The Midwest had a higher share of young buyers than coastal metros in 2021

There is a notable difference between young homebuyers, those aged 30 and below, and older millennial homebuyers, ages 31 to 40. Generally, older millennials have advanced further in their careers, have a more stable income and are already homeowners who are considering a move-up purchase. In contrast, younger people have more financial challenges when competing to buy homes since they are just beginning their careers; have less or no credit history; limited or no savings and generally lower levels of income.

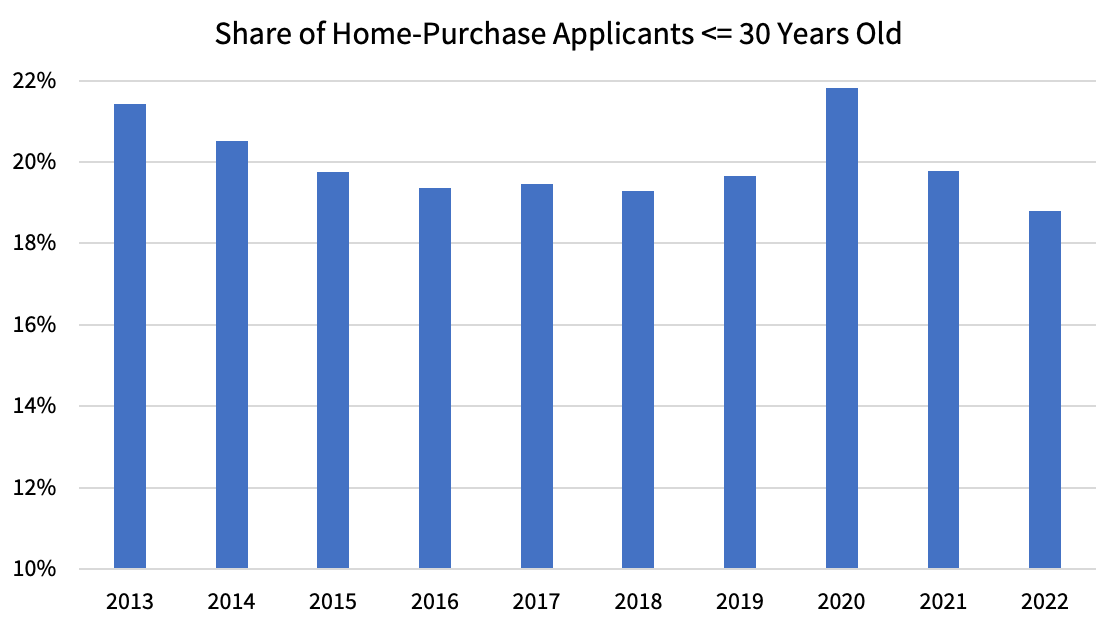

The slim supply of homes for sale is pushing up home prices. Since 2021, record-breaking home price growth has created affordability challenges, especially for young homebuyers.[1] The share of younger homebuyers peaked at almost 22% in 2020 as record-low mortgage rates improved buyer affordability and the pandemic — which exposed older populations to greater health risks — discouraged more mature people from buying (Figure 1).[2] However, by 2021, the share of young buyers dropped back to pre-pandemic levels before further declining in early 2022.

Since 2022 data includes January and February, we looked at the same months for prior years to control for seasonality. The adjusted trend shows that January and February 2022 are at a 10-year low.

Figure 1: Young Homebuyer Share Declining After Reaching Highest Rate in 2020

Note: 2022 includes only data from January to February

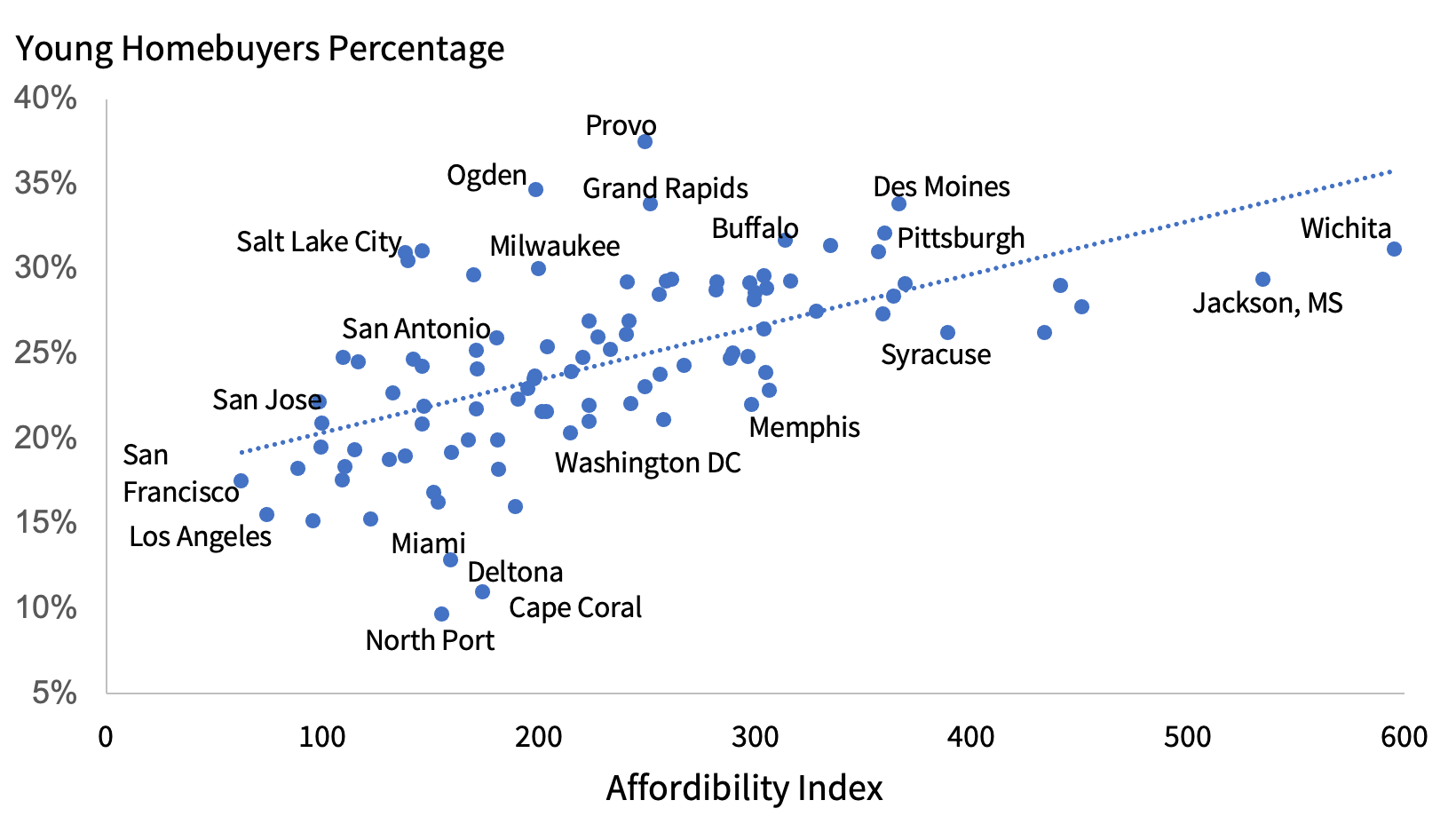

Younger adults make up a higher portion of the homebuyers in Midwest markets but a lower proportion in expensive coastal areas. Figure 2 plots the share of young homebuyers against the affordability index for metro areas in 2021.[3] There is a positive relationship between the share of young homebuyers and the affordability index, meaning there is a larger proportion of younger people purchasing in more affordable markets.

Figure 2: Younger Homebuyer Share is Higher in More-Affordable Metros, 2021

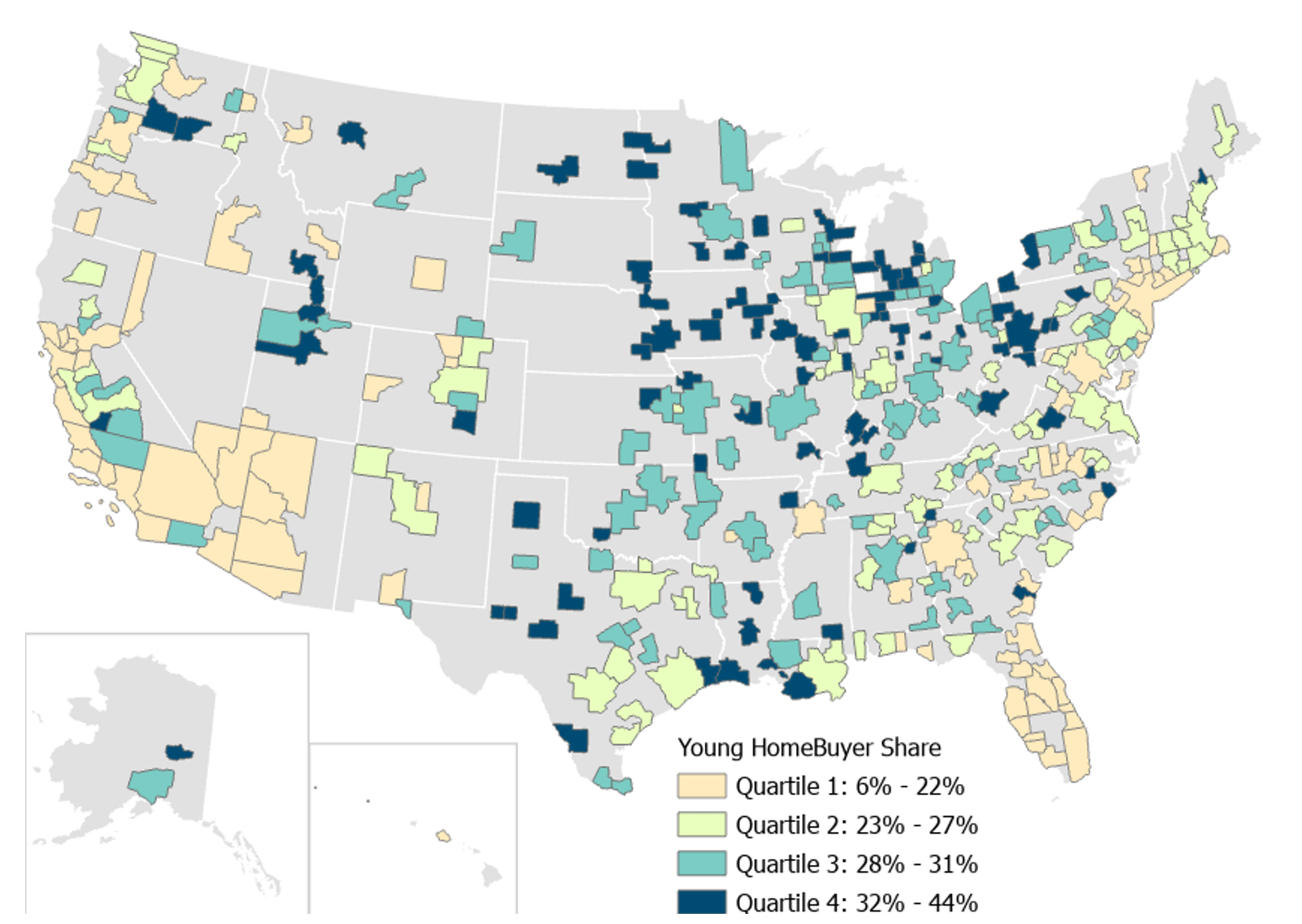

Figure 3 shows U.S. metros based on the share of applications from young homebuyers in 2021. Younger applicants made up a higher share of the potential homebuyers in Midwest markets.

Provo, Utah had the highest percentage (37%) of young adults applying for a home mortgage, followed by Ogden, Utah with 35%; Grand Rapids, Michigan with 34%; Des Moines, Iowa with 34%; Pittsburgh with 32% and Buffalo, New York with 32%.[4] Omaha, Nebraska; Wichita, Kansas; Colorado Springs, Colorado and Cincinnati were among the top 10 metros with the highest percentage of younger homebuyers and these metros are also more affordable areas to buy a house.

Conversely, metros in Florida and California had the lowest percentage of young adults applying for a home mortgage. North Port, Florida had the lowest percentage with 10%, followed by Cape Coral, Florida with 11%; Deltona, Florida with 13%; Oxnard, California with 15% and Miami with 15%. Los Angeles; Bridgeport, Connecticut and San Francisco were among the top 10 metros with the lowest percentage of young adult applicants.

Figure 3. U.S. Metro Areas Based on Share of Young Homebuyers in 2021

Midwest metros had a higher share of young homebuyers

Rising mortgage rates will erode buyer affordability even further. Similarly, home prices are expected to rise, although at a slower pace than in 2021.[5] These trends toward record-breaking home prices and increasing mortgage rates will impact potential younger homebuyers and lower-income homebuyers the most.

[1] See CoreLogic HPI

[2] Only first-lien home purchase applications were used for this study from the CoreLogic Loan Application Database.

[3] Affordability index is computed using NARs Housing Affordability Index formula.

[4]Out of the top 100 metros, based on 2020 population.

[5] U.S. Home Price Insights – CoreLogic®