M7.1 and M6.4 Searles Valley Earthquake Sequence

The earthquake risk in California is no secret. For years scientists have been warning the state is overdue for a large damaging event. It’s been nearly 30 years since the devastating 1989 magnitude (M) 6.9 Loma Prieta earthquake and 25 years since the 1994 M6.7 Northridge earthquake. It has been long enough for society to have become complacent and for earthquake risk to not be at the top of minds. That all changed on July 4 and 5 when two large earthquakes struck near Ridgecrest, California – a fairly remote region in the Mojave Desert.

The largest earthquake in the sequence, a M7.1 struck on Friday, July 5 at 8:19 pm local time in California near Ridgecrest, California. This event was preceded by a M6.4 event on Thursday, July 4. Hundreds of foreshocks (those preceding the M7.1 event) and aftershocks (those following) have been recorded in this earthquake sequence, the next largest of which has been an M5.4, which struck nearly 10 miles west of Searles Valley, on July 5 at 4:07 am local time.

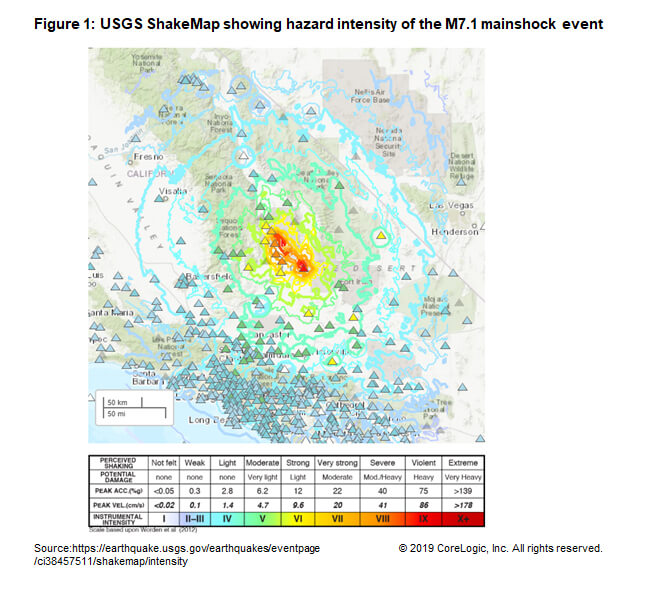

The ground motions from the M7.1 and M6.4 earthquakes would have been strong enough to cause damage within approximately a 40-mile radius of the epicenter of the largest event. Fortunately, both earthquakes struck in a remote area, nearby Ridgecrest and Searles Valley, the former with the largest population center of roughly 28,000.

The media attention that the earthquakes garnered have in part been helped by how far away these earthquakes were felt. Both earthquakes were felt in Los Angeles, over 150 miles away, across southern California and Nevada. The mainshock event was even reported to be felt in the San Francisco Bay area, over 350 miles away.

For this region, a M7.1 is a sizable earthquake in terms of magnitude, however in terms of potential damage, this is a rather light event for California due to the remote location. Based on the USGS PAGER report 45,000 people experienced very strong shaking or MMI VII on the Modified Mercalli Intensity Scale. At this level of shaking, the potential for damage is moderate.

Had the level of shaking been stronger or had a greater number of properties been closer exposed to this level of shaking, more damage could have been expected. Greater damage is expected when MMI is VIII (severe) or greater. At MMI VIII, significant damage can be expected to unreinforced masonry structures, less of an issue in California, with light damage to reinforced masonry buildings and Wood frame structures, and damage to masonry veneers can be expected.

At the time of this writing, a complex at the Naval Air Weapons Station at China Lake has been evacuated and identified as potentially experiencing damage. No information is known as to the extent of damage at this time, however latest information available indicates that the facility is declared non-functional, and road infrastructure damage has been reported surrounding the facility.

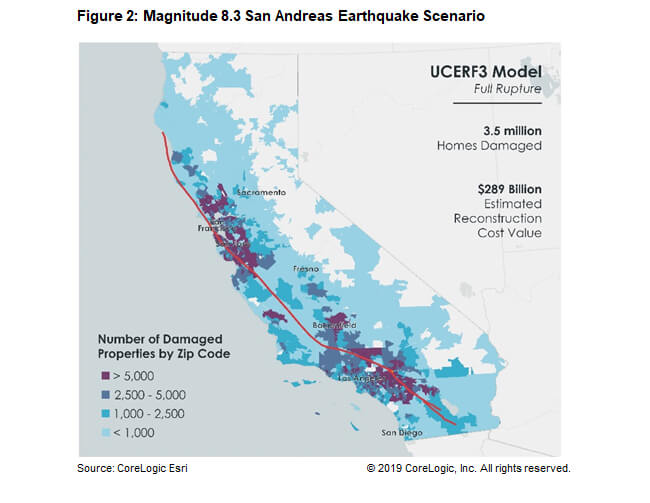

These earthquakes have served as a stark reminder that the earthquake risk is real. Much of the conversation around earthquake risk in California involves the infamous San Andreas fault that straddles North and South California. The Searles Valley earthquake sequence occurred on a different fault system, approximately 93 miles northeast of the San Andreas fault. The maximum likely earthquake on the San Andreas is M8.3.

In terms of energy released, a maximum rupture of the San Andreas would be over 63 times greater than the M7.1 event that occurred on July 5. While a full rupture of the San Andreas fault has a very low probability, it is possible, according to the latest Uniform California Earthquake Rupture Forecast (UCERF3). The size of the potential earthquakes along the San Andreas is one factor driving its importance, as well as the closer proximity of the main fault in this region to population centers.

The fault straddles main population centers from San Francisco and San Jose in the North, following through Central California in to the South, passing to the East of Los Angeles, though close enough for earthquakes to cause significant damage here. A 2016 CoreLogic study found that a full rupture of the San Andreas fault would result in simultaneous earthquake damage to both Northern and Southern California could affect up to 3.5 million homes with a total reconstruction cost value (RCV) greater than $289 billion.

For more information on earthquake risk, visit our hazard risk information site Hazard HQ™ or email [email protected].

© 2019 CoreLogic, Inc. All rights reserved.