U.S. Home prices soared in 2021, pushed up by strong demand and a limited supply of homes for sale. In 2021, the CoreLogic Home Price Index (HPI) posted the highest year-over-year growth in its 44-year history. However, year-over-year growth isn’t the only way to view home price appreciation. Viewing price changes for an entire year, not just for one month, and adjusting for inflation in all other goods, puts 2021 home price growth below record levels.

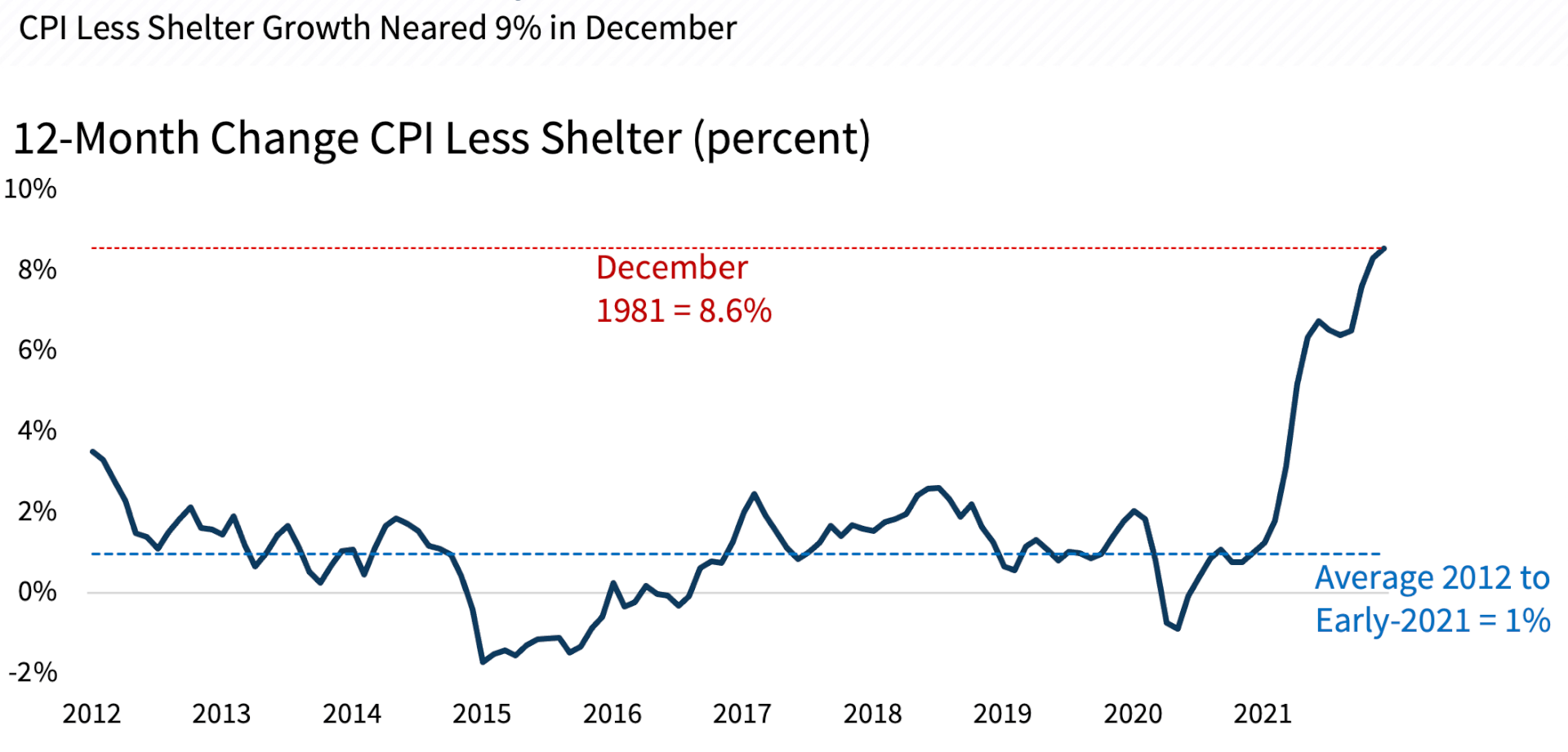

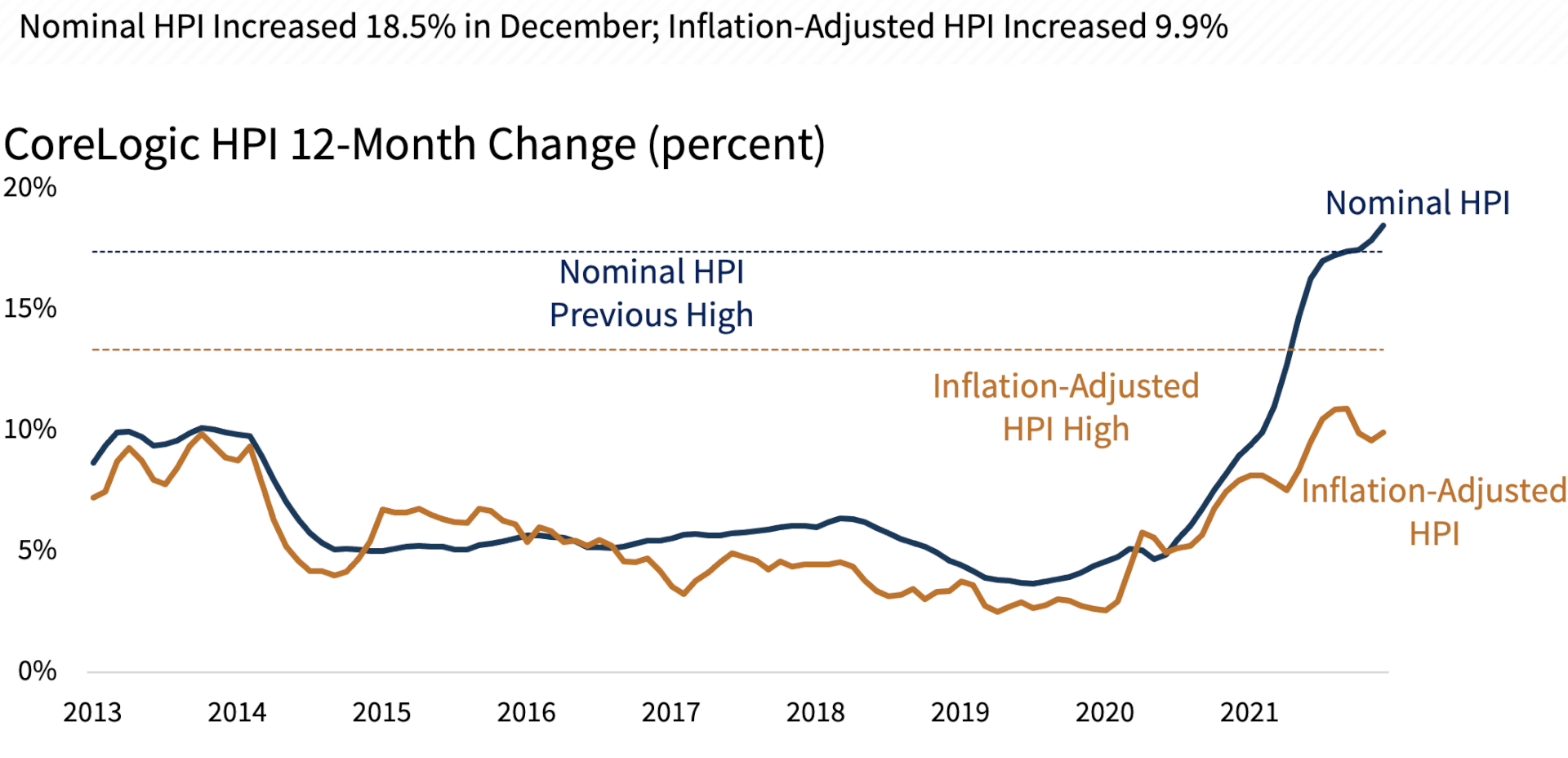

The CoreLogic HPI is measured in nominal terms, meaning that it is not adjusted for inflation. From 2012 to early 2021, annual inflation in non-shelter goods averaged about 1%[1]. In early 2021, inflation began to increase and reached a 40-year high of nearly 9% in December of last year. In 2021, year-over-year growth in the HPI broke the previous record from 1977 in nominal terms. When adjusted for inflation, annual HPI growth is reduced for most of 2021, and in December it is cut from 18% to 10%, putting adjusted HPI below what it was in 2005.

Figure 1: Inflation Spiked in 2021

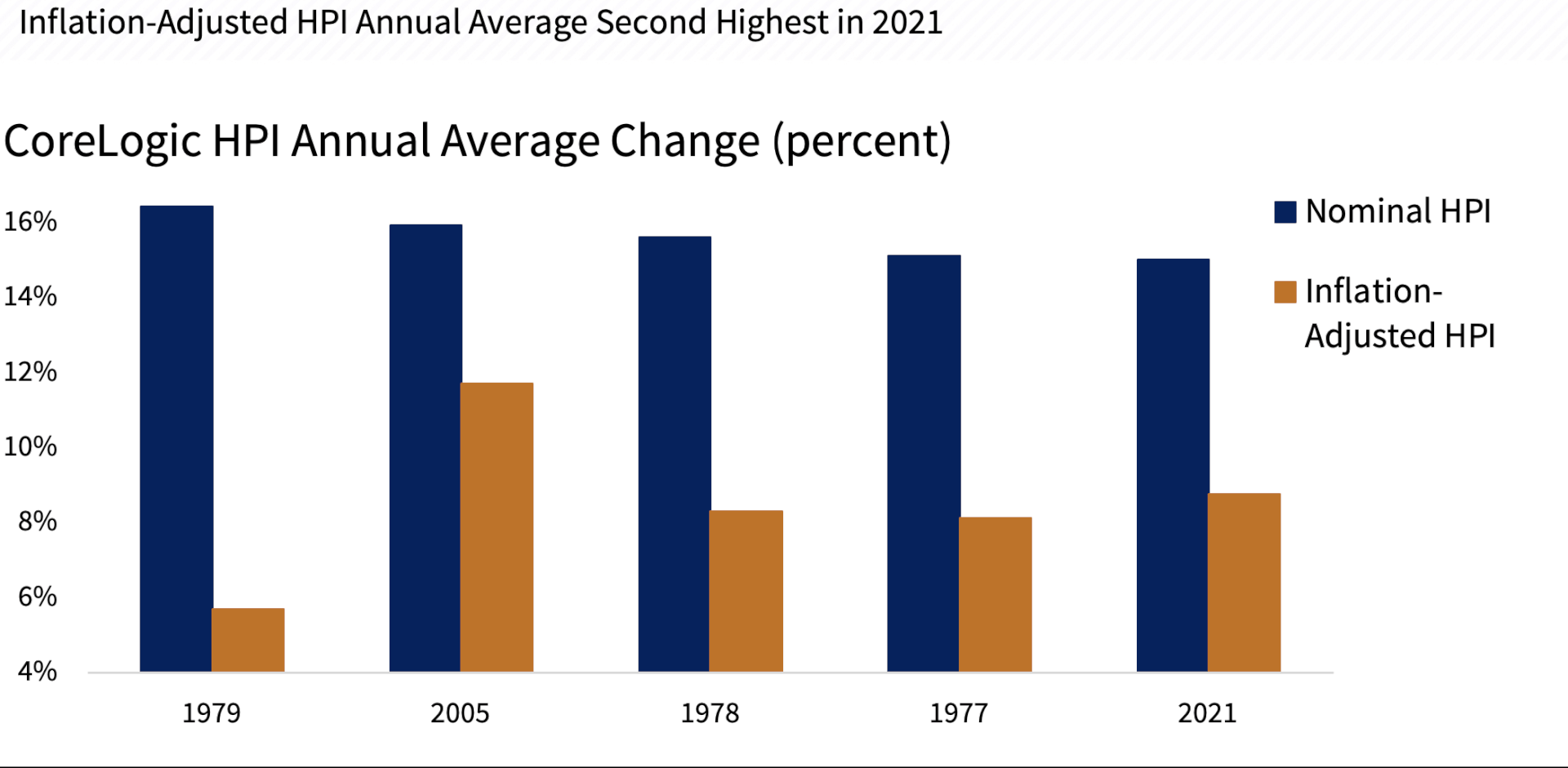

Growth in CoreLogic HPI is typically reported on a year-over-year basis, meaning that it reflects the 12-month growth rate for a particular month. A year-over-year measure is useful when showing the most recent trends in the index. When comparing a full year of home prices, it can be useful to show the average of the growth rates for an entire year. When using the annual average growth in the nominal index, 2021 had the fifth-highest increase in home prices. It was outranked in terms of growth by the late 1970s and 2005. When using the annual average growth in the inflation-adjusted HPI, 2021 moves into second place for record home price growth and is beat out by 2005, when prices were booming and inflation was two-thirds what it was in 2021.

Figure 2: Inflation-Adjusted HPI Below Peak

There is no doubt that 2021 was a record year for housing. High demand and low supply pushed home prices to historical highs. Home price appreciation is expected to ease throughout 2022, starting the year off at double-digit rates and slowing to 3.5% by December. Given the latest projections for inflation, when home price growth is adjusted for inflation, it could be close to zero at the end of 2022.

Figure 3: HPI Annual Average Change Fifth Highest in 2021

Thank you for watching today. For more information on the latest housing trends, including home prices, please visit Corelogic.com

[1] The BLS Consumer Price Index Less Shelter is used to adjust the CoreLogic HPI in this analysis.