The roof is a home’s primary protection and first line of defense against natural weather hazards like hail, wind, fire and tornadoes. It shelters the structure beneath it – as well as the individuals that inhabit it. Given the roof’s massive role in protecting properties and people, it’s no surprise the insurance industry is laser-focused on the integrity of roofs.

Weathering the Storm

Unsurprisingly, roofs are often severely impacted by convective storms like wind, hail and tornadoes. From 2017-2020, Texas led the pack when it came to states with the highest frequency of severe convective storm events. In the wake of these weather events, and in areas with high hail risk, insurance claims for roof damage surge.

Interestingly, data shows that these types of roofing claims are often filed long after the date the storm occurred. The Texas Department of Insurance found that between 2010-2015, 81% of claims were filed three months after the listed date of loss. On average, those claims came in 56 days after the day of loss.1 This means the average insurer waited almost two months before inspecting or adjusting the roof in question. Nearly 10% of claims took more than six months to come in, and those who made claims with legal representation waited 161 days.

During this waiting period, a substantial (and therefore problematic) amount of weathering can occur. In high hail risk areas like Dallas or the entire state of Oklahoma, it’s not uncommon for multiple hailstorms to occur in a given season, making it unclear which storm caused the damage of a claim.

The additional weathering can make roofing inspection and adjustment more difficult. It makes it harder to decipher if the event happened recently, or if it even happened while the policy was active. Additionally, there is a greater likelihood that the roofs with significant damage will leak and further damage the property.

Ultimately, waiting for claims can be avoided by leveraging data to help insurance companies be proactive rather than be reactive.

Case Study: Comparing Historical Verification Techniques to Modern Approaches

On May 23, 2019, a severe hailstorm occurred in Lubbock County, Texas, causing extensive damage from 1.75 inch hailstones. A combination of 70 mph winds and golf-ball-sized hail severely damaged residential dwellings and commercial buildings in the area.

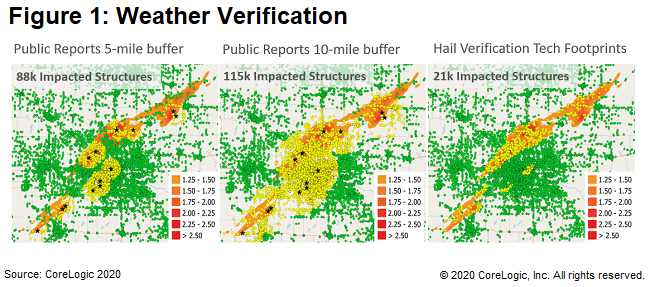

Historically, weather verification uses public reports from organizations like the National Oceanic and Atmospheric Administration (NOAA). The yellow and green dots, in the visual below, represent the structures in the property database impacted by the May 23, 2019 hailstorm. Specifically, the yellow dots show the structures affected by hail greater than 1 inch.

When impacted properties within 5 miles of a public report of hail damage are selected, 88,000 properties populate. However, a 5-mile radius is too small and excludes a number of properties affected by the hailstorm. When the radius is instead set to 10 miles, there is an overcorrection, and 115,000 properties are listed despite many not being impacted by hail. This leaves the estimated number of properties with hail damage, using the NOAA public reports, somewhere between 88,000 and 115,000.

CoreLogic Hail Verification Technology aims to take some of the guesswork out of estimating structure damage from natural hazards. The company uses a combination of radar data, public reports, social media reports and a team of meteorologists to make more data-driven predictions. For instance, looking at the May 23 event in Lubbock County, Texas, the CoreLogic models estimated only 21,000 structures were impacted by greater than 1 inch hail, which is a more precise estimate than traditional models show.

Modernizing the Claims Process

Weather data needs to be precise and accurate to drive informed decision-making. To that end, modern weather verification technologies mean efficient and precise claims processing. Having access to granular data like probability of damage and volume of properties impacted by hail size can help to reduce costs and allows for better management of the effects of the weather event.

Expediting claims processing is critical to reducing the chance for more structural damage – and helping people rebuild their lives as fast as possible. While traditional methods of weather verification lack precision, modern methods that harness the power of new technologies provide insurers with the best tools to estimate the correct number of damaged properties.

Greater Insight. Safer Communities.

Combining speed with accuracy can make the claims process an optimal one for both insurers and policyholders. The faster an insurer can validate a claim, the sooner homeowners and entire communities can recover from a disaster.

For more on how to accelerate recovery, visit our Weather Verification page.

Sources: