As home prices have increased in recent years, home buying has remained relatively affordable due to historically low mortgage interest rates. However, in early 2022, home prices continued to surge as mortgage interest rates also increased, cutting into buyer affordability.

To illustrate the size of the monthly payment for a typical borrower, we calculate the typical mortgage payment. The typical mortgage payment is the monthly payment a borrower would pay for a median-priced home at the going mortgage rate using a 20% down payment. The monthly payment includes principal and interest but does not include taxes and insurance.

Figure 1: Jump in Mortgage Rates and Home Prices Erode Buyer Affordability

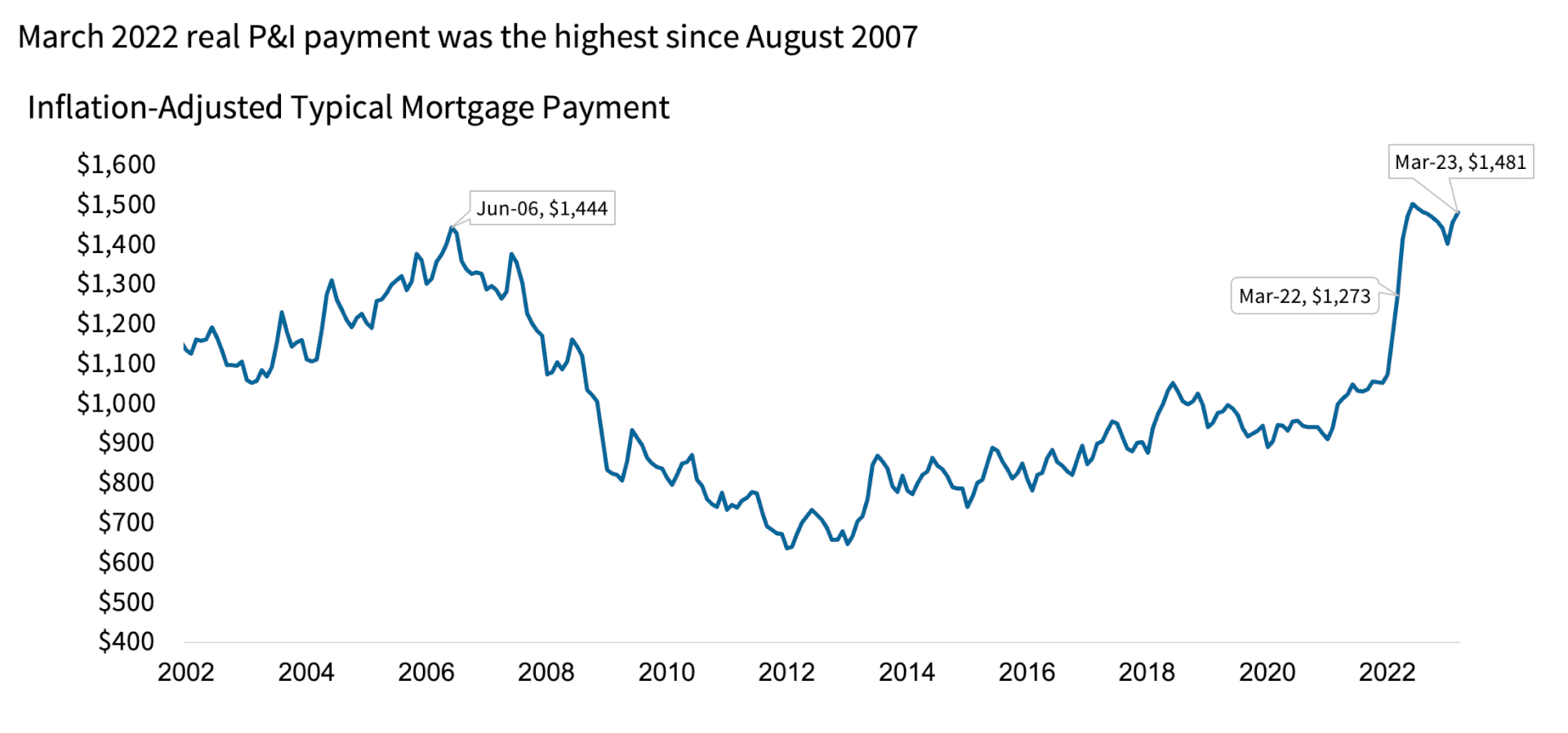

Looking at the past 20 years, we see that the typical mortgage payment peaked at $1,400 in June 2006. This high point came right before the Great Recession and coincided with the peak in home prices and a 30-year mortgage rate of 6.7%. The typical mortgage payment fell to a low of about $600 in February 2012 when home prices also reached their bottom. By January 2021, even though home prices had risen continuously for nine years, the typical mortgage payment only rose to $900. This is due to the 30-year mortgage rate dropping to a record low that month, keeping the monthly mortgage payment low.

However, mortgage rates rose in early 2022, and by spring, they had risen two percentage points from a year earlier. At the same time, home prices continued to rise at record levels. This double whammy caused the typical mortgage payment in March 2022 to increase to almost $1,300, which was 27% higher than a year prior and the highest level since August 2007. During the same period, real personal disposable income fell due to a discontinuation of federal stimulus aid and an increase in inflation.

The rise in the typical mortgage payment demonstrates how both home price appreciation and mortgage rate increases erode buyer affordability. This erosion in affordability is one of the factors that could slow home price growth over the next year. The CoreLogic Home Price Index (HPI) Forecast shows home price appreciation will remain in the double-digits for the rest of 2022 but slow to about 6% by March 2023. However, mortgage rates are expected to remain high, causing the typical mortgage payment to continue to rise.