Borrower Equity Update: Third Quarter 2020

- Average equity gain of $17,000 per homeowner in Q3 2020 was the highest in over six years

- National share of homes with negative equity was 3% for the third quarter of 2020, the lowest in over 10 years.

The amount of equity in mortgaged real estate increased by $1 trillion in the third quarter of 2020 from the third quarter of 2019, an annual increase of 10.8%, according to the latest CoreLogic Equity Report. The average annual gain in equity was $17,000 per homeowner — the largest average equity gain since the first quarter of 2014. Borrower equity hit a new high in the third quarter of 2020, and borrowers have gained nearly $7 trillion in equity in the last 10 years.

The nationwide negative equity share for the third quarter of 2020 was 3% of all homes with a mortgage, the lowest share of homes with negative equity since CoreLogic started tracking this number in the third quarter of 2009. The number of underwater properties decreased by 365,000 from the third quarter of 2019 to the third quarter of 2020.

Despite the economic impact of the pandemic, home prices soared throughout the summer and fall. Appreciation reached its highest level since 2014 in the third quarter of 2020 as prospective homebuyers continued to compete for the low supply of homes on the market, pushing home equity to record levels. Equity gains are likely to persist over the next several months as strong home-purchase demand is expected to remain high and continue pushing prices up. However, the CoreLogic HPI Forecast shows home prices slowing over the next 12 months as new home construction and more existing for-sale homes ease supply pressures. This could moderate the pace of both home price growth and equity gains.

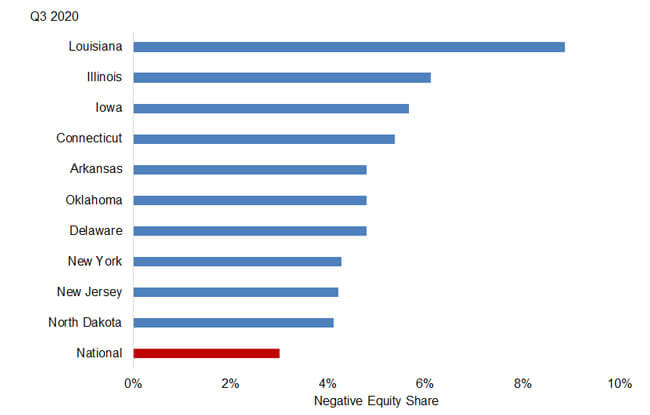

Figure 1 shows the ten states with the largest negative equity shares in the third quarter of 2020. Louisiana stands apart with 8.9% of mortgages with negative equity – nearly three times the national average. Illinois (6.1%) and Iowa (5.7%) rounded out the top three states with the highest negative equity shares. States with high negative equity shares have experienced low home price appreciation.

Figure 2 shows the average dollar amount of negative equity and the negative equity share for 10 large metropolitan areas in the third quarter of 2020. The average amount of negative equity is inversely related to the negative equity share. For example, in this group of metropolitan areas, San Francisco has the largest average amount of negative equity, but the lowest negative equity share at 0.7%. Miami has the smallest average amount of negative equity, but has a negative equity share of 6.8%, which is more than double the national rate.

©2020 CoreLogic, Inc. All rights reserved.