Fifty percent more rental properties exited the market than were added in 2021

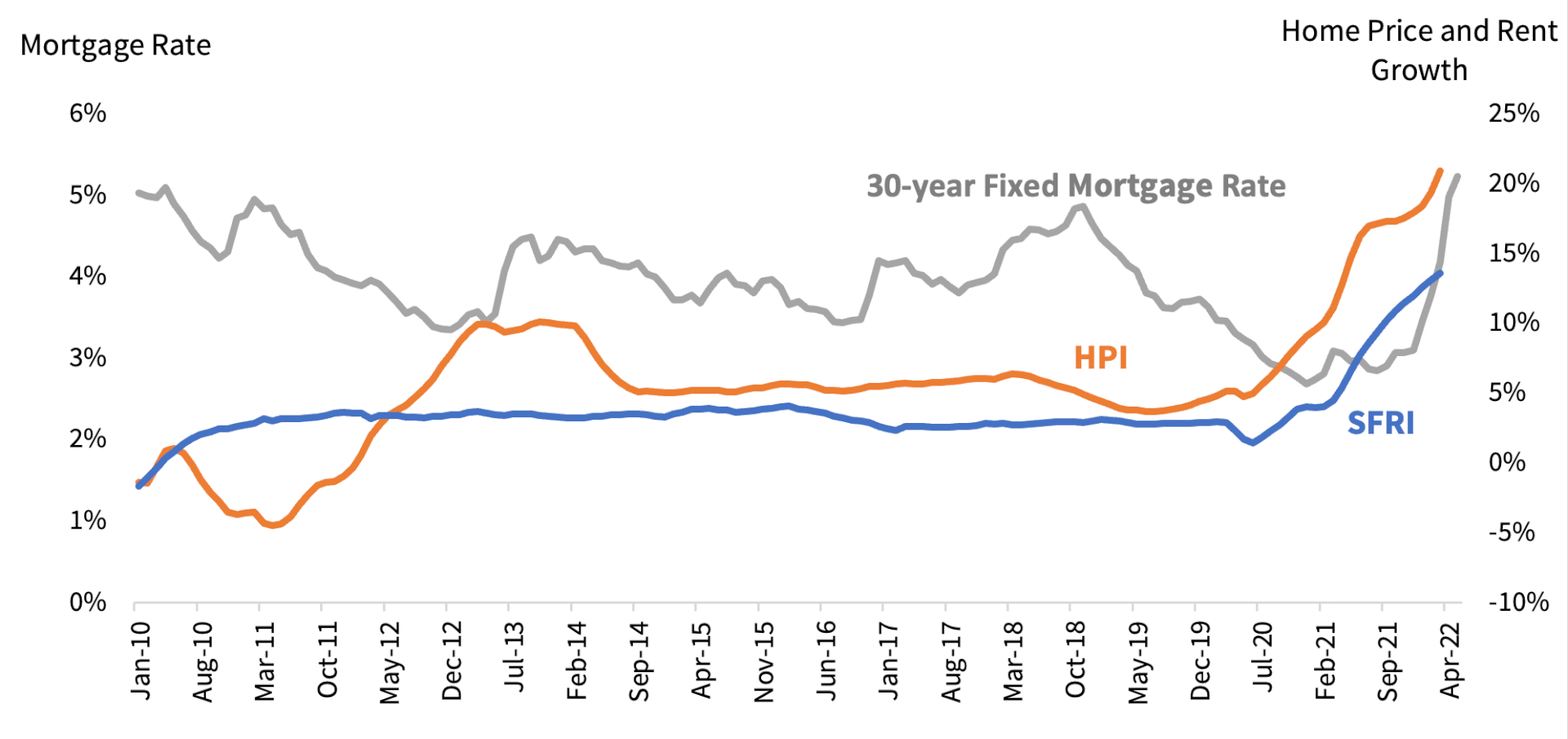

Fueled by the housing supply shortage and historically low mortgage rates during the pandemic, both home prices and rents hit new highs. According to the CoreLogic Home Price Index (HPI), national home prices increased 18.3% in June 2022 compared to a year ago. This growth followed the highest 12-month increase in the U.S. index since the series began in 1976 when April saw prices jump 20.3%. Annual rent posted a gain of 13.4% in June, according to CoreLogic Single-Family Rent Index, a figure just short of a record level.

Figure 1: U.S. Home Price and Rent Growth Reached New Highs

With home price growth at record levels, some single-family investors sold their rental portfolios to extract equity gains. By tracking all sales and lease transactions for a set of 2.8 million single-family rental properties across 47 metros[1], CoreLogic observed gains and losses in the country’s rental stock.

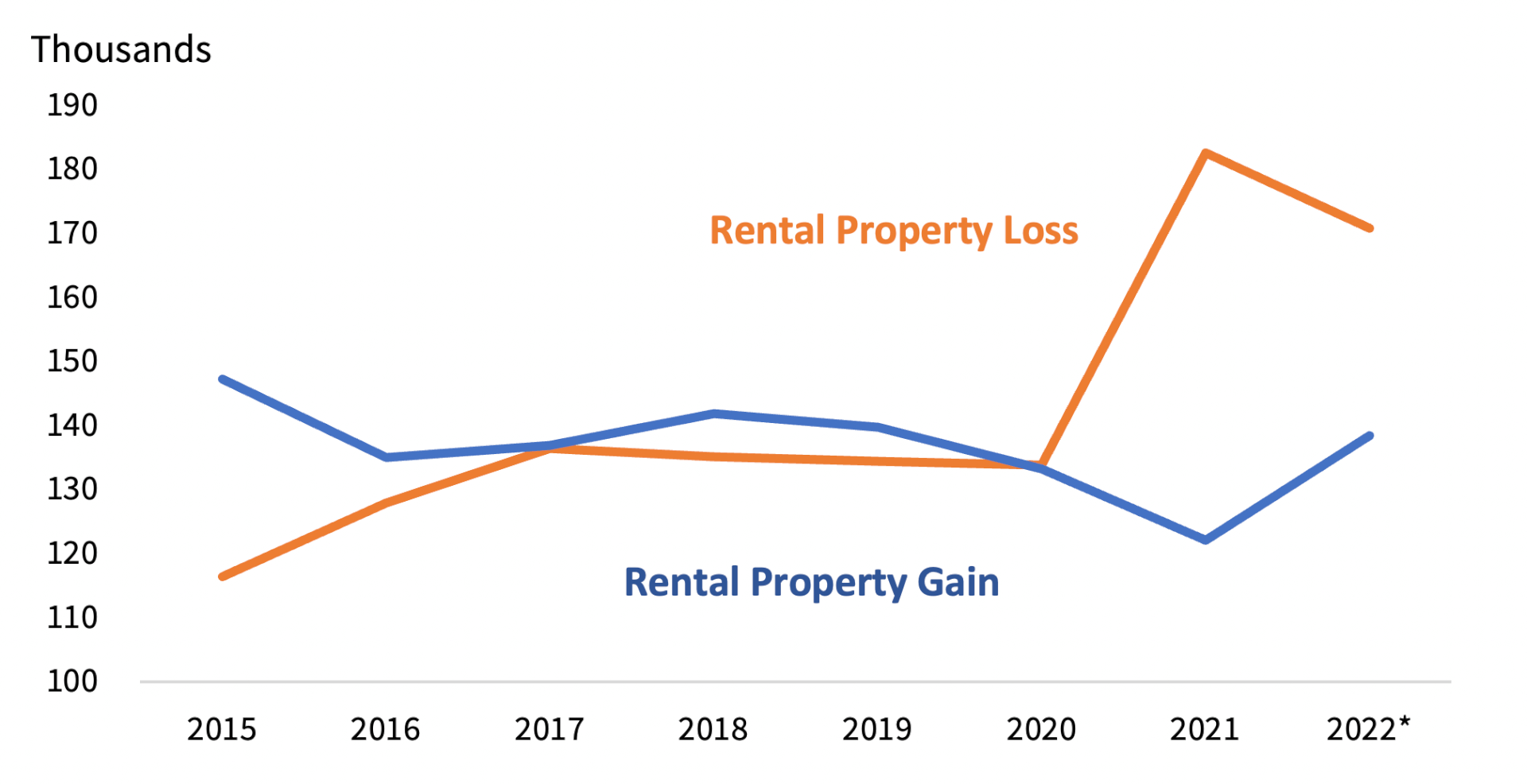

A rental stock gain occurs when there is a record of a leased transaction after a property sells. Conversely, a rental stock loss is defined when a sales transaction follows a leased transaction. Figure 2[2] shows the number of properties added and subtracted from the rental stock since 2015. Before 2017, when home prices were still recovering from the Great Recession, the number of properties entering the rental stock was more than the number of rental properties that exited. Between 2016 and 2020, as home price growth stabilized and slowed before the pandemic, the number of properties that entered and exited the rental stock was about the same. However, as annual home price growth started to post double-digit gains in 2021, more investors and landlords sold their rental properties. The number of rental properties that exited the market was about 50% higher than the number added in 2021.

Figure 2: Rental Stock Flow

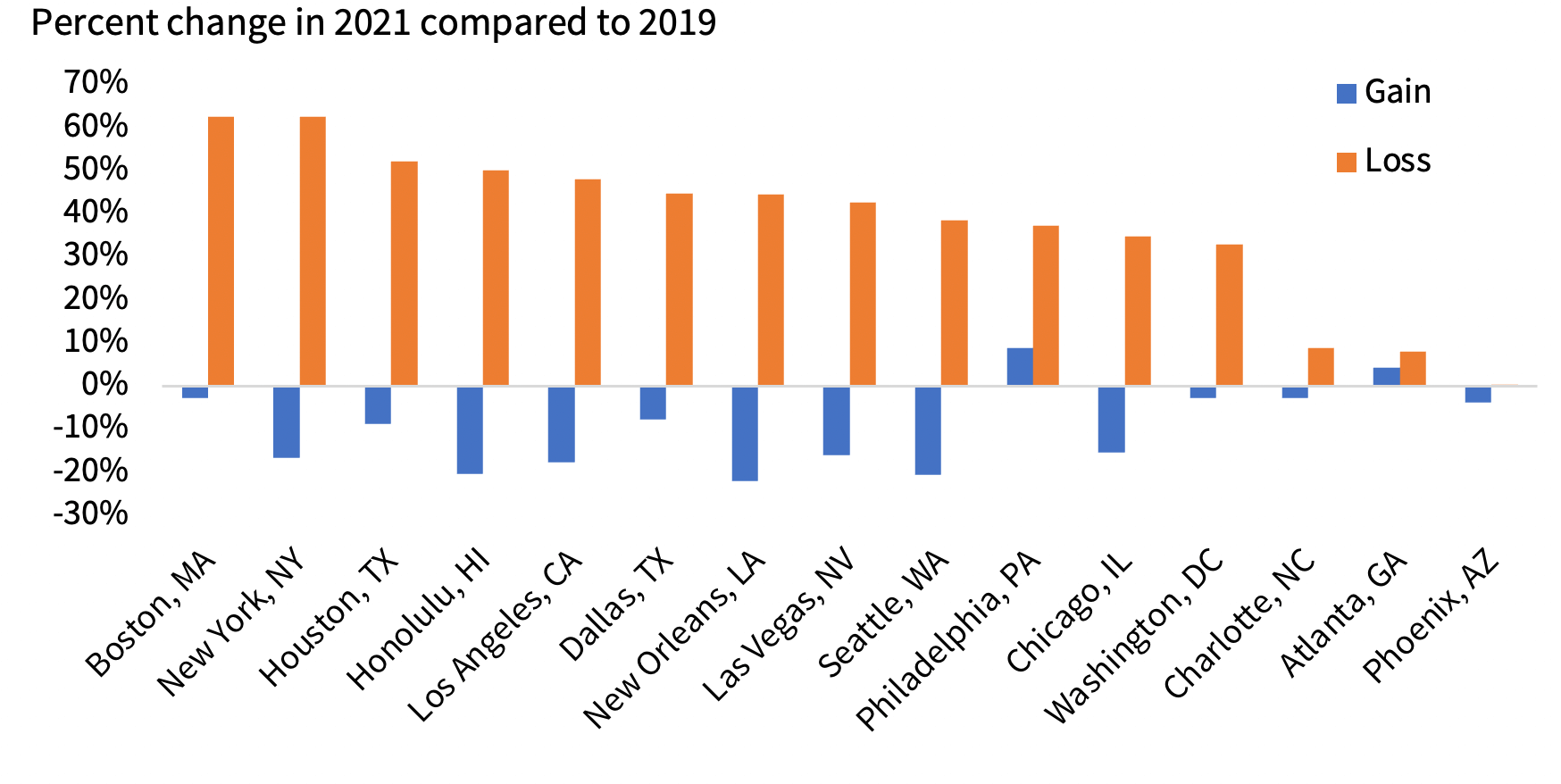

Due to the flexibility of remote work, many people left high-cost cities. As a result, landlords had a difficult time finding new tenants and chose to sell their rental properties. Figure 3 shows the percent change of rental properties added or sold in 2021 compared to 2019 for 15 metro areas. In New York[3] and Boston, where the cost of living is high, the number of rental properties sold on Multiple Listing Service platforms in 2021 increased over 60% compared to 2019. On the other hand, landlords and investors in low-cost areas were not in a hurry to sell their rental properties. The number of rental homes sold in Phoenix remained at the same level in 2021 when compared to 2019.

Figure 3: Rental Stock Changes by Metro

With the strong home price appreciation over the past two years, some investors who sold their rental properties during the pandemic were able to reinvest and acquire other rental properties. As a result, there has been an increase in the number of rental properties that changed ownership but remained a part of the rental housing stock[4] category.

As housing market demand slows and borrowing costs climb, there has been an increase in new for-sale listings and an expansion of for-sale inventory. Slowing home buying demand may also reduce the number of rental properties for sale as investors choose to wait for home buying demand to increase so they can maximize their selling price.

[1] Using CoreLogic Multiple Service Listing Data in 47 Core Based Statistical Areas and Divisions

[2] 2022 preliminary rental stock gain and loss are two times the total of January to June of 2022.

[3] New York-Jersey City-White Plains, NY-NJ, excluding Manhattan.

[4] Rental properties sold and re-rented within six months.