Our best-in-class property data is designed to power your digital mortgage workflows so you can originate loans faster, with fewer steps and at lower costs — all while improving your borrower’s experience. When it comes to servicing, we deliver the predictive knowledge you need to make the best decisions about potential threats and emerging opportunities.

Comprehensive, digitized and streamlined borrower and collateral origination workflows that allow you to take time, touch and cost out of every mortgage.

We help you know more sooner. It’s why the nation’s most successful servicers choose CoreLogic year after year.

CoreLogic solutions are versatile. Contact us to start a conversation.

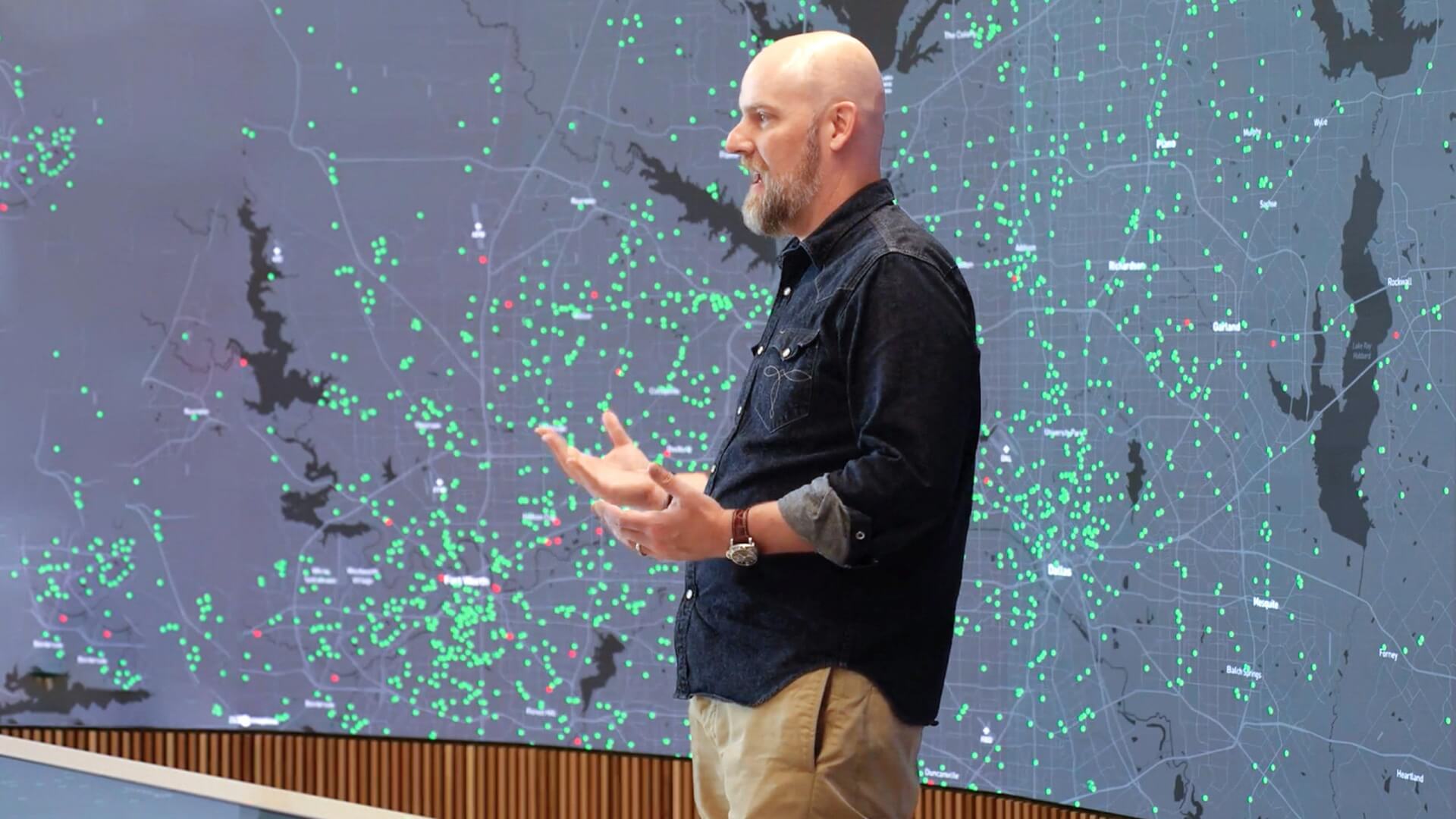

CoreLogic helps diverse businesses and organizations grow revenue, fast track innovations and migrate risk with category-defying data, insights and analytics.

CoreLogic helps real estate professionals and multiple listing enterprises better meet shifting market realities with an ecosystem of collaborative, seamless, secure and compliant solutions.

CoreLogic seamlessly connects the entire insurance process from quote to underwriting, to claims and risk management through our secure digital workflow.