Borrower Equity Update: Fourth Quarter 2021

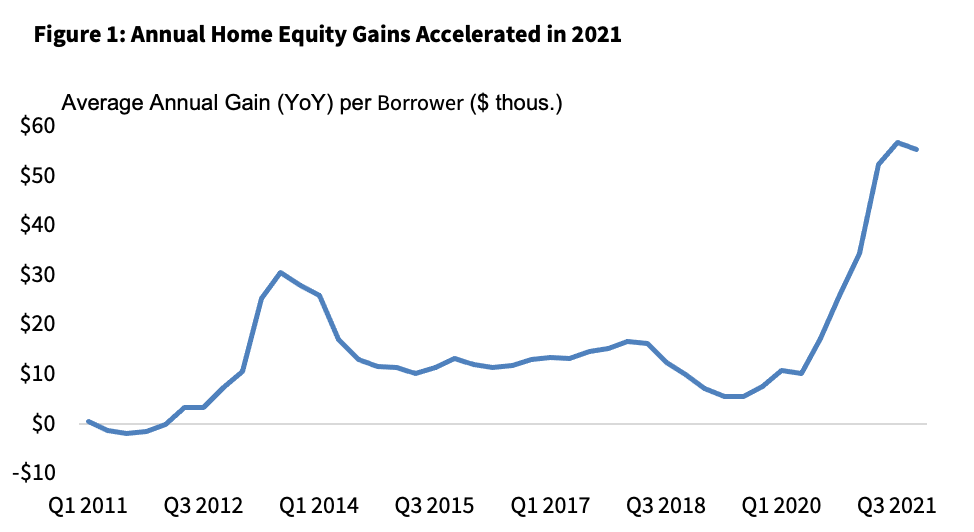

- Average annual equity gain of $55,300 per borrower in Q4 2021 was more than two times the gain from a year earlier.

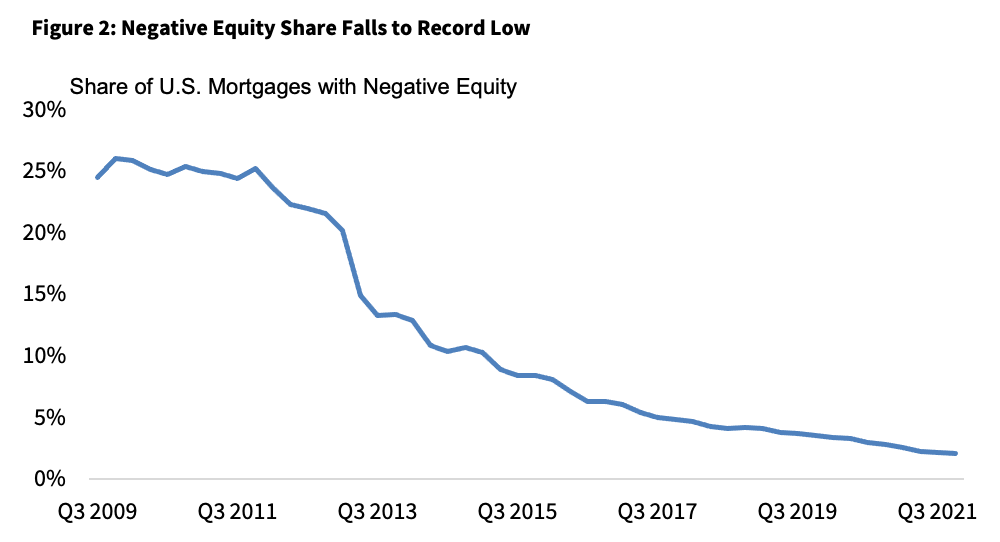

- National negative equity share was 2.1% in Q4 2021, the lowest in more than 12 years.

National Home Equity Trends

Soaring home prices over the past year boosted home equity wealth to new highs through Q4 2021. The amount of equity in mortgaged real estate increased by more than $3.2 trillion in Q4 2021, an annual increase of 29.3%, according to the latest CoreLogic Homeowner Equity Report . The average annual gain in equity was $55,300 per borrower, more than two times the gain from a year earlier.

The nationwide negative equity share for Q4 2021 was 2.1% of all homes with a mortgage, the lowest share of homes with negative equity since CoreLogic started tracking this number in the third quarter of 2009. The number of properties in negative equity decreased by 380,000 to 1.1 million from Q4 2020 to Q4 2021.

State and Metro Level Home Equity

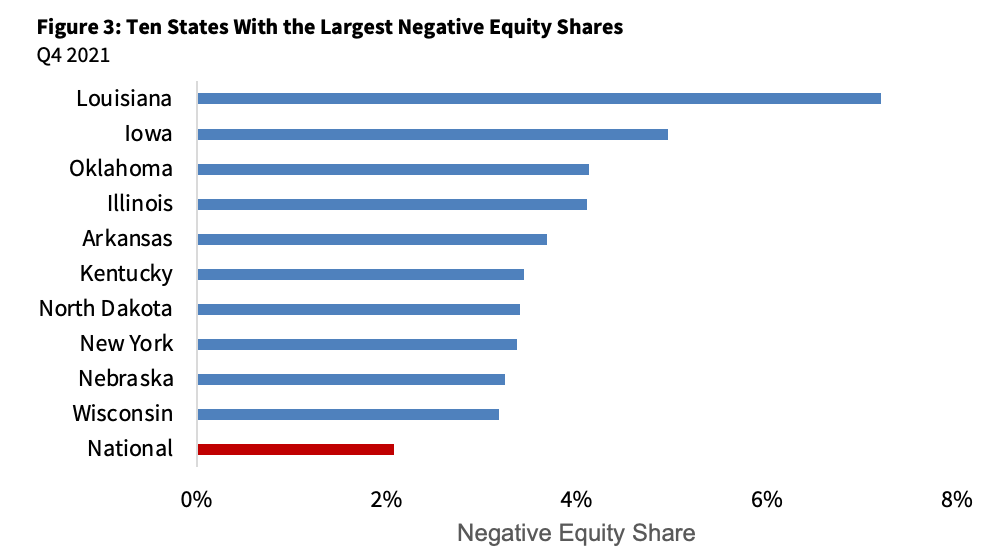

Figure 3 shows the ten states with the largest negative equity shares in Q4 2021. Louisiana stands apart with 7.2% of mortgages with negative equity – more than three times the national average. Iowa (5%) and Oklahoma (4.1%) rounded out the top three states with the highest negative equity shares. States with high negative equity shares have experienced low home price appreciation compared with the national average. In addition, places with high negative equity shares are at higher risk for foreclosure and distressed sales.

U.S. home prices rose by 18% year over year in Q4 2021, up from the 8% annual gain recorded in Q4 2020. The appreciation helped push the national negative equity figure to the lowest in over a dozen years, with just 1.1 million homeowners underwater on their mortgages. Year-over-year home price appreciation increased by 19.1% in January 2022 according to CoreLogic’s latest Home Price Index, though growth is projected to eventually slow over the next 12 months.