Consumer confidence has risen to its highest levels since the onset of the pandemic. But while many consumers are planning to buy homes, cars, and major appliances, there are still about 2 million homeowners behind on their mortgage payments and/or in forbearance programs.

Fortunately, a multitude of loss mitigation waterfalls, many forbearance safeguards and an abundance of home equity have given those borrowers an opportunity to keep their homes when the foreclosure crisis finally sunsets.

According to CoreLogic data, a typical U.S. Federal Housing Administration, or FHA, borrower in a forbearance has about $68,000 in equity while a GSE borrower has about $125,000 in equity. But while tenure in the property and down payment play a role in accumulated equity, so does the geographic location as home prices and home price growth vary across the country.

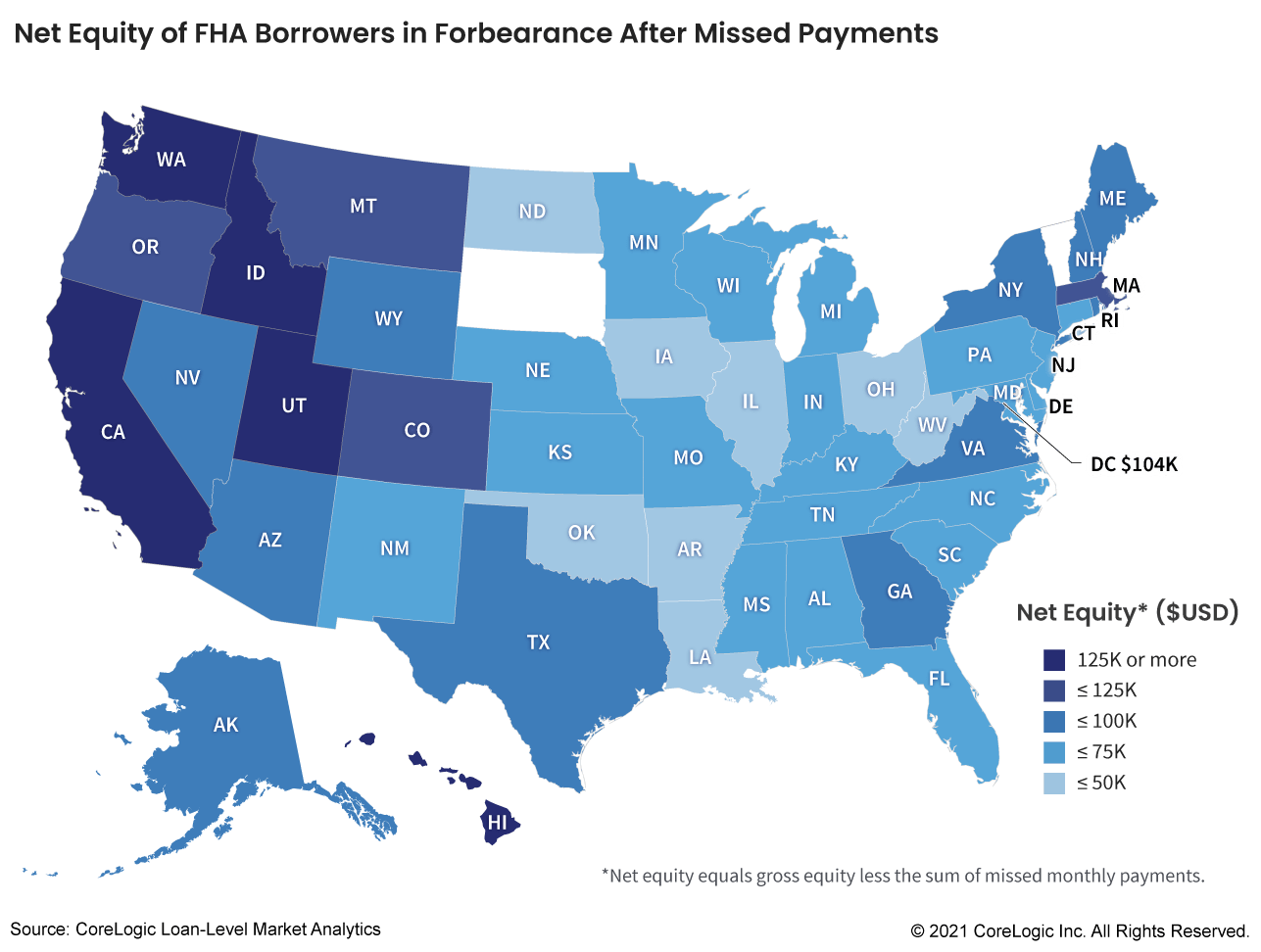

Take a look at a state map of net equity of FHA borrowers in forbearance after accounting for missed payments (Figure 1).

Figure 1:

Following Arkansas at $41,000, the other states with less than $50,000 include Iowa, Oklahoma, Illinois, Louisiana, West Virginia, North Dakota, and Ohio. In contrast, following the top-ranking Hawaii at $178,000 are California, Idaho and Utah, all with around $135,000 in equity among FHA borrowers in forbearance.

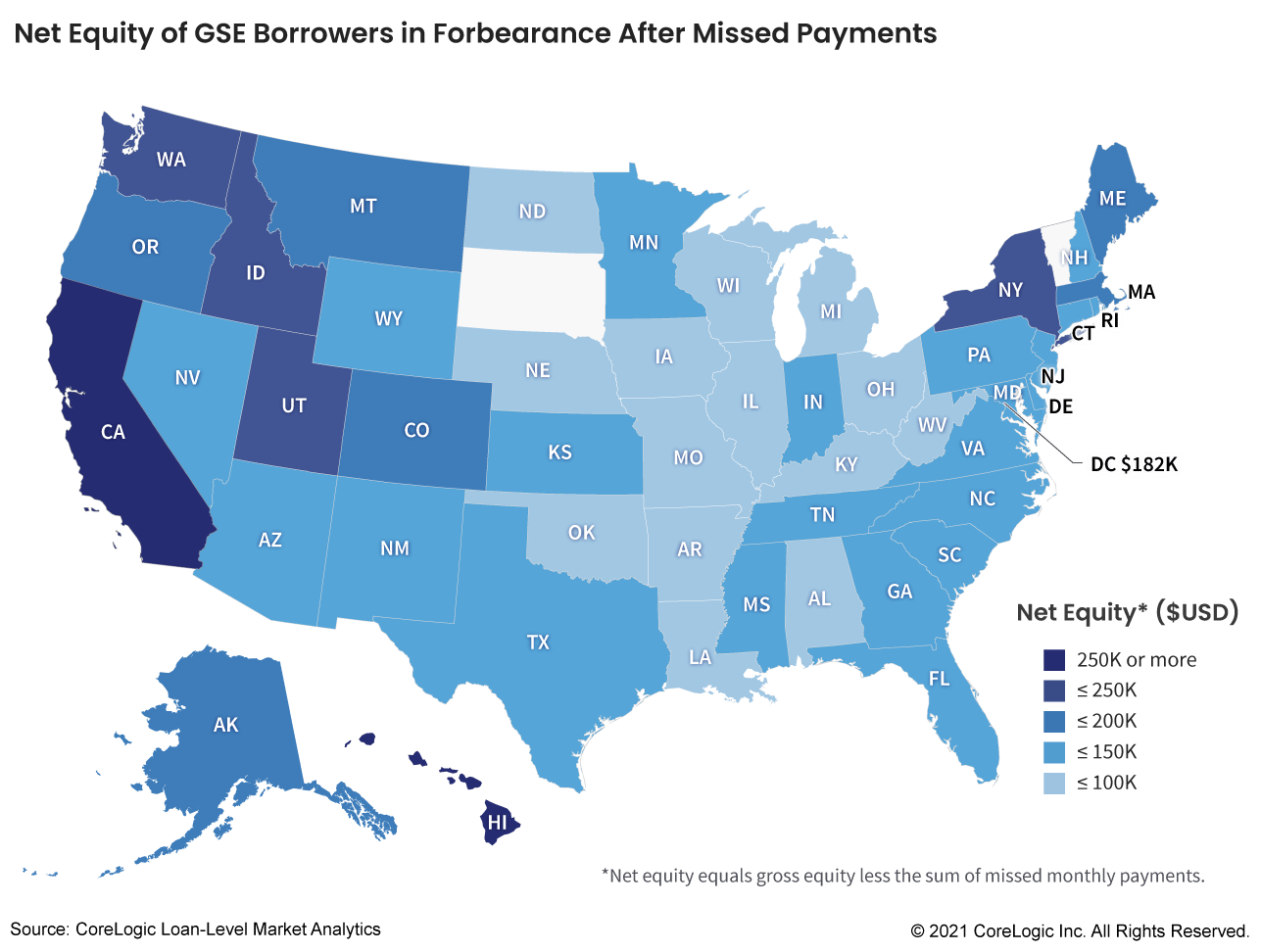

Net equity gains among GSE borrowers, range from $63,000 in Iowa to $357,000 in Hawaii, as GSE borrowers have likely provided larger down payment and have bought pricier homes (Figure 2).

Figure 2:

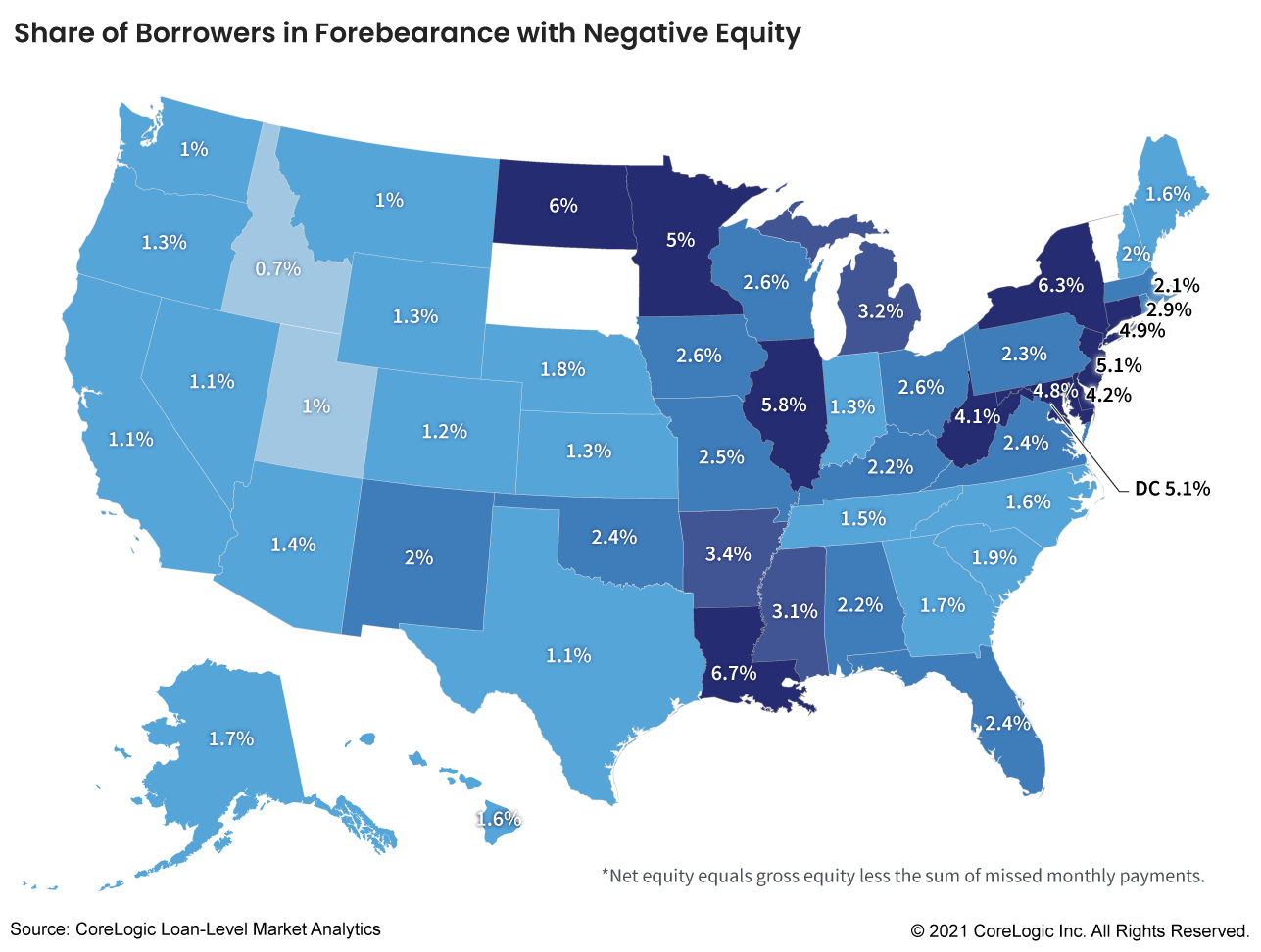

But while borrowers in states with elevated forbearance rates, such as Louisiana, Mississippi, Texas and Nevada seem to have enough equity to prevent them from losing their homes, there are a few states with an elevated share of forbearance loans that have no equity after adding missed payments to the unpaid principal balance.

States with an elevated share of borrowers with negative equity include Louisiana, New York, North Dakota, Illinois, Washington D.C., New Jersey, Montana, Connecticut and Maryland (Figure 3).

Figure 3:

In these areas, there is a heightened risk of a blip in distressed sales after forbearance ends. However, most of these are judicial foreclosure states, so if the blip does occur, it will be stretched out over many months or years, and additional increases in home prices over that period will mitigate losses. In addition, the good news is that the “big” states, such as California, Florida and Texas, have relatively small negative equity shares, mitigating concerns of a distressed sale tidal wave in these markets. That’s particularly good since California and Texas are non-judicial foreclosure states where foreclosures happen quicker.

© 2021 CoreLogic, Inc. , All rights reserved.