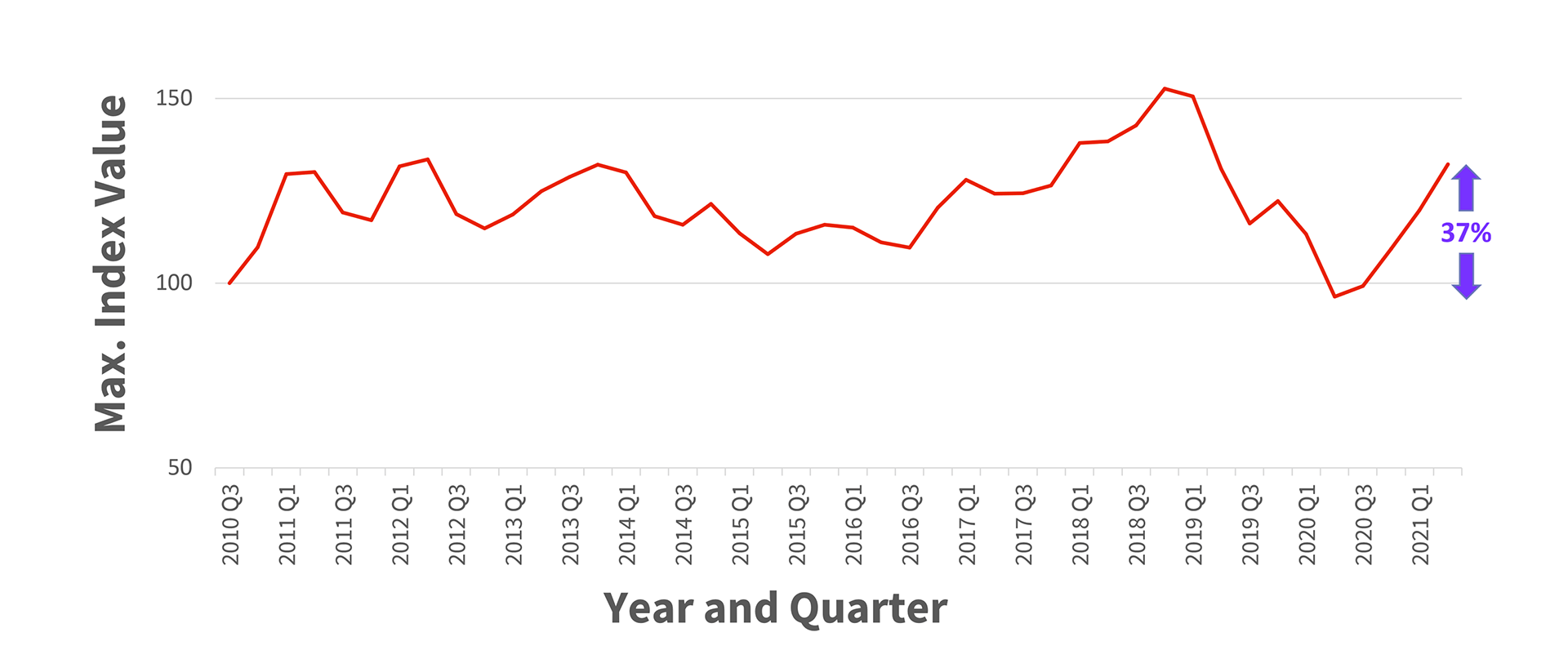

After steady decreases in fraud risk over the past few years, we saw a marked change in 2021. Fraud risk increased 37% over 2020 levels, putting the CoreLogic fraud risk index near pre-pandemic levels. The major difference between 2019 and today is that the risk is rising instead of declining.

Figure 1: National Trend

Fraud Index by Quarter

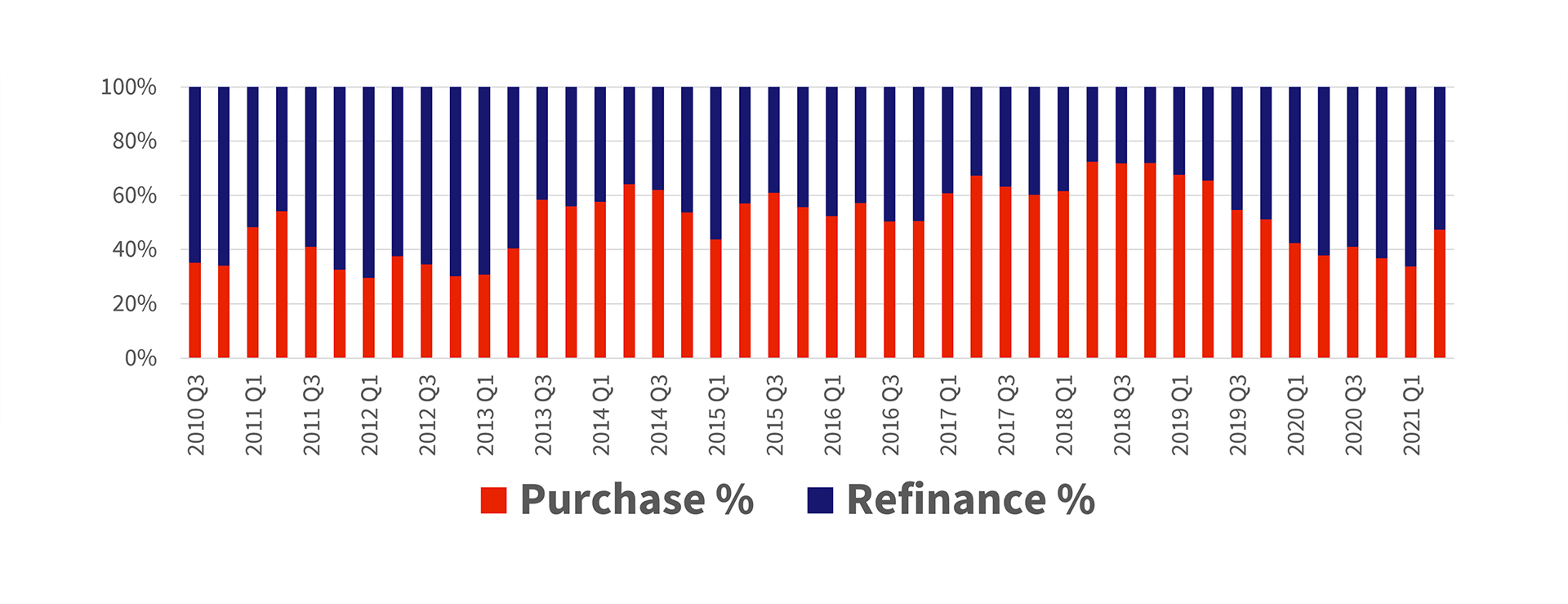

The main drivers of the increase in fraud risk are the lower volumes of rate-term refinances and higher share of mortgages for the purchase of a home. Purchase transactions have higher fraud risk than refinances. In a purchase, there are more parties involved, more commissions, and more motives to “make the deal work.” The mortgage proceeds aren’t just moving from one bank to another to lower an interest rate as is the case with most refinances. As a result, we’ve seen increases in transaction fraud risk, which includes situations like straw borrowers and falsified down payments.

Figure 2: Purchase/Refinance Mix

We estimate the current application fraud rate at about 1 in 120 loans. Looking only at purchases, that estimate increases to 1 in 90. It becomes a more concerning 1 in 23 if we only look at investment purchases.

As for changes in fraud types, transaction fraud risk, which we measure for purchases, had the largest increase at 34%, with the wholesale channels showing much more risk than retail or correspondent. Property fraud risk had the largest decline, at 5% overall. This makes sense given the strong price gains and high demand we saw in the last year.

During 2021, FHFA instituted a limit on fundings for investment and second home loans. As the cap took effect, pricing and qualifications for non-primary loans became more restrictive. As expected, we saw a 6% increase in indicators of occupancy fraud risk, one of the most common types of mortgage fraud. That funding cap was recently lifted, which may temper the rise in occupancy fraud in the near term.

For 2022, we are monitoring how return-to-office mandates may affect lower cost areas that saw a large influx of pandemic migration. We will also be watching impacts of the possible expansion of financing for owner-occupied 2- to 4-unit properties1. Historically, 2- to 4-unit properties have shown a higher level of risk – with a fraud rate we estimate at 1 in 50 applications – because the loan amounts are larger and there is ability to qualify using future income from the property.

2022 CoreLogic, Inc. , All rights reserved.