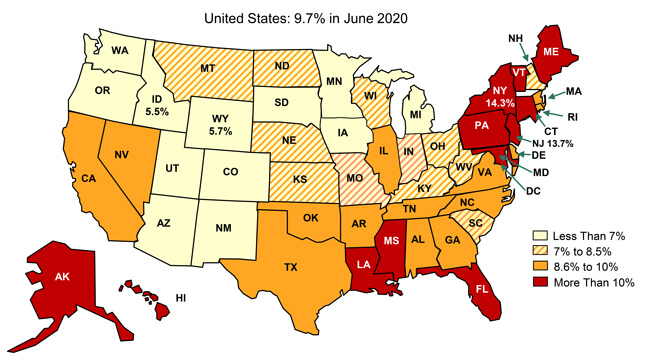

The increase in delinquency rates varies across the U.S., reflecting the unevenness of the pandemic’s spread, existence and stringency of local shelter-in-place directives, and variation in job loss by industry. By state, 90-day delinquency rates in June varied from about 14% in New York and New Jersey to 5.7% or less in Wyoming and Idaho (Figure 2). The delinquency rates have a high correlation (0.40) with the unemployment rate by state: The June unemployment rate in New York was 15.7% and in New Jersey was 16.6%, compared with 7.6% in Wyoming and 5.6% in Idaho. Generally, places with high unemployment also have high loan delinquency rates, as income loss triggers nonpayment of debt.

Summary:

- Loans in private-label RMBS are not federally backed.

- Private-label RMBS issued after 2008 have delinquency rates that are about one-half that of those issued 2008 or earlier.

- Delinquencies reflect a “pig in the python” pattern: 30-day rates spiked in April, 60-day rates in May, and 90-day rates in June.

- Unemployment and delinquency are correlated across states; places with high unemployment tend to have high delinquency too.

For more Insights from CoreLogic, check out our blog – delivering expanded perspective on the housing economy and property markets.

[1] The Coronavirus Aid, Relief, and Economic Security (CARES) Act was signed into law on March 27, 2020.

[2] Private-label RMBS are residential MBS that are not issued or guaranteed by Ginnie Mae, Fannie Mae or Freddie Mac. Nearly all FHA-insured and VA-guaranteed loans are placed in Ginnie Mae MBS.

[3] The weekly Forbearance and Call Volume Survey conducted by the Mortgage Bankers Association reported that 10% of loans that were in a bank portfolio or in a private-label RMBS were in forbearance during June. The survey does not indicate how many (or whether any) private-label RMBS loans were in forbearance. Some of the loans in forbearance were FHA and VA loans bought out of Ginnie Mae MBS and placed in bank portfolios.