The COVID-19 pandemic’s devastating impact on the job market has left many households unable to pay their mortgages or rents. Fortunately, the speedy intervention provided by the CARES Act ensured mortgage forbearance options for homeowners who were financially harmed by the pandemic. And while forbearance options helped many distressed homeowners keep their homes, a rebound in job growth and economic activity remains a critical determinant of the final outcome for many distressed owners.

Availability of home equity is also important for homeowners who may be unable to continue making their mortgage payments. Positive equity gives them the option to sell their home rather than face a foreclosure or a short sale. The following analysis examines home equity for homeowners in forbearance.

Since the onset of the pandemic and initial spike in mortgage delinquencies, delinquency rates[1] have been declining. Serious delinquencies (90+ days past due) fell to 3.7% in February 2021 from the 4.2% peak last August. In addition, new delinquencies (30 days past due) have also fallen since their April peak (at 4.2%) and are now lower than they were prior to the pandemic — at 1.5% in February 2021. As a result, the share of loans in forbearance have also seen improvements, though there are still over 2 million borrowers in forbearance with about half of them at least 180 days behind on their mortgage payments.

Table 1 summarizes loan characteristics of those in forbearance. A typical homeowner in forbearance appears to have sizeable equity in their home, with median equity just over $100,000 and loan to value ratio[2] at about 61%. Even after accounting for missed mortgage payments, a typical homeowner in a forbearance is estimated to have about $88,000 in equity — which is generally more than enough to cover the costs of selling a home and still have some equity left over.Table 1

| Current loan to value ratio | Current loan balance | Monthly scheduled payment | Estimated home equity | Estimated equity excluding missed payments | |

|---|---|---|---|---|---|

| Typical (Median) Borrower in Forbearance | 61% | $159,287.76 | $927.08 | $101,176 | $87,895 |

Source: CoreLogic Home Equity Report 2020Q4and Loan-Level Market Analytics,

February 2021© 2021 CoreLogic,Inc., All rights reserved.

Certainly, homeowners with longer tenure have accumulated more equity in their homes, though given the rapid home price appreciation over the last year, most homeowners have seen their equity share expand.

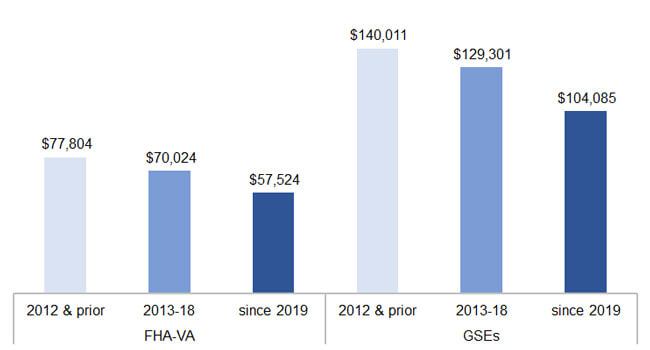

Generally, for homeowners starting their current ownership prior to 2012, who represent about 42% of those in forbearance, the estimated equity excluding the missed mortgages is just about $100,000. On the other hand, 43% of the newer owners — those who purchased their home between 2013 and 2018 — typically have more than $87,000 in equity after accounting for missed payments. And even the newest owners — those who purchased their home in 2019 or later and represent 15% of those in forbearance — also have notable equity gains averaging over $65,000 for a typical borrower.

Furthermore, the original down payment amount also makes a difference in equity accumulation. Those home buyers who purchased their homes with Federal Housing Administration (FHA) or Veterans Affairs (VA) loans, which have lower down payment requirements, take longer to amount sufficient equity gains to provide them with a financial buffer in times of hardship.

Figure 2 illustrates available home equity after missed payments have been excluded by investor type and by period of origination. As noted, lower down payment requirements for FHA/VA loans suggest those borrowers in general have about half of the equity that borrowers with Government-Sponsored Enterprise (GSE) loans have who have likely made 20% down payments.

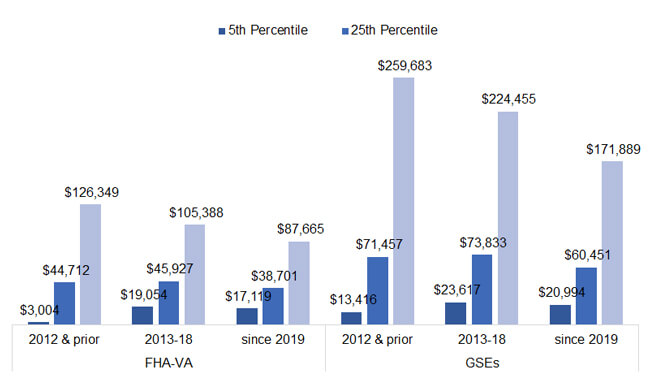

Moreover, our analysis takes a further look at distribution of equity within each of the categories noted in Figure 2. Figure 3 summarizes available equity for those in the fifth percentile of the equity distribution, 25th percentile and 75th percentile. The borrowers in the lowest equity group, the fifth percentile, are most vulnerable to losing their homes since they have the least accumulated equity. For FHA/VA borrowers, home equity in the lowest percentile ranges between about $3,000 to about $19,000, while for GSE borrowers, equity in the lowest percentile is between $13,000 and $23,000.

It is interesting to note that those with longest current ownership starting in 2012 or prior, and in the lowest percentile, have less equity than newer owners. These are likely driven by borrowers who purchased at the peak of home price growth prior to the Great Recession and have yet to gain equity. According to CoreLogic Homeowner Equity Report, there are still about 2.8% or 1.5 million residential properties in negative equity. Among borrowers in forbearance, 2.9% are still in negative equity, or about 58,000 loans.

Again, on the whole, even borrowers with the least amount of equity still have about $3,000 left after paying off the missed payments. On the other hand, those borrowers in 25th or higher range of the distribution have notable financial buffers after paying off their missed payments. Lastly, when the costs of selling a home — which are approximated at about 10% of the home price — are taken into consideration, our previous analysis showed that 4% of borrowers with a mortgage nationally have less than 10% in home equity.

Taken together, while the COVID-19 pandemic has wreaked havoc on many lives, ensuing housing market conditions which drove continued acceleration in home prices ensured existing homeowners saw a notable boost in their home equity with an average increase of $26,000 in 2020 and a total average equity of over $200,000 at the end of 2020.

The equity accumulation is critically important as struggling homeowners decide on their post-forbearance options. Still, as our analysis has shown, most homeowners in forbearance will be able to tap into their equity and sell their home rather than lose it through a foreclosure. In the end, the wave of foreclosures resembling that of the 2008-2013 period seem to be an unlikely outcome of the COVID-19 pandemic recession.

[1] CoreLogic includes loans in forbearance in its delinquency calculations

[2] Loan to value ratio is ratio of current loan balance to current estimated sales price

[3] Other are loan types not as categorized as conventional or FHA, VA, or USDA.