National Foreclosure Rate Down to Less Than 1 Percent From a High of 3.6 Percent

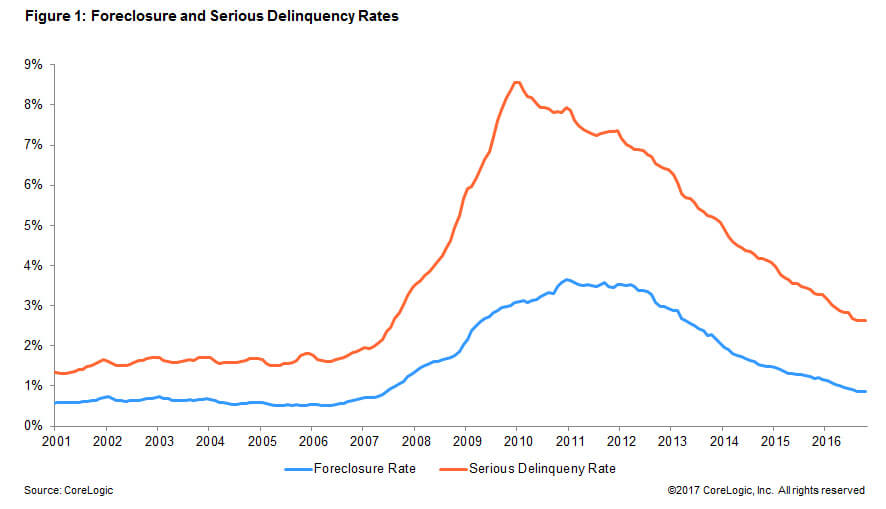

This year marks a decade since the start of the housing crisis.[1] Since mid-2007 more than 7.5 million homes have been foreclosed on according to a 10-year retrospect of the U.S. residential foreclosure crisis, “United States Residential Foreclosure Crisis: 10 Years Later,” released today. The foreclosure situation has improved greatly from the worst points in the housing crisis. The foreclosure rate – the share of all loans in the foreclosure process – fell to 0.9 percent in December 2016, down from the peak of 3.6 percent recorded in January 2011. The December 2016 foreclosure rate is just slightly above the pre-housing-crisis average foreclosure rate of 0.6 percent between 2000 and 2006.

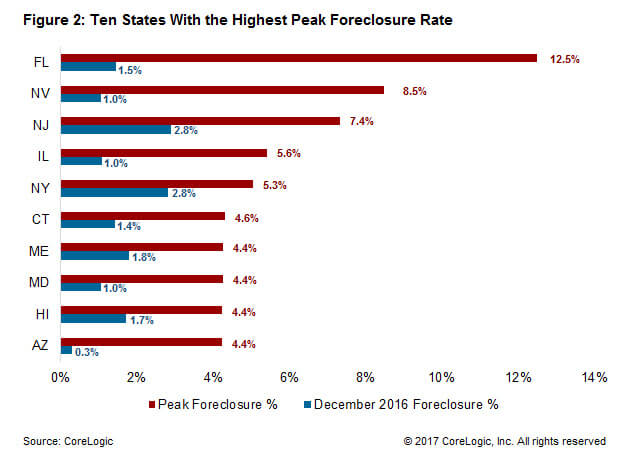

While the national foreclosure rate peaked at 3.6 percent, certain states saw foreclosure rates well above that level. Figure 2 shows the peak foreclosure rate and the December 2016 foreclosure rate for the 10 states with the highest peak foreclosure rates. Florida had the highest peak foreclosure rate, topping out at 12.5 percent in June 2011. While Florida’s December 2016 foreclosure rate of 1.5 percent was well above the national average, its 11-percentage-point, peak-to-current drop in the foreclosure rate was the highest among all the states. North Dakota had the lowest peak foreclosure rate at 0.9 percent in February 2011.

Down at the metro level, Miami-Miami Beach-Kendall, Fla. recorded the highest peak foreclosure rate at 19.2 percent in February 2011. By December 2016, the foreclosure rate had fallen over 17 percentage points to 2.1 percent.

The serious delinquency rate – the share of loans 90 or more days overdue – peaked at 8.6 percent in February 2010, and fell to 2.6 percent in December 2016. Florida had the highest peak in the serious delinquency rate at 18.8 percent followed closely by Nevada at 18.5 percent. Both of these states saw large declines in the serious delinquency rate, falling to 3.7 percent in Florida and 3 percent in Nevada in December 2016. The two states with the highest serious delinquency rate in December 2016 were New Jersey (5.9 percent) and New York (5.3 percent).

United States Residential Foreclosure Crisis: Ten Years Later

1 Many economists mark the beginning of the foreclosure crisis with the collapse of two Bear Stearns subprime funds in June 2007. During the week of July 16, 2007 Bear Stearns disclosed that two subprime hedge funds had lost nearly all of their value amid a rapid decline in the market for subprime mortgages. Lehman Brothers filed for Chapter 11 bankruptcy protection on September 15, 2008. The filing remains the largest bankruptcy filing in U.S. history, with Lehman holding over $600 billion in assets.

© 2021 CoreLogic, Inc. All rights reserved