1. A stalled cold front brought historic flooding to the Metro St. Louis area.

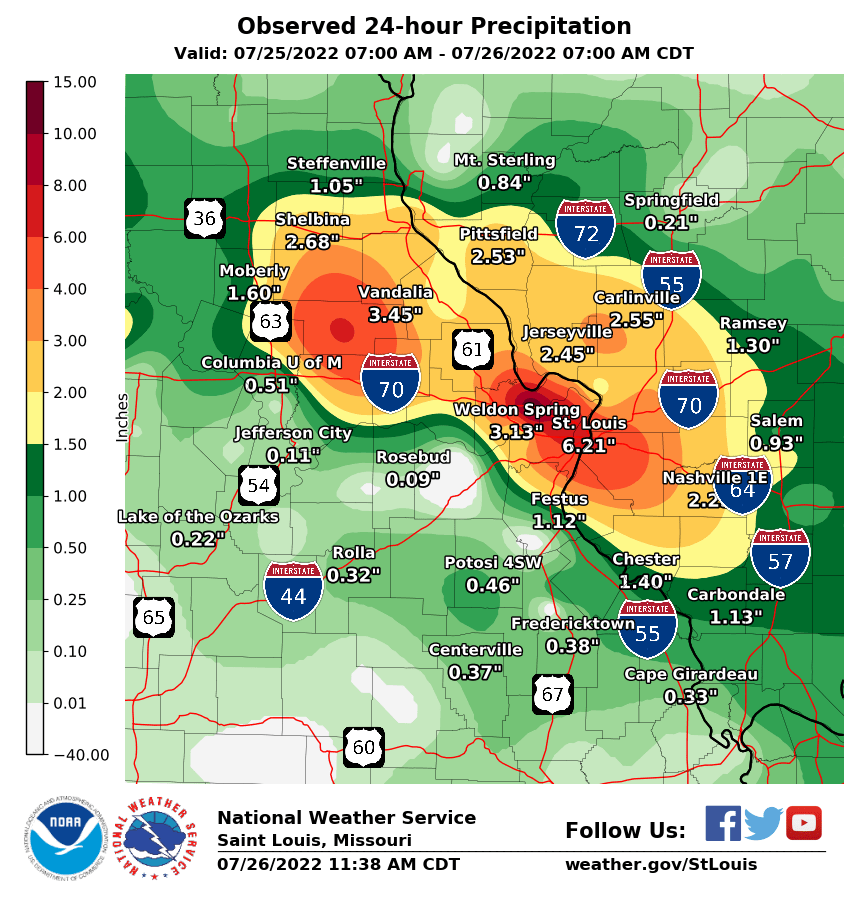

- A slow-moving severe thunderstorm system crossed central Missouri starting mid-afternoon on July 25 bringing record breaking precipitation and floods. The 24-hour rainfall depth record was broken at the St. Louis-Lambert International Airport when 8.64” of rain was recorded (previous record was 6.85” set in 1915). Other regions of the St. Louis Metropolitan Area saw 24-hour precipitation depths of over 12” (Figure 1)[1].

Figure 1

2. The same storm system caused catastrophic flooding southeastern Kentucky.

- Six to nine inches of rain fell in a relatively short period of time over southeastern Kentucky.

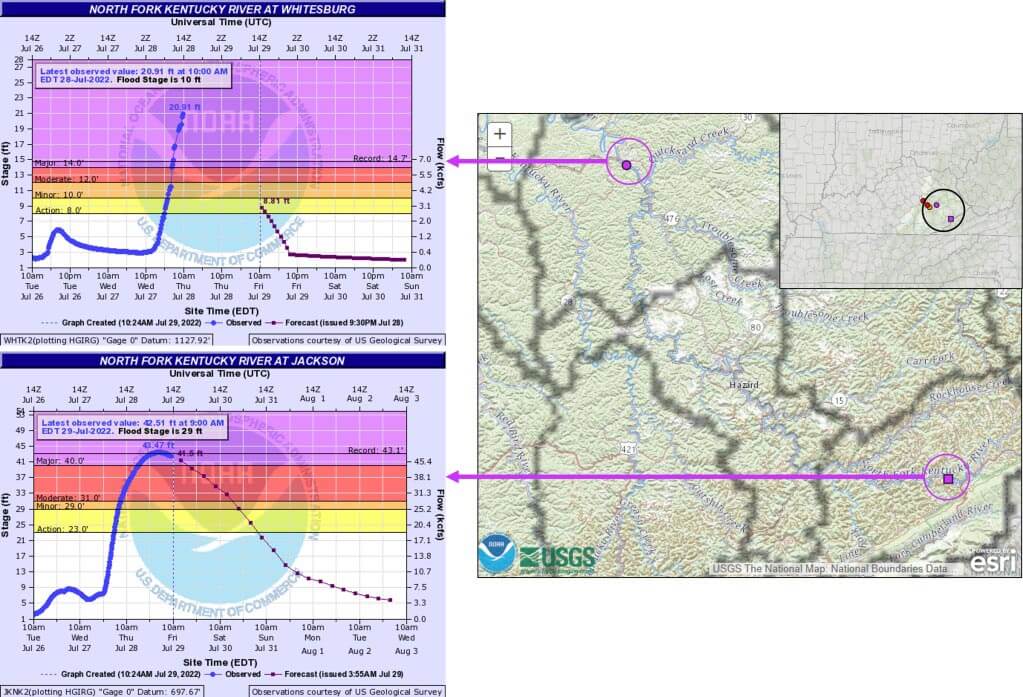

- Moderate to major flooding was recorded at stream gauges along the North, Central and South Forks of the Kentucky River in Estill, Lee, Owsley, Breathitt and Letcher Counties. Stream gauges on the North Fork of the Kentucky River showed record-breaking flood stages (Figure 2).

Figure 2

- The Governor of Kentucky has called the catastrophic flooding the deadliest he has seen in his lifetime.

3. A more comprehensive view of flood risk is required to be prepared

- The Federal Emergency Management Agency’s (FEMA) Special Flood Hazard Area (SFHA) demarcates the areas that have a 1% annual probability of flooding (i.e., 100-year return period). Flood insurance is required for mortgages to be written for structures within the SFHA.

- Flash flooding, also known as pluvial flooding, can occur anywhere, not requiring the presence of streams and rivers. It is difficult to capture pluvial flooding in the SFHA because the modeling techniques employed by FEMA, though detailed and thorough, require too many resources and time to map the entire country at a high resolution. The CoreLogic Flash Flood Risk Score can accurately capture pluvial flood risk without the need for in-situ modeling, as seen in St. Peters, MO (Figure 3).

Figure 3

- Due to the degree of urbanization in St. Louis, flash flooding was the primary hazard. Paved surfaces prevented rapidly falling rain to infiltrate the ground surface, and water quickly pooled.

- Initial reports have indicated material damage and loss of life, official damage reports will take time. In St. Louis, the widespread flash flooding impacted not only homes, businesses, and automobiles, but critical infrastructure. The city’s metro system experienced damaging flooding at multiple stations. Several major highways and roadways were shut down, complicating rescue efforts.

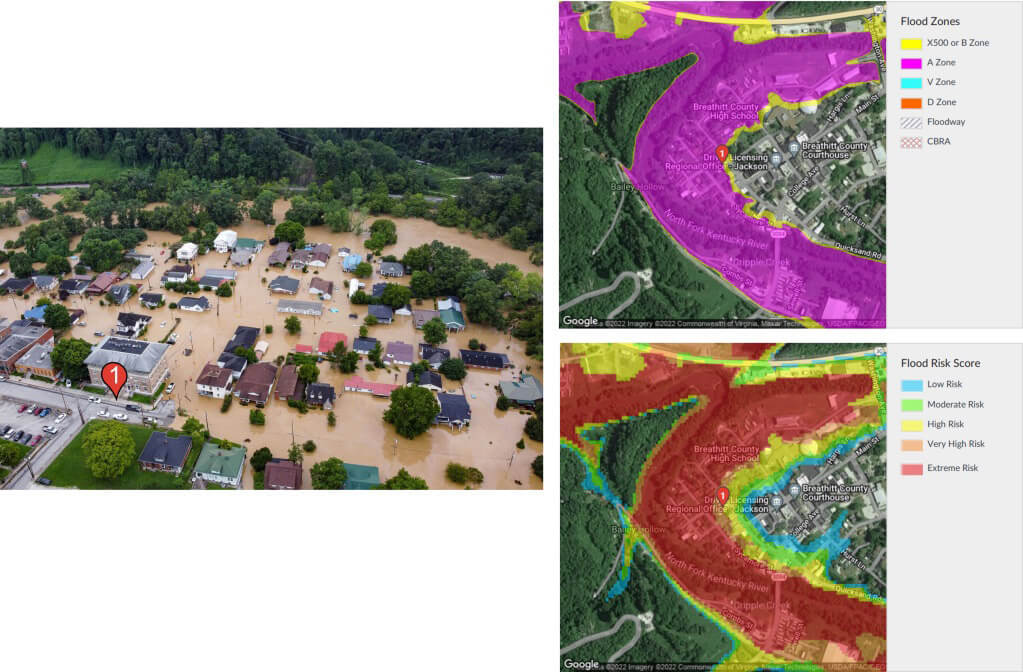

- In Kentucky, Jackson was one of the hardest hit cities by the catastrophic flooding, where buildings were inundated up to the roof (Figure 4). Most, if not all, of the flooded structures were within the SFHA, but there is a stark boundary between the high hazard zone and areas of no flood risk.

- The “in or out” methodology of determining flood risk gives those outside FEMA’s SFHA a false sense of security that their homes will never flood, where in reality, moderate to high flood risk extends further out.

Figure 4

- Across southeastern Kentucky, rivers overflowed their banks sweeping away homes and cars. Many bridges and smaller roads have been reported to be damaged and unpassable. Thousands are without power. 37 fatalities have been reported so far, and hundreds remain unaccounted for currently.[2]

- FEMA is currently on site in both regions to aid in recovery and investigate the extent of damages.

CoreLogic will continue to monitor the St. Louis and southeastern Kentucky flooding and will provide updates when the full extent of damage is clearer.

[1] National Weather Service, July 26th, 2022 Historic Flash Flooding in the St. Louis Metro Area. (NWS 2022). https://www.weather.gov/lsx/July262022Flooding. Accessed July 29 2022.

[2] Singh, Kanishka and Clifford, Tyler, Kentucky floods kill at least 35 as more storms forecast. (Reuters 2022). https://www.reuters.com/world/us/death-toll-kentucky-floods-rises-30-more-storms-forecast-2022-08-01/. Accessed August 1 2022.